by Calculated Risk on 1/31/2006 05:37:00 PM

Tuesday, January 31, 2006

Bush: "America Addicted to Oil"

The AP is reporting:

President Bush ... [will say] Tuesday that "America is addicted to oil" and must break its dependence on foreign suppliers in unstable parts of the world.The problem is not the source of the oil, but that America is addicted to oil in general. Oil is a global market, and to break the addiction the US needs to reduce consumption, not drill for more domestic oil. Unfortunately Bush's energy policies have been focused primarily on oil, even promoting the consumption of more oil with tax breaks for small businesses that buy large SUVs. From 2003:

This year, the perks of buying a large SUV — if you're a small business owner — got even bigger.There are several benefits of moving away from oil; economic, geopolitical and environmental. Hopefully, Bush will not call for more domestic drilling (a huge mistake), but instead call for new innovation and more conservation.

Congress recently passed a tax bill, as proposed in President Bush's economic stimulus plan, that offers a $100,000 tax credit for business owners who purchase any vehicle weighing 6,000 pounds or more when fully loaded.

Monday, January 30, 2006

Fed Funds Rate: 4.5% almost guaranteed

by Calculated Risk on 1/30/2006 07:27:00 PM

Dr. Altig provides the Fed Funds probabilities for the next 3 meetings:

Jan 31st:So even with the dissapointing GDP data, it appears the market expects at least two more rate hikes. Dr. Duy channels the Fed with his always insightful Fed Watch: Now It Gets Interesting...

4.5%, 97%

March 28th:

4.75%, 73%

4.5%, 20%

May 10th:

4.75%, 53%

5%, 28%

4.5% 15%

For the Fed watcher, the 4Q05 GDP report is a real brainteaser. The central focus of the many, many blogs covering Friday’s news was the disappointing growth numbers (see William Polley’s and James Hamilton’s views, the latter including a long list of similar concerns). To be sure, the weak headline number deserved attention. But I was surprised by the relatively little attention placed on the inflation reading. I doubt the Fed is going to let that number slip by so lightly. Weak growth and higher inflation? Now that’s interesting.And on the topic of inflation, Fed Economist Mike Bryan writes: Holding on to the Edge of Comfort

Today’s PCE inflation report for December seems to have gotten a ho-hum response in financial markets. As it should. The data were tame and not widely off expectations.Not everyone agrees with Dr. Bryan's take on inflation (see Barry Ritholtz' Myths of the Greenspan Era). As a caveat, Dr. Bryan is writing for himself and not the Fed. Still its interesting to read his views.

30 year Pleasure Boat Loans

by Calculated Risk on 1/30/2006 02:04:00 PM

The LA Times reports: Sales of Pleasure Boats Buoyed by Soaring Home Values

California's hot real estate market has helped power a rise in boat sales by allowing people to borrow against the soaring value of their homes to buy boats and other big-ticket items.A couple of comments: I guess a 30 year loan on a pleasure boat is better financial planning than a 30 year loan for a hamburger!

In California, retail sales of recreational boats — from runabouts to $4-million luxury yachts — rose about 8% last year to a record $540 million, continuing a growth trend over the last five years, according to the Southern California Marine Assn. A similar increase is expected in 2006.

Though some economists worry that too many people are overextending themselves, the boating industry considers itself lucky that business is humming despite high gasoline prices.

"A lot of people are taking money out of their homes and buying different things, and one of them — fortunately — is boats," said Dave Geoffroy, executive director of the marine association, the organizer of the L.A. Boat Show.

But what happens when mortgage equity withdrawal slows?

... some dealers worry that boat sales could fall if real estate values drop, which happened in the early 1990s.I wonder if the slowdown in Q4 (1.1% annualized growth in GDP) was related to a slowdown in equity extraction? The Federal Reserve's Flow of Funds report (due March 9th) will help answer that question.

"I'm moderately concerned," said Michael Basso Jr., general manager of Sun Country Marine, which sells family boats and has locations in Castaic, Dana Point and Ontario.

He noted that half his buyers last year paid in cash, often from money they pulled out of their homes.

Friday, January 27, 2006

December New Home Sales: 1.269 Million Annual Rate

by Calculated Risk on 1/27/2006 12:16:00 AM

According to the Census Bureau report, New Home Sales in December were at a seasonally adjusted annual rate of 1.269 million vs. market expectations of 1.225 million. November's sales were revised down slightly to 1.233 million from 1.245 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

The Not Seasonally Adjusted monthly rate was 86,000 New Homes sold, essentially the same as the 85,000 in November.

On a year over year basis, December 2005 sales were 3.6% higher than December 2004.

The median and average sales prices are trending down.

The median sales price of new houses sold in November 2005 was $225,200; the average sales price was $283,300.

The seasonally adjusted estimate of new houses for sale at the end of December was 516,000. This represents a supply of 4.9 months at the current sales rate.

The 516,000 units of inventory is the all time record for new houses for sale. On a months of supply basis, inventory is above the level of recent years.

This report is still reasonably strong.

Thursday, January 26, 2006

Lenders ask for Extension on New Mortgage Guidance

by Calculated Risk on 1/26/2006 01:14:00 AM

In December the FDIC, Office of the Comptroller, the Federal Reserve and other agencies issued a new proposed guidance on nontraditional mortgage products.

Now Reuters reports: US banks seek more mortgage proposal comment time

Lenders this week asked U.S. regulators to extend a comment period on a proposal that urged tighter underwriting on new mortgage products that may pose greater risks for banks and borrowers as interest rates rise.

Comments were due Feb. 27, but lenders have asked the Federal Reserve and other regulators for 30 more days.

"The proposal is extremely complex and has far-reaching consequences for our members, as well as for the nation's mortgage markets," wrote Janet Frank, director of mortgage finance in America's Community Bankers' government relations office.

"We believe that it will take an additional 30 days to complete the necessary evaluation and collect comments and data from our membership," Frank told regulators in a letter.

The Consumer Mortgage Coalition and HSBC North America Holdings Inc. also requested an additional 30 days.

Spokesmen for the Fed and Office of the Comptroller of the Currency were not immediately available to comment.

Wednesday, January 25, 2006

Mortgage Application Volume Up

by Calculated Risk on 1/25/2006 10:46:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Application Volume Up In Latest Survey

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 660.5 -- an increase of 7.7 percent on a seasonally adjusted basis from 613.3 one week earlier. On an unadjusted basis, the Index decreased 0.2 percent compared with the previous week and was down 0.4 percent compared with the same week one year earlier.Rates on fixed mortgages decreased slightly again, but ARM rates increased:

The seasonally-adjusted Purchase Index increased by 6.7 percent to 473.7 from 443.9 the previous week whereas the Refinance Index increased by 7.8 percent to 1773.9 from 1645.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.04 percent from 6.07 percent on week earlier ...The MBA survey indicates RE activity is still at a fairly high level and rebounding in January.

The average contract interest rate for one-year ARMs increased to 5.44 percent from 5.39 percent one week earlier ...

Existing Home Sales Fall

by Calculated Risk on 1/25/2006 10:27:00 AM

The AP reports: Existing Home Sales Set Record but Cooling

Sales of existing homes set a record for a fifth straight year in 2005 even though the year ended on a weaker note with three straight monthly declines, sending a strong signal that the nation's housing boom is beginning to cool.From the NAR:

The National Association of Realtors reported that sales of previously owned homes and condominiums dropped by 5.7 percent in December compared to the sales pace in November. It marked the third consecutive monthly decline, something that has not occurred in more than three years.

Existing home sales fell to a 6.6 million annual rate in December, 3% lower than December 2004.

Inventories fell to 2.796 million units, from 2.924 units in November, as sellers took their houses off the market for the holidays. However, inventories are up 26.3% compared to December 2004. This represents of 5.1 months of supply at the current sales rate.

