by Calculated Risk on 9/20/2006 02:03:00 AM

Wednesday, September 20, 2006

MBA: Refinance Applications Rise

The Mortgage Bankers Association (MBA) reports: Refinance Applications Rise in Latest Survey Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 595.8, an increase of 2 percent on a seasonally adjusted basis from 584.2 one week earlier. On an unadjusted basis, the Index increased 12.3 percent compared with the previous week and was down 22.5 percent compared with the same week one year earlier. The previous week was shortened due to the Labor Day holiday.Mortgage rates were mixed:

The seasonally-adjusted Purchase Index decreased by 3 percent to 397.9 from 410.2 the previous week and the Refinance Index increased by 9.5 percent to 1748.7 from 1597 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.36 percent from 6.32 percent ...Change in mortgage applications from one year ago (from Dow Jones):

The average contract interest rate for one-year ARMs decreased to 5.95 percent from 5.96 percent ...

| Percent Change in Number of Applications | |||

| Applications | Change from one year ago | ||

| Total | -22.5% | ||

| Purchase | -19.8% | ||

| Refi | -25.7% | ||

| Fixed Rate | -19.4% | ||

| ARM | -29.8% | ||

Purchase activity is off 19.8% from the comparable week last year.

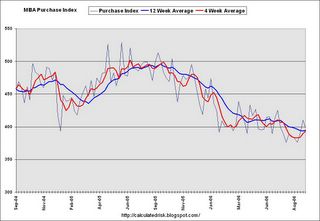

Purchase activity is off 19.8% from the comparable week last year. This graph shows the Purchase Index and the 4 and 12 week moving averages.

Note: Scale does not start at zero to better show changes.

Average year-to-date purchase activity is 13.6% below 2005, and has been running more than 20% below 2005 for the last couple of months.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |