by Calculated Risk on 9/27/2006 12:19:00 AM

Wednesday, September 27, 2006

MBA: 30-Year Fixed Rate Declines

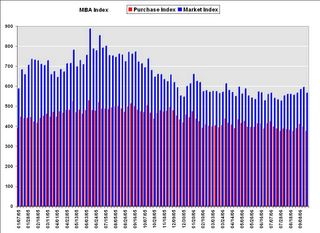

The Mortgage Bankers Association (MBA) reports: 30-Year Fixed Rate Declines Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 566.5, a decrease of 4.9 percent on a seasonally adjusted basis from 595.8 one week earlier. On an unadjusted basis, the Index decreased 5.4 percent compared with the previous week and was down 21.1 percent compared with the same week one year earlier.Mortgage rates decreased:

The seasonally-adjusted Purchase Index decreased by 5.5 percent to 375.9 from 397.9 the previous week and the Refinance Index decreased by 4.1 percent to 1677.5 from 1748.7 one week earlier. The Purchase Index is at its lowest level since November 2003.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.18 percent from 6.36 percent ...

The average contract interest rate for one-year ARMs decreased to 5.90 percent from 5.95 percent ...

The Purchase Index is at its lowest level since November 2003.

The Purchase Index is at its lowest level since November 2003. This graph shows the Purchase Index and the 4 and 12 week moving averages.

Note: Scale does not start at zero to better show changes.

Average year-to-date purchase activity is 13.8% below 2005, and has been running more than 20% below 2005 for the last couple of months.