The average and median prices fell to levels not seen since May 2005. Average prices were up 7.4% for the year, and median prices up 10.5%.

Tuesday, January 24, 2006

Fed Economist: Current Account Deficit near Optimal Levels

by Calculated Risk on 1/24/2006 08:54:00 PM

Federal Reserve economist John Rogers (Chief, Trade and Financial Studies Section) and University of Wisconsin Professor Charles Engel, in a new paper "The U.S. Current Account Deficit and the Expected Share of World Output", Journal of Monetary Economics suggest the US Current Account Deficit may be near optimal levels.

From their conclusions:

We have asked whether the U.S. current account deficit could be consistent with expectations that the U.S. share of world GDP will increase. Under assumptions about the growth in the net GDP share that are not wildly implausible, the level of the deficit can be consistent with optimal saving behavior. But, in making this assessment, we emphasize that there are many difficult issues to deal with, and the conclusion is sensitive to how one handles these questions.

First, our findings are sensitive to how we treat two problems: the high saving rate in East Asian emerging economies, and the "exorbitant privilege" (the term used by Gourinchas and Rey (2005)) that allows the U.S. to receive a much higher return on its foreign investments than foreigners earn on their U.S. investments.

On the first point, most forecasters predict that the emerging market's share of world GDP will be increasing over time. Our empirical work does not include these countries, and if it did, the forecast path of the U.S. share of world GDP would not be as rosy. But, according to themodel, these countries ought to be borrowers in international capital markets. They are not -- they are large net lenders. It is puzzling that they are net lenders. Bernanke (2004) refers to this as a "savings glut", and hypothesizes that these countries are in essence building up a nest egg in order to protect them against a possible future international financial crisis such as the one that beset East Asia in 1997-1998.

We are not sure how to handle this in our model. It may be that these countries will continue to be high savers, in which case their saving will hold down world interest rates and the U.S. deficits will be more justifiable. On the other hand, their saving rate may fall and real interest rates may rise, which works toward the U.S. optimally having a smaller deficit.

We make the "heroic" assumption in our work that these countries are not contributing to net world saving at all. On the one hand, this is a conservative assumption (if one is trying to explain the large U.S. deficits), because the countries are in fact large net savers. On the other hand, if their net saving is reversed, the assumption is too optimistic.

It does seem like markets favor the position that these countries will maintain their positions as large savers, because long term real interest rates are very low. However, much of the recent scholarly and policy-oriented research on the U.S. current account deficit has taken the position that the markets may not be correctly foreseeing events.

Finally, it is possible that the saving rate is high in East Asian countries because of demographic factors. It has been noted that because of the one-child policy, the ratio of old to young is increasing rapidly in China. There are other countries for which demographic factors may be very important as well, and this deserves further study.

We take a similar neutral position on the exorbitant privilege. One possibility is that the U.S. will continue to receive higher returns on its foreign investments than it pays out on its foreign borrowing. On the other hand, that privilege may disappear, and worse, it may disappear not only for future borrowing but also for our outstanding debt when it is refinanced. Our work takes a somewhat neutral position by assuming future borrowing and lending takes place at the same rate of return, but that there is no additional burden to be encountered from refinancing existing debt at less favorable rates of return.

There really are a variety of scenarios that could play out. As Gourinchas and Rey (2005) demonstrate, it is not only that the return on U.S. assets within each asset class is lower than on foreign assets (implying the market views U.S. assets as less risky), but also that the mix of U.S. investments abroad favors riskier classes of assets. It is possible that the U.S. net return will fall in the future both because the risk premium on U.S. assets rises (as in Edwards (2005) or Blanchard, Giavazzi and Sa (2004)), and because foreigners shift toward investing in more risky U.S. assets. But, again, it is notable that markets do not reflect any increasing riskiness of U.S. assets.

With these major caveats in mind, we find that the size of the U.S. current account deficit may be justifiable if markets expect further growth in the U.S. share of advanced-country GDP. The growth that is needed does not appear to be implausible.

But, what the model cannot explain is why the U.S. current account deficit continues to grow. If households expect the U.S. share of world GDP to grow, they should frontload consumption. The deficits should appear immediately, not gradually.

We have allowed in our Markov-switching model for the possibility that there was a shift in regime that U.S. households only gradually learned about. But that turned out not to be able to explain the rising U.S. current account deficits. However, our simulations and estimation assumed that households understood that if a regime shift took place, the U.S. share of world GDP in the long term would be much higher than it was in the early 1980s. In practice, it may be that markets only gradually learned the U.S. long-term share. Examination of the model when there is only gradual learning about the parameters of the model will be left for future work. It is possible that because U.S. households only gradually came to the realization that their share of advanced country GDP was going to be much higher in the long run, they only gradually increased their borrowing on world markets.

This possibility is supported by our examination of the consensus long-term forecasts of U.S. GDP relative to G-7 GDP since 1993. These forecasts have consistently underestimated U.S. GDP growth relative to other countries, by wide margins. The current forecasts for the future, however, show that the markets expect a large increase in the U.S. share of GDP – almost precisely the amount that we calculate would make the current level of the deficit optimal.

There are at least two other possible explanations to explain this gradual emergence of the current account deficit. One possibility is that it takes time for consumption to adjust. This could be modeled either with adjustment costs, or, as is popular in many calibrated macro models, with habit persistence in consumption.

Another possibility is that there has been a steady relaxation of credit constraints for many U.S. households, as well as increased access to U.S. capital markets for foreign lenders. The relaxation of credit constraints was one of the possibilities that Parker (1999) explored in his study of the decline in U.S. saving. He found that it could explain at most 30% of the increase in consumption from 1959 to 1998.

The starting point of Parker's back-of-the-envelope calculation is the observation that the consumption boom is the equivalent of three-quarters of one year's GDP in present value terms. The rise in debt, as measured by the difference in ratios of household total assets to income and net worth to income, was about 20 percent over the period. Therefore, debt can explain at most .20/.75 < 30 percent of the increase in consumption. Since the time Parker wrote his paper, debt has continued to rise, by another 25% through 2005Q2 when the ratio of total assets to income exceeded the ratio of net worth to income by 1.24.

Of course, the other obvious candidate for the increasing U.S. current account deficit is through the effect of U.S government budget deficits. It is useful to note that what we are really talking about is the effects of tax cuts. In the first place, government spending as a share of GDP has not changed dramatically, so could not account for the large current account deficit. Moreover, our analysis allows for the effects of increases in government spending. An increase in current spending above the long-run spending levels would lower the U.S. share of GDP net of government spending and investment relative to future shares, thus inducing a greater consumption to net GDP ratio.

But our model assumes that the timing of taxes does not matter for household consumption -- that Ricardian equivalence holds. Obviously that might not be correct. Recent empirical studies do not show much support for Ricardian equivalence, though the point is debated.8 We note that to the extent that credit constraints have been relaxed in recent years, Ricardian equivalence becomes a more credible possibility. It may be that in more recent years, lower taxes do not boost consumption as much, and instead allow households to pay off some of their credit card debt or prepay some of their mortgage. It may be interesting to pursue empirically the hypothesis that the effects on national saving of tax varies change with the degree of credit constraints in the economy.

Another argument that needs to be explored is the distributional effects of the recent tax cuts. It has been argued that the tax cuts were less stimulative than previous cuts because they accrued mostly to wealthy individuals, who simply saved the additional after-tax income. (That is, the rich act more like Ricardian consumers.) But if that is the case, then it is more difficult to make the case that the tax cuts are responsible for the decline in U.S. national saving.

