by Calculated Risk on 6/28/2006 09:31:00 AM

Wednesday, June 28, 2006

MBA: Mortgage Rates Increase, Application Volume Declines

The Mortgage Bankers Association (MBA) reports: Mortgage Rates Increase, Application Volume Declines (link added)

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 529.6, a decrease of 6.7 percent on a seasonally adjusted basis from 567.6 one week earlier. On an unadjusted basis, the Index decreased 7.0 percent compared with the previous week but was down 31.0 percent compared with the same week one year earlier.Mortgage rates increased:

The seasonally-adjusted Purchase Index decreased by 6.2 percent to 389.0 from 414.8 the previous week and the Refinance Index decreased by 7.5 percent to 1356.0 from 1466.1 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.86 percent from 6.73 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs increased to 6.36 percent from 6.22 percent ...

| Total | -31.0% |

| Purchase | -18.2% |

| Refi | -46.4% |

| Fixed-Rate | -30.1% |

| ARM | -32.9% |

Both the Market Index and Purchase Index are at new lows for the last 3 years.

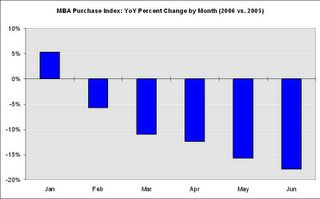

This graph shows the MBA Purchase Index percent change by month for 2006 from 2005.

Based on the MBA Purchase Index, the housing market is continuing to slow compared to 2005.