by Calculated Risk on 7/28/2005 06:09:00 PM

Thursday, July 28, 2005

Housing Mortgage Trends

UPDATE: Also see Asha Bangalore's (pdf) Signs of Distress in the Effervescent Housing Market?

Fitch Ratings released a newsletter "RMBS Mortgage Principles and Interest" this week. (RMBS: Residential Mortgage Backed Securities)

There were several interesting trends. Click on graph for larger image.

Click on graph for larger image.

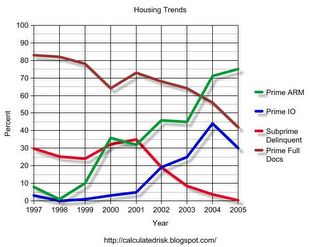

The percentage of prime loans using ARMs and IOs has been increasing (IOs have dipped slightly so far in '05). The same pattern can be seen for subprime loans (not graphed).

At the same time, the percentage of loans requiring full documentation has dropped significantly.

UPDATE: tanta points out that these are old pools with "junk that can't prepay". Ignore this section on subprime delinquencies ... nothing of value here! Also of interest is the percent of subprime loans (the fastest growing segment) that are in delinquency. Although delinquency rates were around 30% (over 60 days late) for a number of years, recently the rate has fallen to almost zero. Also, I believe the extensive use of ARMs and IOs indicates excessive leverage, even in the prime market.

Lower delinquencies would usually be good, but I am concerned if the housing market slows that delinquency rates will return to the 30% range on subprimes.