Finally, we cannot reach firm conclusions about the future path of U.S. real exchange rates. We have calibrated a model that is essentially identical to the one examined by Obstfeld and Rogoff (2004), but one in which the consumption path is determined endogenously as a function of current and expected discounted real income in each country. We found that under one set of baseline assumptions, there should not be much change in the equilibrium real exchange rate as the U.S. current account adjusts. Our model assumes the U.S. will experience higher growth in productivity in both traded and non-traded sectors, and that there is factor mobility between the traded and non-traded sector. On the one hand, if traded/non-traded productivity growth in the U.S. is slightly higher than in the rest of the world, the price of non-traded goods will rise in the U.S. from the Balassa-Samuelson effect. On the other hand, the U.S. terms of trade should fall as the supply of its exports increases. If there is home bias in consumption of tradables, that would work toward causing a U.S. real depreciation. In our baseline calibration, these two effects approximately cancel.

But as we have noted, the conclusions about the real exchange rate depend on assumptions about parameters of the model. Particularly, if the elasticity of substitution between imports and exports in consumption is much lower than our baseline simulation assumed, the U.S. could experience a substantial real depreciation over the next 25 years.

The basic message of our paper is that there are many aspects of the current account adjustment that are just not possible to predict. Under some scenarios that we do not regard as entirely unreasonable, we find that the U.S. current account deficit can be explained as the equilibrium outcome of optimal consumption decisions. But some of our modeling simplifications and assumptions might be wrong in important ways, and so it may turn out, as many have been warning, that the deficits have put the U.S. on the path to ruin.

Dr. Setser on Rubin and a Hard Landing

by Calculated Risk on 1/24/2006 06:23:00 PM

Dr. Brad Setser excerpts from Robert Rubin's Wall Street Journal OpEd and adds some interesting commentary. Setser writes:

Thomas Palley is right: "Foreign flight" (a shock to the United States ability to borrow savings from abroad) is very different from "Consumer burnout" (a slowdown in US demand growth). In both the foreign flight and the consumer burnout scenarios, the US economy slows and the dollar falls. But in the foreign flight scenario, as Palley notes, the fall in the dollar and rise in US (market) interest rates triggers the US slowdown, while in the consumer burnout scenario, the US slump triggers dollar weakness. Foreign flight would combine dollar weakness with higher US (market) interest rates, consumer burnout combines dollar weakness with lower interest rates.A housing market slowdown, and lower mortgage equity withdrawal, might lead to "consumer burnout". This is a potential problem right now for the US economy. But the addition of "foreign flight" might lead to a vicious cycle on the downside.

Click on diagram for larger image.

Click on diagram for larger image.This diagram is from an earlier post. The diagram depicts a virtuous cycle that might have been occurring over the last few years. Lower interest rates leads to higher housing prices and this leads to more equity withdrawal, higher consumption and more imports. Flush with cash, foreign CBs invest in dollar denominated bonds leading to lower interest rates ... and the cycle repeats.

Unfortunately, as the second diagram depicts, this has the potential to become a vicious cycle as housing slows. As Dr. Setser concludes:

But as US rates start to fall, foreign investors lose interest in lending even more to the US. Rather than adding $1 trillion or so to their portfolio of dollar denominated bonds at 4.5%, they want to add only say $600 billion or so ... Reduced foreign demand for US dollar assets ends up pushing US interest rates up.Of course, this was my top economic prediction for 2006:

At least those interest rates that are set in the market. The Fed's response to consumer burnout could trigger foreign flight.

That is a bad scenario. It implies that the US economy wouldn't benefit from some of the stabilizers that normally buffer the US from really bad (economic) outcomes.

I think long rates will start to rise when the Fed starts cutting the Fed Funds rate.Also, see Dr. Kash's post today: Will the Fed Overshoot?

This will be Bernanke's "conundrum"! As the economy slows, this will reduce the trade deficit and also lower the amount of foreign dollars willing to invest in the US - the start of a possible vicious cycle.

Monday, January 23, 2006

HSBC Economist: Housing Slowdown Could lead to US Recession

by Calculated Risk on 1/23/2006 08:48:00 PM

From a Financial Times article: Prospect of housing downturn casts pall over US economy

The ratio between average income and the costs associated with buying a home has risen to record levels. "Strong price growth momentum has resulted in very high prices relative to incomes across the country," says Ian Morris, chief US economist at HSBC.The article offers other views too. The data later this week might be interesting.

...

Mr Morris says a "bubble zone" has been created where house prices are overvalued by 35-40 per cent, equivalent to $6,000bn. Although this bubble could take time to deflate, Mr Morris warns that "the consequences of a punctured housing bubble could be traumatic". Even a soft landing of zero house price growth, he says, will dry up the mortgage equity withdrawal that has fuelled consumer purchasing. Consumer spending makes up two-thirds of the US economy.

So could a bursting of the housing bubble pull the US economy into recession?

Mr Morris says yes. "If this adjustment can be managed over many years, the economy can avoid recession. If the process is squeezed into a shorter time-frame instead, then recession is probable."

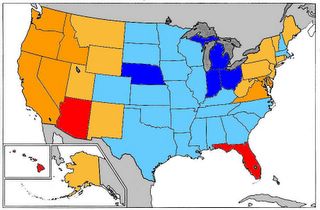

Gallup: America Turning Blue

by Calculated Risk on 1/23/2006 05:16:00 PM

On Angry Bear, I reported the newest Bush Approval (actually disapproval) ratings.

Now Gallup reports: Many States Shift Democratic During 2005

Click on map for larger image.

Note: Gallup doesn't normally interview in Hawaii and Alaska. I added both states.

This shift is probably due to the dissatisfaction with Bush's policies. It will be interesting to see if this translates to Democrat victories later this year.

Sunday, January 22, 2006

WaPo: Debt makes Greenspan's Legacy Unclear

by Calculated Risk on 1/22/2006 10:24:00 PM

In Monday's WaPo: As U.S. Economy Has Thrived, So Has Debt

"The jury is out on his legacy in large part because of the debt" and the trade deficit, said Stephen S. Roach, chief economist at Morgan Stanley. "You will not be able to truly judge his accomplishments until we see how this plays out in the post-Greenspan era."The article offers these examples:

· U.S. household debt hit a record $11.4 trillion in last year's third quarter, which ended Sept. 30, after shooting up at the fastest rate since 1985, according to Fed data.The debt binge has definitely contributed significantly to the current recovery. The big question is what happens next?

· U.S. households spent a record 13.75 percent of their after-tax, or disposable, income on servicing their debts in the third quarter, the Fed reported.

· The trade deficit for last year is estimated to have swollen to another record high, above $700 billion, increasing America's indebtedness to foreigners.

West Coast Ports: December imports Down

by Calculated Risk on 1/22/2006 06:00:00 PM

The Ports of Long Beach and Los Angeles reported a seasonal decrease in import traffic for December.

Import traffic at the Port of Long Beach decreased 12.7% compared to November and was 1.2% less than December 2004. A total of 266 thousand loaded cargo containers came into the Port of Long Beach, compared to 305 thousand in November. The record is 313 thousand set in August 2005.

The Port of Los Angeles import traffic decreased 1.2% in December compared to November, but imports were up 16% from December 2004. Imports were 321 thousand containers. The record for the Port of Los Angeles was set in October with 368.5 thousand import containers.

For Long Beach, outbound traffic was down 3% to 104 thousand containers. At Los Angeles, outbound traffic was steady at 98 thousand containers.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. Given these numbers, I expect imports from Asia to be lower in December than in November.

Iran

by Calculated Risk on 1/22/2006 01:03:00 AM

First, it is fairly clear, as pgl notes, that Iran is not currently an imminent threat to the US. But what about the economic issues with the "Iranian Oil Bourse"?

