by Calculated Risk on 10/04/2006 12:26:00 AM

Wednesday, October 04, 2006

MBA: Mortgage Applications Rise

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Rise Sharply Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 633.9, an increase of 11.9 percent on a seasonally adjusted basis from 566.5 one week earlier. On an unadjusted basis, the Index increased 11.5 percent compared with the previous week and was down 10.9 percent compared with the same week one year earlier.Mortgage rates were mixed:

"Refinance applications continue to increase as mortgage rates have declined to their lowest levels since the beginning of the year," said Mike Fratantoni, MBA’s senior director, single family research and economics.

The seasonally-adjusted Refinance Index increased by 17.5 percent to 1970.8 from 1677.5 the previous week and the Purchase Index increased by 7.6 percent to 404.6 from 375.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.24 percent from 6.18 percent ...

The average contract interest rate for one-year ARMs decreased to 5.86 percent from 5.90 percent ...

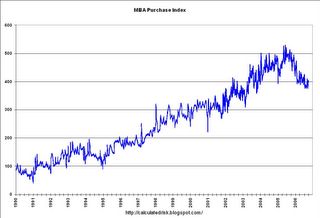

The second graph shows the MBA Purchase Index since inception in 1990. The index was started as housing slumped in the early '90s.

The second graph shows the MBA Purchase Index since inception in 1990. The index was started as housing slumped in the early '90s.Note: Actual data after 2001. Before 2001, graph was copied from another source.

This third graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

This was the last week of loan activity before the New Nontraditional Mortgage Guidance was released. Refinance and ARM activity was very strong. It will be interesting to see if the guidance has any impact on applications over the next few weeks.