by Calculated Risk on 7/30/2006 11:37:00 PM

Sunday, July 30, 2006

Goldman Sachs on Housing Prices

The Business Online reports: Fears as US house prices to dip for the first time ever

HOUSE prices are set to drop in the US for the first time on record, US investment bank Goldman Sachs warned this weekend.

Prices in several segments of the market have already started to fall, and the overall market will move into the red even in nominal terms next year, fuelling fears that this will trigger a downturn in consumer spending and hit an already slowing US economy.

Jan Hatzius, economist at Goldman Sachs, said: “The risk is rising that nominal US home prices may be headed for an outright decline in 2007. It would be the first decline in national home prices ever recorded, at least in nominal terms.”

In real terms, prices have declined during several periods, including a 9% drop from 1979 to 1984.

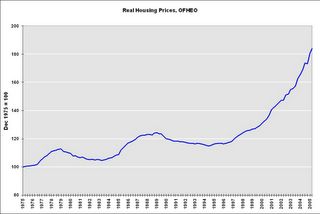

Click on graph for larger image.

This is a graph of the OFHEO real House Price Index adjusted by CPI less shelter. Real prices fell 7.2% from 1979 to 1984. From 1989 to 1995, real prices fell 7.9%.

UPDATE 1: Hatzius used the core PCE deflator and I used CPI less shelter. That is why there is a small difference between the calculations.

The Office of Federal Housing Enterprise Oversight’s index is also likely to show a sharp slowdown for the rest of this year. As of the first quarter of 2006, this index was up 10.1% year-on-year, extremely close to the 10.4% year-on-year increase seen in the National Association of Realtors median-price data.UPDATE 2: Hatzius used the Purchase Only Index that shows a 10.1% YoY increase (see page 6). The OFHEO HPI shows a YoY 12.54% increase (see third page). The nominal quarterly apprection was 2.03%.

Goldman is forecasting that the year-on-year Office of Federal Housing Enterprise Oversight’s index growth could fall to 4% by the second or third quarter of 2006, and possibly into negative territory in 2007.

UPDATE 3: I wrote: Based on OFHEO's method, there is almost no way the year-on-year "index growth could fall to 4% by the second or third quarter of 2006".

Hatzius suggests:

"If you assume roughly flat seasonally adjusted numbers for Q2 and Q3, I calculate the year-on-year rate would drop to 4.2% by Q3. Also, you could get some downward revisions to prior quarters, which would also work in the direction of pushing down the yoy rate."Using the Purchase Only Index, and if Q2 and Q3 are flat (very possible), and there are no revisions, the YoY increase would be 6.95% in Q2 and 4.2% in Q3. So Hatzius' estimate is very possible for Q3, even without any downward revisions. Using the HPI with the same assumptions, Q2 would be 8.6%.

The underlying purchase-only and a seasonally-adjusted purchase-only index can be downloaded here. I agree that we will be seeing both real and nomnal price declines soon.