Dr. Hamilton has a nice post addressing that issue: Strange ideas about the Iranian oil bourse

I agree with Dr. Hamilton, but I'm afraid the actual economic impact (or lack of economic impact) doesn't really matter. What matters is what Bush / Cheney think. Although the Bourse is inconsequential, an attack on Iran could have significant economic implications.

In my economic predictions for 2006, I included this caveat:

So, without trying to predict natural disasters, a pandemic or human stupidity (terrorism, bombing Iran, etc.), ...And for some reason I'm reminded of the fictional character Forrest Gump's quip: "Stupid is as stupid does." Lets hope the US is not stupid this time, otherwise $68/barrel WTI oil might look cheap, and my 2006 economic predictions wildly wrong.

Friday, January 20, 2006

Stephen Roach: The Irony of Complacency

by Calculated Risk on 1/20/2006 11:42:00 PM

Morgan Stanley's Chief Economist Stephen Roach writes: The Irony of Complacency

So far, so good, for an unbalanced world -- the sky has yet to fall.Roach is always interesting reading.

... suffice it to say, were it not for another year of solid support from US consumer demand -- our latest estimates put real consumption growth at an impressive 3.5% in 2005 -- the rest of a largely externally dependent world would have been in big trouble.

What did it take for the American consumer to deliver yet again? ... With America’s internal income-generating capacity continuing to lag, US consumers once again tapped the home equity till to draw support from the Asset Economy. According to Federal Reserve estimates, equity extraction by US households topped $600 billion in 2005 -- more than enough to compensate for the shortfall of earned labor income. Comforted by this asset-based injection of purchasing power, consumers had little compunction in stretching traditional income-based constraints to the max. The personal saving rate fell deeper into negative territory that at any point since 1933, and outstanding household sector indebtedness -- as well as debt service burdens -- hit new record highs.

So much for what happened in 2005. The big question for the outlook -- and quite possibly the most important macro issue for world financial markets in 2006 -- is whether the American consumer can keep on delivering. My answer is an unequivocal “no.”

Home Equity Extraction Still Hot In Q3

by Calculated Risk on 1/20/2006 10:44:00 AM

More on MEW, IBD reports:

As of the third quarter ... the home equity-piggy bank still looked bright and shiny.NOTE: This estimate of equity extraction is lower than my estimate of $289.5 Billion ($1.16 Trillion annual rate) for Q3. See GDP Growth: With and Without Mortgage Extraction). The difference is the FED's approach excludes buyer's estimated down payment for a subsequent home.

Estimated gross equity extractions rose 10% from the previous quarter to a seasonally adjusted $990.6 billion, according to an update provided to Investor's Business Daily of a September Federal Reserve study on mortgage originations.

Extractions include money left over after a homeowner sells his home and pays off his mortgage, cash-out refinancings and home equity loans. It takes into account equity gains used for the down payment of a subsequent home purchase by excluding the buyer's estimated down payment.

Consumers had also dug more wealth out of their homes in the second quarter, with equity withdrawals rising 27% to an estimated $904.4 billion after falling for two prior quarters, said the Fed.

For the first nine months of last year, equity extraction totaled $2.6 trillion vs. $2.4 trillion for the same period of 2004 and over double withdrawals during all of 2000.

Goldman Sachs is concerned going forward:

... with sales and prices slipping at the end of 2005 and refinancing less attractive, economists have started to place bets on when the country's favorite piggy bank will finally start to crack. If and when that happens, consumers may have to cut back, slowing overall economic growth.

"We expect mortgage-equity withdrawals to decline and therefore not just stop supporting growth in spending and but actually act as a drag on spending," said Goldman Sachs economist Ed McKelvey.

That drag could happen mid-year, he said.

Thursday, January 19, 2006

Northern California: Home Sales, Prices Decline

by Calculated Risk on 1/19/2006 02:51:00 PM

DataQuick reports: Decline in Bay Area home sales, prices

Home sales in the nine-county Bay Area declined on a year-over-year basis for the ninth month in a row in December as prices eased back from their November peak, a real estate information service reported.

A total of 9,347 new and resale houses and condos were sold in the region last month. That was down 3.8 percent from 9,717 for November, and down 15.5 percent from 11,068 for December last year ...

"Demand still seems to be there, but the sense of urgency seems to be a thing of the past. We don't expect the market to tumble, but we do expect price increases to level off between now and spring," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $609,000 last month. That was down 2.6 percent from November's record high of $625,000, and up 14.3 percent from $533,000 for December a year ago. The annual price increase was the lowest since prices rose 13.1 percent to $474,000 in March 2004.

Wednesday, January 18, 2006

MBA Purchase Index

by Calculated Risk on 1/18/2006 05:11:00 PM

In my earlier post I plotted the weekly Mortgage Bankers Association (MBA) Market and Purchase indices since last June. It appears that the purchase activity has weakened a little over the last 6 months.

Click on graph for larger image.

The graph on the right is of the Purchase Index for the 3rd week in January for each of the last 9 years.

This clearly shows that purchase activity is still at a very high level according to the MBA.

SoCal Housing

by Calculated Risk on 1/18/2006 04:42:00 PM

The OC Register reports: $621,000: record price for O.C. homes

Orange County home prices finished the year at a new record high – $621,000.The LA Times reports: SoCal Housing Market Cooled in 2005

DataQuick reported this morning that the median sales price for all local residences in December rose $5,000 from November's $616,000 to top the previous peak of $617,000 set in August.

Overall prices in O.C. are up 12.7 percent in a year. Condo prices had the strongest growth – up 17.9 percent in a year to $460,000. Detached homes rose 16.2 percent to $660,000. New-home prices, which include a recent surge in sales of apartments converted to condos, fell 8.8 percent to $702,000.

O.C. sales activity slowed to 3,826 for December – that's down 9.2 percent from a year ago and the slowest December for sales since 1996. For the year, Orange Countians bought 48,883 residences – up 2 percent from 2004.

O.C. trends mirror regional buying patterns. Southern California's median price in December was up 13 percent in a year to $479,000. Last month's sales volume was down 4.5 percent from December 2004.

Southern California's real estate market cooled in 2005 as the rate of appreciation slowed for the first time since 1999 and sales remained flat, according to a real estate report today.And here is the DataQuick press release: Southland home sales down, lower appreciation

The overall median price last year for the six-county region — spanning from San Diego to Ventura and east to San Bernardino — reached $460,000, up 16.5% on an annual basis. That is down from the 23% gain recorded in 2004, when Southern California was branded as one of the hottest housing markets in the country.

Starting in the second half of 2005, the Southland began to simmer down, as prices leveled off and the pace of sales waned and even declined at certain points.

The slowing trend continued last month, when sales fell 4.5% to 28,952, which was the fewest homes sold in any December since 2001, according to DataQuick Information Systems, the La Jolla-based research firm that compiles and analyzes property transactions.

December home sales in Southern California fell to their lowest level in four years as price increases eased back another notch, a real estate information service reported.San Diego was the weakest market in SoCal. As 2005 ended, price appreciation slowed and transaction volumes decreased.

A total of 28,952 new and resale homes were sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 4.8 percent from 27,637 in November, and down 4.5 percent from 30,317 for December last year, according to DataQuick Information Systems.

A decline from November to December is normal for the season. Last month's sales count was the lowest for any December since 24,913 homes were sold in December 2001. The Inland Empire bucked the regional trend and posted sales increases last month, led in part by record-breaking sales of newly-built homes.

"The frenzied part of this real estate cycle is behind us and what we're seeing so far is a normalizing of the market. Mid-market and entry-level homes are selling well, the move-up and prestige markets are leveling off. It'll be interesting to see how this plays out between now and spring, " said Marshall Prentice, DataQuick president.

