by Calculated Risk on 3/05/2005 02:22:00 AM

Saturday, March 05, 2005

Greenspan's March to Infamy

On two March 2nds, exactly four years apart, Fed Chairman Alan Greenspan testified before the House Committee on the Budget, not in his role as Chairman of the Federal Reserve, but speaking for "himself".

In his 2001 testimony, Mr Greenspan, with his usual caution and caveats, talked of surpluses for the foreseeable future. Greenspan was effusive (well, effusive for Greenspan) offering projections of "an on-budget surplus of almost $500 billion ... in fiscal year 2010". The National Debt would soon be retired and the Boomer's retirements secure. Greenspan offered a projection of "an implicit on-budget surplus under baseline assumptions well past 2030 despite the budgetary pressures from the aging of the baby-boom generation, especially on the major health programs."

Just four years later, again on March 2nd, Greenspan offered a starkly different view to the same committee. This year Greenspan talked of large "unified" deficits and commented that "our budget position is unlikely to improve substantially in the coming years unless major deficit-reducing actions are taken." He targeted Social Security and Medicare for cuts, saying "we may have already committed more physical resources to the baby-boom generation in its retirement years than our economy has the capacity to deliver."

I will leave the interpretation of Greenspan's motivations to others (like Paul Krugman's Op-Ed piece "Deficits and Deceit" in the NYTimes). But for this review, I would like to point out three significant misleading comments in Greenspan's speeches.

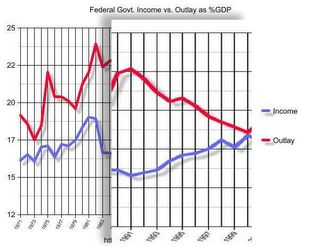

First, in both speeches Greenspan praised the fiscal discipline of Congress in the '90s and suggested that Congress' discipline, along with strong productivity gains, brought the deficits of the '80s under control. Greenspan is only half right. Look at this graph (with the 1990s enlarged) from this previous post.

NOTE: Click on graphs for larger image.

Source: U.S Treasury

Not only did Government Outlay as a % of GDP decline in the '90s, but Greenspan seems to have forgotten that Government Income increased as a % of GDP; the tax side of the equation! In fact there were 5 major General Fund tax increases between 1982 and 1993 that contributed to bringing the budget into balance. They were:

Tax Equity and Fiscal Responsibility Act of 1982 - ReaganFor an analysis of Major Tax Bills since 1940 see OTA Working Paper 81, U.S. Treasury Office of Tax Analysis by Jerry Tempalski.

Deficit Reduction Act of 1984 - Reagan

Omnibus Budget Reconciliation Act of 1987 - Reagan

Omnibus Budget Reconciliation Act of 1990 - G HW Bush

Omnibus Budget Reconciliation Act of 1993 - Clinton

Second, Mr. Greenspan erroneously suggests that only budget cuts, not tax increases, will bring the budget back into balance. He said "... tax increases ... arguably pose significant risks to economic growth and the revenue base." Further, Greenspan said "... if at all possible ... close the fiscal gap primarily, if not wholly, from the outlay side." That argument ignores the cause of the budget deficit that the following graph illustrates (same as above without '90s enlarged):

The annual deficit is the difference between the red and blue lines. Although spending increased after 2000, most of the deficit came from the substantial tax cuts of the last four years. These are historically low tax rates (as a % of GDP) and to suggest that raising the rates would jeopardize the recovery has no foundation in economic theory. It also contradicts recent history (that Mr. Greenspan seems to have forgotten).

Source: U.S. Treasury

And third, in his 2005 speech, Mr. Greenspan referred to the "unified budget" saying that "the unified budget is running deficits equal to about 3-1/2 percent of gross domestic product". In his 2001 speech, Mr. Greenspan more correctly spoke of on-budget and off-budget surpluses. Now that we are running large deficits, he only talks about the "unified budget". This is very misleading.

The problem with the "unified budget" is that it adds the Social Security surplus (and other off-budget surpluses) to the General Fund and masks the actually budget problem. One would think that the annual budget deficit would equal the annual increase in the National Debt. This is true if you use the General Fund deficit, but not the "unified deficit". The real fiscal issue is the General Fund deficit; the General Fund is running annual deficits of almost 6% of GDP!

Of course, if the Social Insurance payroll tax is just another General Fund tax then Mr. Greenspan is correct. But let me remind Mr. Greenspan (who chaired the 1983 Social Security "Greenspan Commission"):

1) IF the entire Social Insurance payroll tax is used for social insurance (retirement insurance, survivors insurance, health insurance) then the tax is NOT regressive.

2) IF the Social Insurance surplus is used as a General Fund tax (as using the "unified budget" suggests), then that portion of the payroll tax is highly regressive.

A regressive tax is redistributive of wealth from lower income workers to the wealthy. Not a desired consequence of tax policy.

These are three major misleading comments. Mr. Greenspan may have been speaking for himself, but his words carry the power and authority of the World's leading banker. I believe he should be more careful and far more accurate.