by Calculated Risk on 11/03/2005 05:47:00 PM

Thursday, November 03, 2005

More Evidence of a Housing Slowdown

From TheStreet.com: Zip Realty Warns

"It is important to appreciate that our fourth quarter and preliminary 2006 guidance is being provided in the context of what we believe to be a transitioning market, slowly shifting the advantage from sellers to buyers," said CEO Eric Danziger. "Evidence of this shift is seen in rapidly rising inventory levels in September and slightly declining median selling prices across our markets for the past two months." emphasis addedAnd from DataQuick:

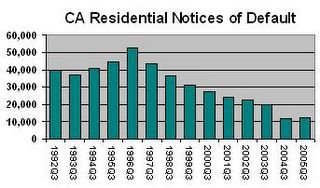

California Foreclosures Edge Up

Foreclosure activity in California showed a year-over-year increase during the last quarter for the first time in more than three years, the result of lower appreciation rates and riskier loans...Just more evidence of a slowing housing market.

"Current foreclosure levels are extremely low and this increase is a step towards more normal activity. Foreclosures decline when home prices go up. As home appreciation rates come down, we expect the foreclosure numbers to go up. They could double by the end of 2006," said Marshall Prentice, DataQuick president.