MBA: Mortgage Refinance Applications Up

by Calculated Risk on 1/18/2006 10:42:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Refinance Applications Up In Latest Survey

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 613.3 -- an increase of 2.2 percent on a seasonally adjusted basis from 600.1 one week earlier. On an unadjusted basis, the Index increased 31.4 percent compared with the previous week but was down 10.9 percent compared with the same week one year earlier.Rates on mortgages decreased slightly again:

The seasonally-adjusted Purchase Index decreased by 3.0 percent to 443.9 from 457.4 the previous week whereas the Refinance Index increased by 9.9 percent to 1645.2 from 1497.5 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.07 percent from 6.08 percent on week earlier ...The MBA survey indicates RE activity is still at a fairly high level.

The average contract interest rate for one-year ARMs decreased to 5.39 percent from 5.42 percent one week earlier ...

Tuesday, January 17, 2006

Housing Slowdown: Impact on State Government

by Calculated Risk on 1/17/2006 05:27:00 PM

The housing boom has increased tax revenue and boosted the economies of "bubble" states. Naturally, many state and local governments are behaving as if the good times will last forever.

The SF Chronicle reports:

After touting his budget plan to increase funding for education and transportation, the governor sounded a cautionary note.And we all know what happened to the California budget and Gray Davis. Is Arnold making the same mistake?

"It's important to remember, however, that our great good fortune is the result of a strong economy and a surging stock market. And anybody who follows the Dow, and particularly the Nasdaq, realizes how volatile these sources of funds are."

The governor was not Arnold Schwarzenegger, but Gray Davis as he released his budget six years ago when state coffers were brimming with $12.3 billion in extra cash.

Now, as the state's economy rebounds from the technology bust, some are questioning whether Schwarzenegger is venturing down a similar path by using a windfall in tax revenues on more spending when another key sector of the economy -- the real estate market -- shows signs of softening.And on a related note, the OC Register is reporting: Late taxes hint at housing's toll

...

The robust economy has been driven by "real estate, real estate and real estate," said Christopher Thornberg, a senior economist at the UCLA Anderson Forecast. He said that market is already starting to cool.

"The question is how much does it cool and how hard," he said, adding that the governor's budget doesn't seem to take the possibility into account. "There doesn't seem to be any contingency planning. There's no downside slack in this budget."

A yellow warning light is shining on the Orange County real estate market's dashboard.

The number of delinquent property tax payments has reached the highest level in a decade.

This worrisome trend may be evidence that high purchase prices and burgeoning payments on popular adjustable mortgages as interest rates rise may finally be taking a toll on the budgets of local property homeowners.

Monday, January 16, 2006

San Diego: Home Prices Fall

by Calculated Risk on 1/16/2006 05:03:00 PM

The Union-Tribune reports: House resales take a tumble in December

San Diego County resale house prices tumbled last month by the biggest number in 18 years of record-keeping and contributed to the smallest year-to-year rise in overall prices in six years, DataQuick Information Systems reported Monday.Rising inventories, fewer transactions and now lower prices.

The median resale price for existing single-family homes dropped $15,000 from November to December to stand at $550,000, the largest month-to-month decline since DataQuick began keeping records in 1988.

However, last month's figure was still ahead of what it was in December 2004 by $25,000, or 4.8 percent.

...

Last year was the first time since 2001 that the number of home sales fell from the previous year. The total sold last year was 55,366, down 9.1 percent from 2004's 60,886.

...

On Thursday, the San Diego Association of Realtors, which monitors about 60 percent of the housing market, reported that properties took longer to sell in 2005 than in 2004 – lingering on the market for, on average, 62 days last year compared to 54 in 2004.

And the total number of listings has been growing, reaching a peak of just over 15,000 listings in November, about five times more than at the peak of the buying frenzy in spring 2004.

DataQuick will report on the rest of California over the next few days - it will be interesting to see if other areas are reporting falling prices - San Diego (along with Boston) has been leading the way into this slowdown. Also inventories probably declined in December as many sellers removed their properties from the market for the holidays. I expect inventories to start rising again in the January report.

MarketWatch: U.S. economy slows to below trend

by Calculated Risk on 1/16/2006 11:48:00 AM

MarketWatch reports: U.S. economy slows to below trend

The U.S. economy grew at the slowest pace in nearly three years in the just-concluded fourth quarter, economists now estimate.

Led by what could be the weakest consumer spending since 1991, the economy likely grew at about a 2.7% annual pace in the quarter after 11 straight quarters of growth above 3%, economists say.

...

Few economists expect the slump to worsen significantly. For the first quarter, economists are estimating growth at 3.6% ... Most economists do see growth slowing again at the end of the year as the housing market weakens.

...

Housing was one of the few bright spots in the fourth quarter's growth mix, along with inventory rebuilding. The weak sectors were consumer spending, business investment, exports and government spending.

"We do not believe the apparent weakness in the fourth quarter represents a clear change in the trend," said James O'Sullivan, an economist for UBS. GDP will likely slow from about 3.6% in 2005 to 3% in 2006 and 2.7% in 2007.

Saturday, January 14, 2006

Sasha Wins!

by Calculated Risk on 1/14/2006 02:56:00 PM

Congratulations Sasha!

Sasha Cohen is the new US Ladies Figure Skating champion.

Please excuse this off topic post: I happen to know Sasha, and in addition to being an incredible athlete, Sasha is an intelligent, warm and funny person. She is very deserving and will be a great representative for skating and America in Turin.

Friday, January 13, 2006

White House:Deficit Could Top $400 Billion

by Calculated Risk on 1/13/2006 01:33:00 AM

The Washington Post reports: Deficit Could Top $400 Billion

Driven by the cost of hurricane relief, the federal budget deficit is expected to balloon back above $400 billion for the fiscal year that ends in September, reversing the improvements of 2005, a White House official told reporters yesterday.The General Fund deficit will be close to $600 Billion this year - the White House is reporting the Enron style "unified budget deficit". But kudos to WaPo writer Jonathan Weisman for correctly describing the political game the White House has been playing with the budget for the last few years.

But some budget analysts cautioned that the estimate should be considered more of a political mark to inform the coming budget debate than an economic forecast.

This is the third straight year in which the White House has summoned reporters well ahead of the official budget release to project a higher-than-anticipated deficit. In the past two years, when final deficit figures have come in at record or near-record levels, White House officials have boasted that they had made progress, since the final numbers were below estimates.

"This administration has a history of overestimating the deficit early in the year, lowering expectations, then taking credit when it comes in below forecast," said Stanley E. Collender, a federal budget expert at Financial Dynamics Business Communications. "It's not just a history. It's almost an obsession."

The bottom line is simple: the General Fund budget is a disaster and the situation continues to get worse.

Thursday, January 12, 2006

The Economist: Danger time for America

by Calculated Risk on 1/12/2006 01:24:00 PM

From The Economist cover story: Danger time for America

In [Greenspan's] final days of glory, it may therefore seem churlish to question his record. However, Mr Greenspan's departure could well mark a high point for America's economy, with a period of sluggish growth ahead. This is not so much because he is leaving, but because of what he is leaving behind: the biggest economic imbalances in American history ...

Handovers to a new Fed chairman are always tricky moments. They have often been followed by some sort of financial turmoil, such as the 1987 stockmarket crash, only two months after Mr Greenspan took over. This handover takes place with the economy in an unusually vulnerable state, thanks to its imbalances. ...

How should Mr Bernanke respond to falling house prices and a sharp economic slowdown when they come? While he is even more opposed than Mr Greenspan to the idea of restraining asset-price bubbles, he seems just as keen to slash interest rates when bubbles burst to prevent a downturn. He is likely to continue the current asymmetric policy of never raising interest rates to curb rising asset prices, but always cutting rates after prices fall. This is dangerous as it encourages excessive risk taking and allows the imbalances to grow ever larger, making the eventual correction even worse. If the imbalances are to unwind, America needs to accept a period in which domestic demand grows more slowly than output.

