by Calculated Risk on 2/24/2005 04:56:00 PM

Thursday, February 24, 2005

Mortgage Debt and the "Recovery"

Is the current recovery built on a "marshland of debt"?

Over the last 4 years, GDP has increased 19%. Meanwhile, mortgage debt (by households) has increased 54% and the National Debt 30%. In dollars, mortgage debt increased $2.6 Trillion and the National Debt $1.7 Trillion. Over that same period, the GDP grew by $1.88 Trillion. So it is easy to imagine that America just "bought" GDP growth by adding debt.

Primarily I've focused on the increases in the National Debt and the astounding increase in mortgage debt over the last 4 years. The following graph shows the increases in the National Debt and Mortgage debt since 1971.

Source: Federal Reserve

If we normalize the data (by comparing to the GDP), we can really understand what is happening. The following graph shows the enormous increase in National Debt in the '80s and early '90s, followed by a period of declining debt (as a % of GDP). However, starting in 2001, the National Debt started to climb once again. Since the structural General Fund deficit is forecast at almost $650 Billion for fiscal 2005 (ends Sept 30th), so the chart will continue to climb for the foreseeable future.

Source: U.S. Treasury

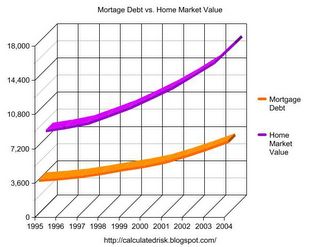

The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP.

Source: Federal Reserve

Some obervers have remarked that mortgage debt is still below 50% of household RE assets - and that is an accurate statement. In fact, if you plot mortgage debt vs. household RE assets everything looks reasonable.

Source: Federal Reserve

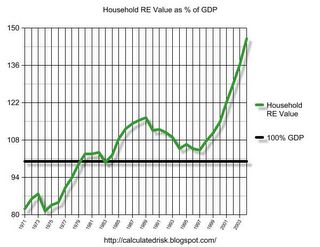

But lets plot household RE assets as a % of GDP.

Source: Federal Reserve

This final graph shows the potential problem. Household assets have really soared in the last few years. Many homeowners have refinanced their homes (or moved and taken cash out), in essense using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.