by Calculated Risk on 9/24/2006 01:01:00 AM

Sunday, September 24, 2006

Mortgage Extraction and the Trade Deficit

In the previous post, I graphed GDP growth, with and without mortgage equity withdrawal (MEW), for the last 30 years. Now for a little good news.

Note: the previous post also reviewed the record low equity percentage in household real estate - even though the U.S. housing market has seen significant appreciation. Click on graph for larger image.

Click on graph for larger image.

This is graph 2 from the previus post and shows real annual GDP growth, with and without MEW, for the last 30 years.

One of the key assumptions is that MEW related consumption is of domestic products and services. Any MEW related consumption of imports does not impact GDP.

Let's review the components of Gross Domestic Product (GDP):

GDP = Consumption (PCE) + Investment + Trade Balance + Government Spending.

So if consumption rises $30 Billion due to MEW, but all of that consumption is of imported products and services (reducing the trade balance by $30 Billion), GDP is not impacted. And there appears to be a correlation between MEW and the trade deficit. Alan Greenspan commented on this relationship in Feb of 2005:

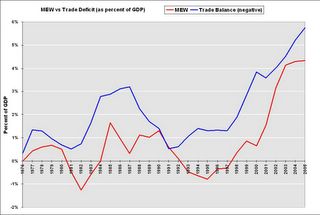

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."The following graph uses MEW (instead of the increases in the mortgage debt) and the trade balance (instead of the current account balance). MEW is probably better than the overall increase in mortgage debt - because much of the increase in mortgage debt is due to residential investment and is not available for consumption.

Note: The trade balance is inverted since MEW would increase the trade deficit.

Note: The trade balance is inverted since MEW would increase the trade deficit.MEW and the trade deficit, as a percent of GDP, have tracked each other with a high correlation over the last 30 years. As Greenspan noted correlation is not causation.

However a possible explanation for this correlation is that a disproportionate percentage of MEW, as compared to normal consumption patterns, flows to imports as opposed to consumption of domestic products and services.

This means that the impact of MEW on GDP would be less than in graph 1. That is the good news.

However this would imply potential bad news for U.S. trading partners if MEW continues to decline as expected. And there is a possible impact on interest rates (bad for housing) that I will discuss soon