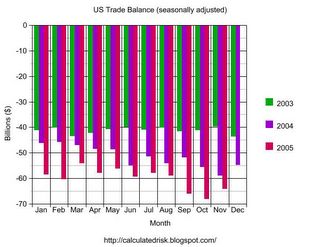

November U.S. Trade Deficit: $64.2 Billion

by Calculated Risk on 1/12/2006 12:14:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reports that the U.S. trade deficit for November was $64.2 Billion. Imports fell slightly to a $173.5 billion from a record $175.5 billion in October.

Click on graph for larger image.

Imports from China were $22.4 Billion, down from a record of $24.4 Billion in October, while exports to China were steady at $3.9 Billion. Imports from Japan decreased to $11.9 billion from $12.2 Billion in October.

The Petroleum deficit was $22.9 billion, down from the October record of $23.9 Billion. The decrease in the petroleum deficit was primarily due to a drop in the price of crude oil.

Dr. Setser (US November trade data) and Kash comment on the trade data.

Wednesday, January 11, 2006

US Migration Patterns

by Calculated Risk on 1/11/2006 07:54:00 PM

United Van Lines released their annual analysis of US migration patterns: Southeast, West Continue to Attract Residents as Midwest, Northeast See More Leave

United classifies each state in one of three categories -- "high inbound" (55% or more of moves going into a state); "high outbound" (55% or more of moves coming out of a state); or "balanced." Although the majority of states were in the "balanced" category last year, several showed more substantial population shifts.

What stands out to me is that California is seeing a net outflow for the first time since 1995. And Florida is "balanced" after years of net inflow. This is probably related to housing prices in both states.

So lets compare migration to housing prices ... the following graph is house price appreciation based on the OFHEO House Price Index.

Click on graph for larger image.

Quarterly Appreciation:

Red: Greater than 20%

Dark Orange: 15% to 20%

Light Orange: 10% to 15%

Light Blue: 5% to 10%

Dark Blue: less than 5%

NOTE: D.C. is also red. These are annual rates of appreciation for Q4 2004 through Q3 2005. So this is not the exact same time period as the United analysis (calendar 2005). Q4 2005 is not yet available.

There are two regions seeing significant migration inflow: the West (excluding California) and the Southeast (excluding Florida). It is no surprise that western states like Arizona, Oregon, Nevada and Idaho have seen housing prices surge based on the migration data.

However, a similar pattern is not happening the Southeast. The states seeing inflows, like the Carolinas and Georgia, are not seeing above average house price increases. Perhaps there is more available land and higher rental vacancy rates.

Its no surprise that high outbound states like Michigan and Indiana are price laggards.

FED's Geithner: Monetary policy must account for Asset Prices

by Calculated Risk on 1/11/2006 05:41:00 PM

From Reuters: Fed must take asset prices into account on policy

U.S. monetary policy must take asset price fluctuations into account even if it cannot target them explicitly, New York Federal Reserve President Timothy Geithner said on Wednesday.Here is the text of Geithner' speech: Some Perspectives on U.S. Monetary Policy

The comments set Geithner apart from others at the central bank who had been quicker to dismiss the impact of significant price rises in assets like stocks or housing.

Some economists worry that, like the stock market in the late 1990s, housing prices may haven gotten out of whack with the fundamental value of home assets after a five-year boom.

While some of his colleagues have argued that there is simply nothing the Fed can do about it, Geithner said action was indeed warranted under certain circumstances.

"When policy-makers have already witnessed a significant move in asset values and are confident in what that move means for the outlook, it (the Fed) should be prepared to adjust policy accordingly," Geithner told an economics luncheon at the Harvard Club.

Geithner also reiterated his concerns over the longer-term stability of the global financial system, saying that the calm of recent years should not be taken as a green light for complacency.

He said the U.S. current account deficit, and the eventual need for an adjustment, posed serious risks.

"It would be hard for anyone looking at the size of the U.S. current account deficit to not be worried," Geithner said.

MBA: Mortgage Activity Rebounds

by Calculated Risk on 1/11/2006 12:14:00 PM

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Down for Fifth Consecutive Week

Click on graph for larger image.

The Market Composite Index — a measure of mortgage loan application volume was 600.1 -- an increase of 9.9 percent on a seasonally adjusted basis from 545.9 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index increased 27.2 percent compared with the previous week but was down 19.1 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs were steady:

The seasonally-adjusted Purchase Index increased by 9.3 percent to 457.4 from 418.3 the previous week whereas the Refinance Index increased by 9.9 percent to 1497.5 from 1363.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.08 percent from 6.15 percent on week earlier ...

The average contract interest rate for one-year ARMs increased to 5.42 percent from 5.41 percent one week earlier ...

Tuesday, January 10, 2006

China and the Dollar

by Calculated Risk on 1/10/2006 02:15:00 PM

It seems that every time there is a discussion of some foreign central bank diversifying away from the dollar, it is promptly denied by the rumored country. These two articles follow that pattern ...

From the WaPo: China Set To Reduce Exposure To Dollar

China has resolved to shift some of its foreign exchange reserves -- now in excess of $800 billion -- away from the U.S. dollar and into other world currencies in a move likely to push down the value of the greenback, a high-level state economist who advises the nation's economic policymakers said in an interview Monday.And from the AP: China's central bank denies dollar plans

As China's manufacturing industries flood the world with cheap goods, the Chinese central bank has invested roughly three-fourths of its growing foreign currency reserves in U.S. Treasury bills and other dollar-denominated assets. The new policy reflects China's fears that too much of its savings is tied up in the dollar, a currency widely expected to drop in value as the U.S. trade and fiscal deficits climb.

...

Some economists have long warned that if foreigners lose their appetite for American debt, the dollar would fall, interest rates would rise and the housing boom could burst, sending real estate prices lower.

The comments of the Chinese senior economist, made on the condition of anonymity because the government disciplines those who speak to the press without express authorization, confirmed an analysis in Monday's Shanghai Securities News stating that China is inclined to shift some its savings into other currencies such as the euro and the yen, or into major purchases of commodities such as oil for a long-discussed strategic energy reserve.

China said Tuesday it has no plans to sell dollars from its $800 billion-plus foreign reserves, rejecting speculation that had jolted financial markets and fed speculation about the possible impact on the U.S. dollar.

"We won't sell off our dollar-denominated assets," a central bank official, Tang Xu, told Dow Jones Newswires.

China's foreign currency regulator said last week its plans for 2006 include "widening the foreign exchange reserves investment scope." That sparked speculation that Beijing might shift some reserves from dollars, the bulk of its holdings, into other currencies.

...

Tang, director-general of the central bank's Research Bureau, said foreign reserves were expected to top $800 billion at the end of 2005, up from $769 billion when the last quarterly report was issued in September, according to Dow Jones.

ALSO: see Martin Feldstein's: Uncle Sam’s bonanza might not be all that it seems Note: Dr. Thoma provides excerpts: Martin Feldstein: Capital Inflows Primarily from Foreign Governments, not Private Investors

And Dr. Setser's comments: Martin Feldstein joins the dollar doomsday cult.

This is a key reason of why one of my top economic predictions of the year was that long rates would rise when the Fed starts cutting rates later this year.

Monday, January 09, 2006

The End of Defined Benefit Plans

by Calculated Risk on 1/09/2006 02:06:00 AM

First, my post on Angry Bear, Stiglitz and Bilmes: The Real Cost of Iraq War

The NY Times reports: More Companies Ending Promises for Retirement

The death knell for the traditional company pension has been tolling for some time now. Companies in ailing industries like steel, airlines and auto parts have thrown themselves into bankruptcy and turned over their ruined pension plans to the federal government.This will put the burden on the employee and from my experience, the employees that will probably need the benefits the most, will contribute the least (as a percentage of income), and invest poorly.

