by Calculated Risk on 12/13/2006 12:09:00 AM

Wednesday, December 13, 2006

MBA: Refinance Applications Hit Highest Levels in Over a Year

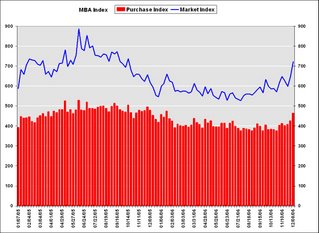

The Mortgage Bankers Association (MBA) reports: Refinance Applications Hit Highest Levels in Over a Year Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 721.2, an increase of 11.4 percent on a seasonally adjusted basis from 647.6 one week earlier. On an unadjusted basis, the Index increased 10.2 percent compared with the previous week and was up 22.2 percent compared with the same week one year earlier. The Market Index is at its highest level since October 2005.Mortgage rates were mixed:

“The substantial decline in mortgage rates over the past six months, greater than 80 basis points in total, has led to a significant increase in refinance activity. Additionally, we are seeing a steady increase in purchase applications,” said Mike Fratantoni, Senior Economist at the Mortgage Bankers Association.

The seasonally adjusted Refinance Index increased by 15.8 percent to 2304.4 from 1989.7 the previous week and the Purchase Index increased by 8.7 percent to 463.8 from 426.6 one week earlier. The Refinance Index is at its highest level since September 2005 while the Purchase Index is at its highest since January 2006.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.02 from 5.98 percent ...

The average contract interest rate for one-year ARMs decreased to 5.76 percent from 5.79 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 3.1 percent to 424.6 from 411.9 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 3.1 percent to 424.6 from 411.9 for the Purchase Index.The refinance share of mortgage activity increased to 52.6 percent of total applications from 50.1 percent the previous week. The refinance share is at its highest level since April 2004. The adjustable-rate mortgage (ARM) share of activity increased to 24.9 from 23.9 percent of total applications from the previous week.With the dramatic drop in the ten year yield, the 30 year mortgage had fallen briefly under 6% two weeks ago. Based on Freddie Mac's monthly data, that was the first time the 30 year rate has been below 6% since September 2005.