by Calculated Risk on 7/06/2005 07:39:00 PM

Wednesday, July 06, 2005

Bank of England to Lower Rates?

UPDATE: We are all British today ...

The Bank of England's Monetary Policy Committee will conclude a two day meeting tomorrow and will announce monetary policy at 12 noon immediately following the Thursday meeting. The London Times has called for a rate cut.

THE Bank of England should move to bolster the economy today with a cut in interest rates, four out of nine members of The Times Monetary Policy Committee (MPC) said yesterday amid anxiety over faltering growth.The calls for a rate cut come as more evidence of economic weakness has emerged:

As worries were fuelled by figures showing manufacturing stagnating and homeowners further scaling back borrowing against their properties, pressure on the Bank to act was emphasised by the close vote among the independent experts.

Fears that the consumer downturn will be prolonged were heightened by the Bank’s latest figures for mortgage equity withdrawal, when homeowners borrow against increased property values for reasons other than moving home. The amount of cash raised in this way fell to £6.4 billion in the first quarter from a revised £8.3 billion in the previous three months and a peak of £17.7 billion in late 2003.The Confederation of British Industry has also called for a rate cut:

In The Times MPC vote, Martin Weale, NIESR’s director, and Sir Steve Robson, former Treasury Second Permanent Secretary, added their voices to call for an immediate rate cut. They were joined by The Times’s Anatole Kaletsky and Sushil Wadhwani, a former member of the Bank’s MPC, who also voted for a cut in June.

Sir Steve said that last week’s overhauled GDP data “suggested that the economy has been losing momentum for a good deal longer than previously thought”. “There are no new factors in prospect which would give it new momentum,” he said. Inflation remained subdued, he added. Mr Weale echoed this, arguing that growth was likely to have been below its long-term trend for a year.

``As there still seems little risk of inflation, the time for action is now,'' said CBI Director-General Digby Jones in the text of speech to be given in northern England this evening. There are ``troubling signs of decline in the housing market where confidence is everything. Such a loss of confidence is something the U.K. economy cannot afford.''

U.K. growth lagged behind the euro region for the first time in more than four years during the first quarter as the increase in consumer spending slowed and manufacturing contracted, government statistics showed last week. Inflation in May stayed at a seven-year high of 1.9 percent for the third month running.

Click on graph for larger image.

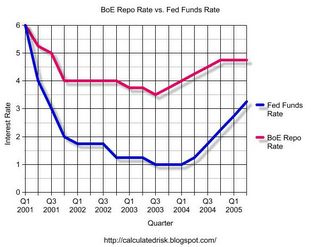

Click on graph for larger image.It is possible that the UK housing slowdown is a leading indicator for the US housing market. The BoE didn't lower rates as far as the FED and they started raising rates sooner. Now, with the UK housing market faltering and high street sales slumping, it looks like the peak of the BoE interest rate cycle will be the lowest in fifty years.

What does this mean for the FED? Probably nothing. As Dr. Altig points out, the futures market is indicating at least two more 25 bps point rate increases from the FED at the next two meetings.

UPDATE: Financial Times: Grim outlook for UK manufacturing sector

David Page at Investec said: “Although manufacturing appeared firmer than markets were expecting in May, wholesale revisions in line with last week’s National Accounts revealed a weaker recent past for manufacturing and firmly pointed to a manufacturing recession.”Scotsman: Manufacturing recession rears its ugly head

"UK manufacturers are finding it difficult to pass on cost increases, particularly given the scale of the increase in oil,'' said George Buckley, an economist at Deutsche Bank. "In addition, weakening consumption makes it difficult to sell their products."