by Calculated Risk on 5/19/2006 02:13:00 PM

Friday, May 19, 2006

Housing Busts: Looking Back

Greenspan says the housing boom is over. Bernanke suggests the cooling is "orderly". Leamer and Thornberg predict prices will be flat for a number of years, unless employment falls. What is likely to happen?

Although every bust is different, and this boom was larger than previous booms (so the bust might be worse), taking a look back at previous busts might give us an idea of what to expect:

Housing "bubbles" typically do not "pop”, rather prices tend to deflate slowly in real terms, over several years. Historically real estate prices display strong persistence and are sticky downward. Sellers want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices. This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes.

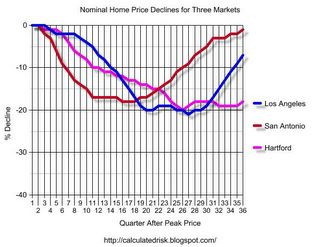

Even though prices tend to deflate slowly, they can still drop significantly over time. On the following graph are the nominal price declines for three busts: Los Angeles in the early '90s, San Antonio in the mid '80s (the oil patch bust) and Hartford starting in '89. The peaks of all three housing booms are aligned on the left and the relative price declines are plotted by quarter after the local market’s price peak.

Click on graph for larger image.

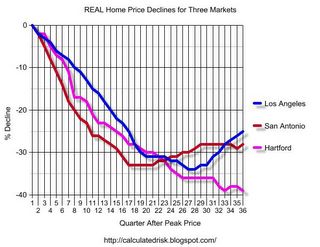

Click on graph for larger image.For all three busts, the prices steadily declined over many quarters. Although these are three of the worst busts of the last 25 years, the price action is representative of other housing busts. In real terms (adjusted by CPI less shelter), the price declines are even more dramatic:

Data Sources: OFHEO House Price Index, BLS CPI less Shelter.

In real terms, prices in the Hartford market declined for over 8 consecutive years before reaching a nadir of almost 40% off the peak price of 1989. The other markets experienced similar declines:

Percent Decline (Real and Nominal), Years from Peak to Trough Real Years Nominal Years Decline Decline Los Angeles 34% 6 3/4 21% 6 3/4 San Antonio 33% 4 3/4 18% 4 Hartford 39% 8 1/4 15% 6 1/2

NOTE: Most of this post is excerpted from my post last year on Angry Bear: After the Boom.