by Calculated Risk on 12/04/2006 11:27:00 AM

Monday, December 04, 2006

Fed Fund Probabilities

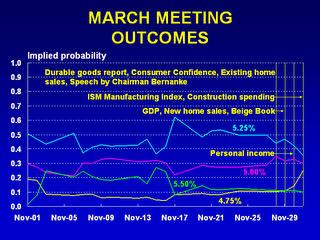

After the raft of weak economic news last week, the market expectations for a rate cut in March have increased (based on Fed Funds futures): Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

The expectations of a 50bps rate cut in March are 25%, and for a 25 bps rate cut almost another 30%.

This is more evidence for Carlone Baum's article last week: The Fed Cries Wolf; Mr. Market Isn't Listening

Federal Reserve officials are getting a first-hand lesson in the law of diminishing returns: Try as they might, they can't seem to get the same mileage from their hawkish rhetoric.

In the past few months, every time a policy maker found a waiting platform, he or she used the opportunity to remind us that the Fed is more concerned about rising inflation than slowing growth.

Their words had predictable results. The prices of interest- rate futures contracts that reflect expectations of Fed policy sank, wiping out the gains registered on weak economic data.

...

Then something strange happened. The market stopped listening.