by Calculated Risk on 1/31/2007 08:33:00 PM

Wednesday, January 31, 2007

Tanta on "Scratch and Dent" Loans

Note from CR: A friend sent me an excerpt from Fleckenstein's newsletter yesterday and I forwarded it to Tanta. First, from Fleck:

Turning to the subprime industry, once again I heard from my friend who has been staggeringly accurate. He continues to feel that things are about to really get worse. In an email to me, he wrote: "Scratch and dent loans are killing everybody. Bids that were 92 or 93 are now low to mid-80s. It is a bloodbath, and is pressuring even strong companies to buckle. NO ONE is making any money in the market right now. We are at a point of no return for many. The next two weeks will be wild."And the following are Tanta's comments:

I've been in the investment business over 25 years, and again, I have rarely seen someone so accurately call a turn in the market as he has done. Remember, we are just now witnessing a change in lending standards, and these will ripple all through the lending food chain, though thus far only small changes have occurred.

Thanks for the tidbits--a former colleague of mine used to get Fleck’s newsletter and you could frequently hear some serious snickers from that cubicle—we’d all have to go over and hear what Fleck said this time. Mortgage punks—the Secondary Marketing ones, at least--aren’t, in my experience, mostly permabears, but they’re cynical as the day is long. It comes from constant exposure to the underbelly of the credit monster.

“Scratch and Dent” is a real industry term. The approximate meaning is “loan with incurable defect.” “Curable” is a real industry term and indicates something like a loan that closed with too little MI coverage (a kind of “bad stuff that happens”): you can “cure” that by buying more coverage. If you can’t get the customer to pay for it, though (usually because you didn’t disclose the correct MI on the regulatory docs, and so if you start charging the borrower more MI, you then provide yourself lawsuit or pissy regulator material), the loan has a serious long-term yield problem and qualifies for a “scratch & dent” pool. A loan that once had a 30-day late but then made the last six payments is just “seasoned,” unless the late was EPD (Early Payment Default), in which case the loan, assuming it’s performing again, is S&D. (You can’t “cure” an EPD. It’s the mortgage equivalent of the unforgivable sin.) The stuff the rating agencies call “reperforming” is S&D. 99% of performing loans that are repurchased from an investor are sold by the repurchaser as “S&D.”

The actual industry term for seriously nonperforming loans (in BK, 90 days, nonaccrual, in FC, etc.) is “nuclear waste.”

I suppose you could get someone to take a loan with certain kinds of “misrepresentation” evidenced as S&D or NW—the ones, say, where income has been proven to be “exaggerated” but there is no other evidence of fraud that could mean a payable claim for the property seller or some other party. The ones with incurable title problems? No exit. If nobody can convey title, you can’t foreclose. Your only possible recovery comes from criminal prosecution, if you’re lucky enough not to be an unindicted co-conspirator yourself and therefore have standing in the courts. That will, of course, take longer than a lot of these folks can stay solvent.

Fleck’s informant is saying that scratch & dent is getting nuclear waste bids. This implies that nuclear waste is probably heading for “no bid.” In any case, one is generally made to repurchase a loan at par (you might have to give back any actual premium paid if it’s an EPD, depends on the contract). So passing it off to a junk dealer, in turn, at a bid in the 80s is a painful thing. Hanging on to it, if you’re as thinly capitalized as your average subprime mortgage banker, is out of the question. Hence the “bloodbath.”

If it hits an outfit like Fremont—which is an FDIC-insured thrift and can therefore hang onto this stuff a lot longer than a mortgage banker can—we’ll be out of “thinning the herd” and into “decimation.” One reason it’s so hard to tell at the moment how bad this might get is that it’s hard to tell how many more “pending” repurchases we have out there. The EPD garbage is just the first wave. Every NOD in that big pile you see reported has been most thoroughly examined for other potential rep and warranty “issues” if the investor is any kind of awake, and they seem to be waking up. There used to be this idea that you didn’t push so hard on your correspondents and brokers that you broke their backs—you need a counterparty to keep having a business model. That’s a “normal” downturn idea. The current one seems to be more like “close the gates of mercy, shoot the wounded, and sink the lifeboats.” That does imply—as JPMorgan also implies—that the Big Dogs have more cooties on the balance sheet than they’re prepared to tolerate. Looks like total war to me.

Residential Investment as Percent of GDP

by Calculated Risk on 1/31/2007 04:11:00 PM

This graph shows Residential Investment as a percent of GDP. Click on graph for larger image.

Click on graph for larger image.

Residential investment (RI) has now fallen to 5.3% of GDP from the peak of 6.3% in the second half of 2005.

If RI falls back to the median level of the last 35 years (4.5% of GDP), then the RI declines are just over half over. If RI falls to the '80s and '90s bust lows (below 3.5% of GDP), then the RI bust has just started.

