by Calculated Risk on 10/28/2006 12:06:00 AM

Saturday, October 28, 2006

Merrill Lynch Forecast

From the Oct 24th Merrill Lynch forecast: 2007 US interest rate outlook

UPDATE: Bill Cara also has this Merrill Lynch report: The "D" word sets in for the builders — "Desperation"

*[W]e expect that GDP growth could hard-land in late 2007 and early-2008 ...

Click on graph for larger image.

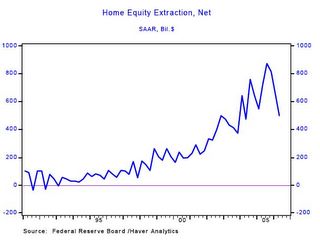

Click on graph for larger image.* Unlike the Fed’s view for “limited” spillover effects from the housing correction, we foresee a substantial degree of economic contagion (from the residential construction correction and from a decline in mortgage equity withdrawals).If there is spillover from the housing bust into the general economy, the initial impacts will be from the loss of housing related jobs and the decline in mortgage equity withdrawal. I don't think we will have to wait until late 2007 to see if there is spillover from the housing bust - the next few quarters should tell the tale.

* In our hard-landing view, this contagion likely will be severe enough to drive the unemployment rate up to 5.8% by the end of 2007 (currently, the unemployment rate is 4.6%).

* In our hard-landing view, monthly US nonfarm payroll growth likely will average 75k to 125k over the very near-term, but that monthly jobs growth should begin to turn negative by 2Q-2007.