Now, with the recent announcements of pension freezes by some of the cream of corporate America - Verizon, Lockheed Martin, Motorola and, just last week, I.B.M. - the bell is tolling even louder. Even strong, stable companies with the means to operate a pension plan are facing longer worker lifespans, looming regulatory and accounting changes and, most important, heightened global competition. Some are deciding they either cannot, or will not, keep making the decades-long promises that a pension plan involves.

...the pension freeze is the latest sign that today's workers are, to a much greater extent, on their own. Companies now emphasize 401(k) plans, which leave workers responsible for ensuring that they have adequate funds for retirement and expose them to the vagaries of the financial markets.

When I was a trustee for a 401(k) plan, I saw the following behavior repeated many times: Less sophisticated investors would tend to be overly conservative putting most of their money in money market funds. Then they would occasionally invest in whatever went up in the most recent quarters. If they had a losing quarter, they would scurry back to the money market fund. Their overall results were poor.

This will leave Social Security Insurance as the only defined benefit portion of an individual's retirement income - an insurance policy for life's vagaries.

Friday, January 06, 2006

What will the Fed do?

by Calculated Risk on 1/06/2006 08:19:00 PM

Here is another Fed Watch from Dr. Duy: A Little Something for Everyone. Duy mostly looks at the employment report, but he also writes:

Wall Street's stamp of approval implies a wide expectation of "one and done" for this tightening cycle. That's not quite my interpretation, although I can't blame traders for looking for good news after a dreary December. Instead, I left the minutes with the sense that another rate hike at the end of the month is in the bag, but beyond that, future changes in policy are not automatic but instead data dependent. That is decidedly not the same thing as "done."Barring some drastic change in the data, I think two more rate hikes are "in the bag" and we will see 4.75% at the March meeting.

As a note: Dr. Duy's Fed Watch is a regular column on Economist's View. For weekly updates on market expectations for the Fed Funds rate, see Dr. Altig's Macroblog.

The reason I think the Fed will raise rates at least two more times is because: 1)the data will probably be inconclusive and 2) Dr. Bernanke has been heavily criticized (I think unfairly) for being an inflation dove based on this speech: Deflation: Making Sure "It" Doesn't Happen Here and, therefore, if the Fed pauses at Bernanke's first meeting in March that would inflame the criticism. So I believe Bernanke will lean towards one more hike to prove his inflation fighting credentials.

Click on graph for larger image.

Using the Cleveland Fed Median CPI, this graph shows the real Fed Funds rate by quarter for the last five years - the period of emergency interest rates.

I think the Fed would like to see inflation below 2% - median CPI was 2.6% annualized last month and 2.4% over the last 12 months. To achieve their goal, the Fed will probably have to raise the real Fed rate to 2% to 2.5% and that puts the nominal Fed Funds rate at 4.75% or even 5%.

After the January hike, the key data will be the various measures of inflation. If inflation is subsiding, then the Fed might stop. If its close, I expect another hike in March.

When will the Fed cut rates?

I've written several times that I expect a rate cut later this year. The reason I expect a cut is because of the impact of a housing slowdown. If there is no housing slowdown, as predicted by Wells Fargo, then I doubt we will see a rate cut in 2006. If there is a slowdown, I expect two things: 1) Mortgage equity withdrawal to decrease significantly and impact consumer spending (like what happened in England) and 2) housing related employment to fall.

The Fed doesn't like to change directions too quickly. Looking at the Fed's recent history:

Rates peaked at 6.5% on May 16, 2000 and the first rate cut was almost 9 months later, in January 2001.And speaking of England, the Bank of England repo rate peaked in August 2004 at 4.75% and the BOE cut the rate to 4.5% one year later.

Rates peaked at 6% on Feb 1, 1995 and the first cut was 5 months later in July.

So, if housing slows down, I expect a rate cut in late 2006.

Wells Fargo forecasts 6.5% 2006 SoCal House Appreciation

by Calculated Risk on 1/06/2006 04:43:00 PM

Wells Fargo is forecasting 6.5% house price appreciation in Southern California for 2006 compared to their estimate of 14.3% in 2005.

An internal forecast from a Wells Fargo Senior Economist:

| Wells Fargo Forecast | 2005(est) | 2006(f) |

| Median Existing Home Price | $489K | $521K |

| Percent Change in Prices | 14.3% | 6.5% |

| Housing Starts | 101.3K | 103.4K |

| Single Family Starts | 72.4K | 74.3K |

| Multifamily Starts | 28.8K | 29.K |

Christopher Thornberg, senior economist with the UCLA Forecast, expects housing construction to drop by 25 percent next year, resulting in significant job loss for the construction industry.Two very different views.

Employment Report

by Calculated Risk on 1/06/2006 02:37:00 PM

The BLS reported:

"Total nonfarm payroll employment increased by 108,000 in December, and the unemployment rate was little changed at 4.9 percent"Kash calls the report "disappointing" and pgl looks at the labor force participation rate and the employment-population ratio.

Click on graph for larger image.

Although the December report might be disappointing, the number of jobs created in 2005 seems solid.

A major concern going forward is the impact of a housing slowdown. Housing was once again a key driver for employment gains in 2005; construction alone added almost 250K jobs. Since construction usually accounts for around 5% of total employment, I would have expected around 100K construction jobs given the total employment growth.

The good news is the economy has been adding jobs at around the expected rate. The bad news is the economy is probably still too "housing centric".

Thursday, January 05, 2006

Mortgage Spread

by Calculated Risk on 1/05/2006 04:59:00 PM

The spread between the yields of a 30 year fixed mortgage (as reported by the MBA) and the Ten Year Treasury note has widened steadily over the past year.

Click on graph for larger image.

If the current spread was 145 bps, as in early 2005, the rate on a 30 year mortgage would be about 5.7% today.

Instead, the rate on a 30 year fixed mortgage is 6.15%.

That is a substantial increase in the spread and I'm guessing it indicates investors have become increasingly wary of mortgage backed securities.

Wednesday, January 04, 2006

UCLA's Thornberg expects 25% decline in housing construction

by Calculated Risk on 1/04/2006 06:56:00 PM

The Contra Costa Times reports: Home builders see flat housing starts

California's 12-year run of home building gains will likely end in 2006, as developers pause to clear out excess inventory during the early part of the year, according to a trade group's annual housing forecast.Dr. Thornberg is not so optimistic:

The Sacramento-based California Building Industry Association report released Wednesday also predicted the state's torrid pace of housing price advances will slow, to between 5 percent and 8 percent per square foot. That's well off the 25 percent to 30 percent increases of the past few years.

The first quarter in particular could promise some price relief, as home builders pony up concessions to slice their growing inventory levels, said Alan Nevin, CBIA chief economist.

...

Statewide, the CBIA projects 185,000 to 205,000 new housing permits in 2006, down from an estimated 212,000 last year. Most of the decline will likely be in the high-end segment in coastal areas. Transactions in the resale market will likely fall to between 550,000 and 600,000, down from a recent high of 650,000.

Given the decline in housing construction, the CBIA also expects to see a "modest pull-back" in construction employment, which accounted for 13 percent of the more than 400,000 new California jobs created in 2005.

Christopher Thornberg, senior economist with the UCLA Forecast, expects housing construction to drop by 25 percent next year, resulting in significant job loss for the construction industry.

He said the CBIA's pricing prediction could prove true, but he hopes it doesn't because he believes prices are already "out of whack with reality."

"The real question is, is it a good thing if they go up and the answer is clearly 'no,'" he said. "It will just make things that much worse and it will take that much longer to correct."

