by Calculated Risk on 4/14/2005 07:25:00 PM

Thursday, April 14, 2005

IBM: More Evidence of a Global Slowdown

IBM reported that earnings would fall short of expectations: "IBM Misses Quarterly Earnings Forecast". Perhaps more important than the earnings announcement was this comments by IBM's Chairman and CEO Samuel J. Palmisano:

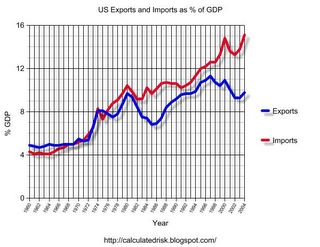

"After a strong start, we had difficulty closing transactions in the final weeks of the quarter, especially in countries with soft economic conditions, as well as with short-term Global Services signings,"This comment does not bode well for the US trade and current account deficits. The following graph shows the total US imports and exports since 1960.

Click on graph for larger image.

Imports have been rising fairly steadily since the early '70s. Exports have also been rising, but they have been more erratic. There have been two large declines in exports, the first in the early '80s and the other recently. Both declines were associated with a strong dollar as the next graphs indicate.

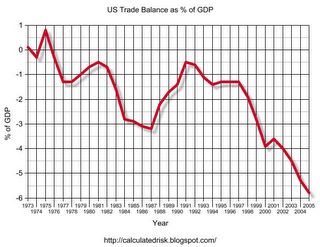

This graph shows the exchange rate since 1973 for the dollar against major currencies as calculated by the Federal Reserve. The second graph for the same time period shows the trade balance as a % of GDP.

NOTE: The 2005 trade deficit is estimated at $720 Billion with a 6% nominal increase in GDP.

The signing of the Plaza Accord in 1985 is very clear as the value of the dollar started to drop. The dollar stopped dropping in 1987 with the Louvre Accord. The weaker dollar clearly led to an increase in American exports.

With the recent dramatic drop in the value of the dollar, many people are hoping that the US exports will start to increase again in relation to imports. But with overseas economies faltering and the US economy still strong, US exports will probably continue to decline in relation to imports.

An improvement in the trade balance requires either overseas economies to strengthen or a slowdown / recession in the US.