by Calculated Risk on 8/06/2005 12:01:00 AM

Saturday, August 06, 2005

Gasoline Demand Strong, Inventories Drop

Oil prices (WTI Sept Delivery) closed over $62 per barrel today. And gasoline is averaging $2.29 per gallon. Gasoline prices are expected to set a new nominal record next week. Despite this relatively high price, demand for gasoline has remained robust.

Click on graph for larger image.

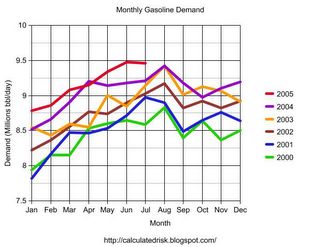

This graph (data from DOE) shows the average US daily demand for gasoline by month for the last 6 years. Although there is some randomness, demand has clearly been increasing every year and demand growth remains robust in 2005.

Most of the increase in gasoline prices has come from increases in the price of crude oil. Both pgl and Kash have pointed this out on Angry Bear. But now, due to some refinery problems, gasoline stocks have been dropping. The AP noted:

At least seven refineries have reported problems of one kind or another, ranging from fires at Chevron Corp.'s El Segundo, Calif., and BP PLC's Texas City refineries to the complete shutdown of Exxon Mobil's plant in Joliet, Ill.Although gasoline stocks have dropped, they are still in the normal range and refinery problems have not impacted gasoline prices yet.

The DOE comments:

Recent refinery problems point to the potential for higher prices as the next few weeks unfold, but absent any additional major petroleum infrastructure problems, a repeat of the August 2003 price spike is very unlikely.Since gasoline stocks are low and demand growth robust any disruption (a hurricane in the GOM or a refinery fire) could lead to significantly higher gasoline prices.

Meanwhile, stocks of crude oil remain above normal. The primary reason for the high price of crude, according to the DOE, is the limited excess world production capacity, not lack of current supply. Dr. Hamilton offers some other possible reasons and discusses peak oil issues with geography professor Dr. Robert Kaufmann at the WSJ Online.

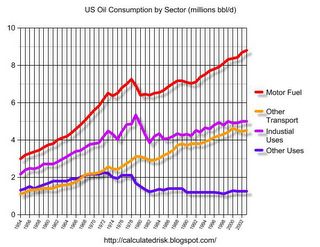

The final graph shows oil consumption by sector. You can see why it is important to follow gasoline demand.

The industrial sector has never returned to the 1979 consumption levels (due to a combination of efficiencies and substitutes) and "other uses" has also declined significantly, primarily because electricity generation has moved away from oil. This leaves motor fuel and "other transportation" as the major growth sectors for oil consumption.

This suggests that any reduction in oil consumption will have to come mainly from transportation. To reduce oil consumption for transportation, people will have to drive less, buy more efficient vehicles, or substitutes, suitable for transportation, will have to be found.

So far, even at these higher prices, we haven't seen any evidence of reduced consumption for transportation.