by Calculated Risk on 8/07/2005 02:54:00 AM

Sunday, August 07, 2005

San Diego Housing Market Update

As a follow up to the LA Times article that discussed the slowing San Diego housing market: I spoke with one of the top RE agents in San Diego yesterday and she told me the market has taken a "nosedive". (Her words referring to time on market, not prices). She told me specifically about two of her listings that have been on the market for 45 days that would have sold in a week or two earlier this year.

Also the LA Times article included this comment on the previous bust (1991-1997):

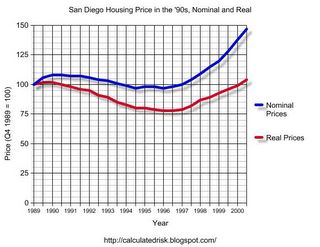

San Diego home prices were virtually flat for six years."Virtually flat" is being generous.

Click on graph for larger image.

Click on graph for larger image.According to the OFHEO house price index, housing in San Diego experienced a steady decline for six years following the peak in 1991. In nominal terms, house prices dropped 10% in San Diego and didn't achieve their previous highs until Q4 1999 - eight years after the previous peak.

In real terms (adjusted for CPI less shelter), house prices declined 24%, also over a six year period and didn't recovery their value until Q2 2001 - eleven years after the peak.

Finally, this housing bubble appears far worse than the '91 bubble. Earlier I posted a Price-Rent ratio for the US on Angry Bear:"Housing: Speculation and the Price-Rent Ratio". And the same calculation for San Diego.

UPDATE: See link for San Diego Price to Rent ratio.

Based on the price-rent ratio and many other measures, the current housing bubble dwarfs the '91 housing bubble. Therefore it might be reasonable to expect that the bust will also be worse and last longer.