by Calculated Risk on 7/25/2006 09:44:00 AM

Tuesday, July 25, 2006

NAR: Existing-Home Sales Flattening, Prices Cooling

The National Association of Realtors (NAR) reports: Existing-Home Sales Flattening, Prices Cooling

Click on graph for larger image.

Existing-home sales were down modestly in June, and home prices were up slightly from a year ago, according to the National Association of Realtors®.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 1.3 percent to a seasonally adjusted annual rate1 of 6.62 million units in June from an upwardly revised level of 6.71 million May. Last month’s sales were 8.9 percent below the 7.27 million-unit pace in June 2005.

David Lereah, NAR’s chief economist, said the housing market is flattening-out. “Over the last three months home sales have held in a narrow range, easing to a level that is near our annual projection, which tells us the market is stabilizing,” he said. “At the same time, sellers have recognized that they need to be more competitive in their pricing given the rise in housing inventories. Home prices are only a little higher than a year ago.”

The national median existing-home price2 for all housing types was $231,000 in June, up 0.9 percent from June 2005 when the median was $229,000. The median is a typical market price where half of the homes sold for more and half sold for less.

“The change in price performance is directly tied to housing inventories – a year ago we had a lean supply of homes and a sellers’ market, with monthly home sales at an all-time record high,” Lereah said.

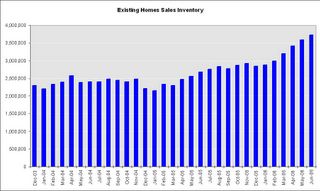

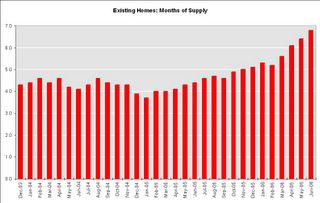

Total housing inventory levels rose 3.8 percent at the end of June to 3.73 million existing homes available for sale, which represents a 6.8-month supply at the current sales pace. By contrast, in June 2005, there was a tight 4.4-month supply on the market.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so June sales reflects agreements reached in April and May.

As I've noted before, usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem. Current inventory levels, at 6.8 months of supply, are now in the danger zone.