by Calculated Risk on 3/23/2006 10:05:00 AM

Thursday, March 23, 2006

Existing Home Sales

UPDATE: The National Association of Realtors (NAR) released their data for Existing Home Sales in February. NAR reported:

Existing-home rose in February following five months of decline, indicating a stabilization is taking place in the market, according to the National Association of Realtors®.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so February sales reflect agreements reached in January. That is why weather in January is important.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 5.2 percent to a seasonally adjusted annual rate1 of 6.91 million units in February from an upwardly revised pace of 6.57 million in January, but were 0.3 percent below a 6.93 million-unit level in February 2005.

David Lereah, NAR’s chief economist, said mild weather appears to be responsible for some of the gain. “Weather conditions across much of the country were unseasonably mild in January and likely were a factor in higher levels of buyer activity, which boosted sales that closed in February,” he said. “Higher interest rates had been tapping the breaks, notably in higher-cost housing markets since mortgage interest rates trended up last fall, but we’re seeing signs of stabilization in the market now with the sales rebound. Home sales should level-out in the months ahead.”

Also note that mortgage applications fell about 10% in February and March (compared to January). This probably indicates that existing home sales will fall in the coming months on a seasonally adjusted (SA) basis.

The MBA Purchase Index averaged 455 in December, 453 in January, 407 in February and 399 so far in March (all numbers SA).

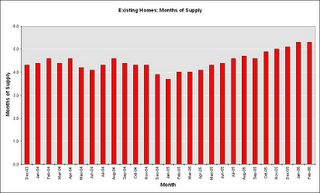

Click on graph for larger image.

Existing Home inventories rose to over 3 million units in February. This is the start of the listing season, and I expect inventories to continue to rise. If sales fall about 10% (as indicated by the MBA purchase index) and the inventory continues to rise that could put the months of supply over 6 months.

If sales fall about 10% (as indicated by the MBA purchase index) and inventories continues to rise at the current pace, the months of supply could be over 6 months by Summer. Usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem.

New Home sales (released tomorrow) is usually a better indicator of the housing market.