MBA: Mortgage Activity Declines

by Calculated Risk on 1/04/2006 11:50:00 AM

The Mortgage Bankers Association (MBA) reports: ARM Applications Down in Latest Survey

Click on graph for larger image.

The Market Composite Index - a measure of mortgage loan application volume was 545.9 -- a decrease of 1.5 percent on a seasonally adjusted basis from 554.1 one week earlier. A holiday adjustment was included in the seasonally adjusted numbers to help account for the reduced application activity during the holiday week. On an unadjusted basis, the Index decreased 20.8 percent compared with the previous week and was down 9.9 percent compared with the same week one year earlier.Rates on fixed rate mortgages decreased, while rates for ARMs increased:

The seasonally-adjusted Purchase Index decreased by 4.5 percent to 432.9 from 453.1 the previous week whereas the Refinance Index decreased by 11.2 percent to 1259.1 from 1418.1 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.15 percent from 6.21 percent on week earlier ...Activity is falling, but still reasonably strong. The YoY decline of 9.9% for the same week is concerning. These reports will be more informative after the holidays.

The average contract interest rate for one-year ARMs increased to 5.41 percent from 5.36 percent one week earlier...

Tuesday, January 03, 2006

Fiscal 2006: Record YTD Increase in National Debt

by Calculated Risk on 1/03/2006 07:25:00 PM

After three months, Fiscal 2006 continues to set new records for the YTD increase in National Debt. For the first three months of fiscal year 2006, the National Debt increased $237.7 Billion to $8.17 Trillion as of Dec 30, 2005.

Click on graph for larger image.

The previous record for the first three months was in fiscal 2004 with an increase in the National Debt of $218.1 Billion.

Each month I will plot the YTD increase in the National Debt and compare it to the proceeding years. I expect fiscal 2006 to set a new record for the annual increase in the National Debt.

Two Views: Debt, Deficit and Social Security

by Calculated Risk on 1/03/2006 01:53:00 PM

There are two distinct views of the US fiscal situation.

VIEW 1:

National Debt = $8.1 Trillion or about 63% of GDP.VIEW 2:

General Fund Deficit = ~$600 Billion per year (about 4.7% of GDP)

Social Security Insurance (SSI) has a small, but manageable shortfall.

Publicly held portion of the National Debt is $4.7 Trillion or 37% of GDP. The rest of the National Debt the US owes to itself.Dr. Thoma posted Mankiw's Guidelines for Policy Makers. Mankiw's first resolution for policy makers:

Unified Budget Deficit = ~ $350 Billion per year - a problem, but manageable.

Social Security Insurance is a massive problem.

Mankiw's #1: "This year I will be straight about the budget mess. I know that the federal budget is on an unsustainable path. I know that when the baby-boom generation retires and becomes eligible for Social Security and Medicare, all hell is going to break loose. I know that the choices aren't pretty -- either large cuts in promised benefits or taxes vastly higher than anything ever experienced in U.S. history. I am going to admit these facts to the American people, and I am going to say which choice I favor."Obviously Mankiw holds View #2 above. One of the unstated, but obvious components of View #2, is that the excess SSI taxes collected over the last 20+ years has really just been another General Fund tax. In the eyes of Mankiw, these extra payroll taxes have been a surreptitious method of instituting a flatter tax system.

Ostensibly the excess payroll tax is not a General Fund tax; it is a prepayment on future benefits. Legally, the General Fund receives most of its revenue from high income individuals, whereas the revenue burden for the SSI Trust Fund falls mostly on low and middle income wage earners.

Those holding View #1 see reversing the Bush tax shifts as the primary method for restoring fiscal balance. By bringing the General Fund back into balance, SSI is only a minor problem.

Those holding View #2 see cutting future benefits, primarily for low and middle income earners, as the solution for restoring fiscal balance.

So its a question of who pays: high income earners or low and middle income earners.

Although this is mostly a normative question, View #1 has the advantage of being straightforward. In fact, any politician who really explained View #2 to their constituents would likely be removed from office, tarred and feathered, or far worse.

Monday, January 02, 2006

G.R.E.B.B. Day

by Calculated Risk on 1/02/2006 03:53:00 PM

My friend, Ramsey, has started calling Feb 1, 2006 G.R.E.B.B. DAY (Greenspan real estate bubble bursting day). Very funny.

Although I think the slowdown will be gradual, Ramsey provided the following data today on the San Diego housing market:

San Diego real estate update:I've felt the housing slowdown would start with rising inventories, followed by falling transaction volumes, and then falling prices. Inventories for both new and existing homes have been rising for months. Now the second phase may be starting: from Ramsey's comparison of Dec 2005 to Dec 2004 for San Diego, transaction volumes dropped significantly (36%).

December 05 closings 2,107

That is 36.2% less than YTY Dec 04 of 3,300

That is 12.7% less than sequential Nov 05 of 2,414

2005 total closings 39,950

2004 total closings 42,809

December 05 avg sold price $633,223

That is 9.2% higher than YTY Dec 04 of $579,749

That is 1.3% higher than sequential Nov 05 of $625,172

December 05 closings averaged 63 days on market.

That is 16.6% longer than YTY Dec 04 of 54 days.

That is 6.8% longer than sequential Nov 05 of 59 days.

Avg days on market for all 2005 closings was 52 days.

Avg days on market for all 2004 closings was 33 days.

32.9% of Dec 05 sales were condos.

35.1% of all 2005 sales were condos.

December 05 pending sales 1,775

Jan 06 closings, based on Dec 05 pendings, are going to fall off the cliff unless sales miraculously pick up right now.

For sale inventory peaked at just over 15,000 early December 05 and dropped back to 13,876 on Dec 31, 05 due to the holidays. We should see a number of listings coming back on the market soon. How fast this inventory gets absorbed is going to tell us the health of the market.

It is no surprise that inventories fell in December. That happens every year as sellers take their houses off the market during the holidays. When the December existing homes numbers are released, I expect inventories to fall 10% to 20% from 2,903,000 in November (in 2004, inventories dropped 13% from November to December). That doesn't mean the market is recovering - it is just part of the seasonal pattern.

Sunday, January 01, 2006

Interesting Times

by Calculated Risk on 1/01/2006 09:18:00 PM

Happy New Year to All! It does appear we are living in interesting times. The biggest story of the New Year is the Constitutional Crisis concerning the warrantless surveillance of US citizens. And on the economic front, housing is still the hot topic.

The San Diego Union has a series of articles on housing:

Understand risks of 'creative' loans

Creative loans push overextended owners into dangerous waters

When she bought her two-bedroom condominium in Mira Mesa in mid-2004, Elizabeth Eure didn't envision herself one day sleeping on an egg-crate mattress in an empty unit.Pressure grows as market cools

The furniture was gone in December because Eure was preparing to move, awaiting the close of escrow. After living there less than a year and a half, she had sold her home to cut her losses. Her monthly mortgage payment of $2,500 was too much for her to handle.

"It was a mistake," Eure, 29, said of the purchase. "If I could do it all over again, I would have rented an apartment."

Richard Mehren, a real estate agent who specializes in condominiums, said Eure's predicament is a common one. Many recent buyers are beginning to realize they have taken on too much debt.

And from the Southwest Florida Herald Tribune: Clock is running down on 'cheap' mortgages

Lenders who started making those teaser-rate loans a few years ago are getting ready to charge real-world payments on them.

Starting in 2006 and accelerating into 2007, as much as $2.5 trillion worth of the fancy mortgages called "hybrids" are coming to the end of the free-lunch part of the deal.

And while prices in Southwest Florida are hovering at twice those of three years ago, the house party seems to have ended in July. Since then, as mortgage rates continue their upward creep, inventories are stacking up, while the rate of closings is slowing down.