GDP Report

by Calculated Risk on 1/31/2007 10:28:00 AM

From MarketWatch: GDP surges at 3.5% rate in fourth quarter

Fed by robust consumer spending, a drop in energy prices and big turnaround in the trade balance, the economy notched its highest growth in a year, offsetting the drag of the weak housing and auto sectors.As predicted, PCE inflation was negative in Q4, for the first time in 45 years. And PCE was everything in this report. Residential investment fell 19.2% annualized. Nonresidential investment fell 0.4%, the biggest drop in nearly four years.

The 3.5% growth rate was much stronger than the 2% recorded in the third quarter, and handily beat the 3% expected by economists surveyed by MarketWatch.

Consumer prices fell 0.8% annualized in the quarter, the first quarterly decline in 45 years and the biggest drop in 52 years.

UPDATE: On Investment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in residential investment vs. nonresidential investment. In general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble. But typically changes in residential investment lead changes in nonresidential investment, and GDP, by three to five quarters. Something to watch.

MBA: Mortgage Applications Increase

by Calculated Risk on 1/31/2007 09:59:00 AM

The Mortgage Bankers Association (MBA) reports: Refinance and Purchase Applications Both Increase

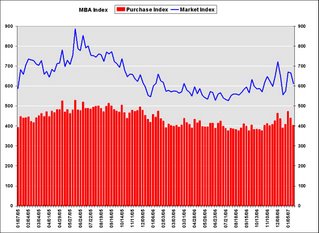

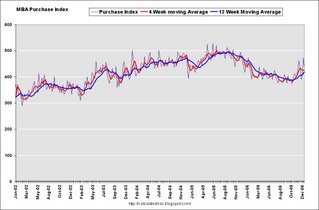

Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 631.3, an increase of 3.2 percent on a seasonally adjusted basis from 611.3 one week earlier. On an unadjusted basis, the Index increased 5.9 percent compared with the previous week and was up 0.7 percent compared with the same week one year earlier.Mortgage rates were mixed:

The Refinance Index increased by 4.9 percent to 1940.2 from 1848.8 the previous week and the seasonally adjusted Purchase Index increased by 1.3 percent to 408.0 from 402.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.29 from 6.22 percent ...

The average contract interest rate for one-year ARMs decreased to 5.86 percent from 5.91 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.1 percent to 430.8 from 430.5 for the Purchase Index.

The refinance share of mortgage activity decreased slightly to 47.4 percent of total applications from 47.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 21.4 from 20.3 percent of total applications from the previous week.

Forbes: The Adventurer (Part II)

by Calculated Risk on 1/31/2007 01:38:00 AM

Jim Clash interviews Sasha (part II)

Part I was here.

Tuesday, January 30, 2007

JPMorgan CEO: Recession Signs

by Calculated Risk on 1/30/2007 06:43:00 PM

From MarketWatch: Dimon sees a sign of recession

Rising defaults in some of the riskiest home loans offered by J.P. Morgan Chase & Co. signal a recession may be looming, Jamie Dimon, the bank's chief executive said Tuesday.Did someone just say "credit crunch"?

Dimon, speaking at Citigroup's annual financial services conference, said high-risk loans - as measured by credit scores and loan-to-value ratios of 90% or more -- make up 2% of the bank's home equity portfolio, Dimon said according to a live webcast.

He also said defaults are rising at J.P. Morgan "a little bit," adding, "home equity is subject to deterioration" from a recession, but that the bank is well positioned to sustain a downturn in the economy. The bank has largely exited the subprime lending area.

Give Bernanke Credit

by Calculated Risk on 1/30/2007 04:28:00 PM

"We've never had a decline in housing prices on a nationwide basis. What I think is more likely is that house prices will slow, maybe stabilize ... I don't think it's going to drive the economy too far from its full-employment path, though."From the AP: Thumbs Up for Bernanke on First Year

Dr. Bernanke, July 29, 2005

The economy tested Federal Reserve Chairman Ben Bernanke during his first year on the job. A sinking housing market and a troubled auto industry threatened to short-circuit economic activity. Gyrating energy prices threatened as well.Although I've disagreed with Bernanke at times, I think he deserves credit so far. I included the above quote as a point of disagreement - I expect we will see housing prices decline on a nationwide basis in 2007.

By most accounts, the Fed chairman passed.

I'd also argue that Bernanke hasn't been tested yet. From Stephen Roach in late 2005:

"Alan Greenspan faced a stock-market crash two months after he took over in August 1987. Paul Volcker had to cope with a rout in the bond market three months after he became chairman in August 1979. G. William Miller was challenged immediately by a dollar crisis in the spring of 1978. For Arthur Burns, it was the inflation bogie in the early 1970s."So far Bernanke hasn't faced anything like the challenges of his predecessors, but I do feel a little vindicated for supporting his nomination.

Monday, January 29, 2007

Record Homeowner Vacancy Rate

by Calculated Risk on 1/29/2007 05:02:00 PM

The Census Bureau reports the Homeowner Vacancy Rate was a record 2.7% in Q4 2006. Click on graph for larger image.

Click on graph for larger image.

This graph shows the recent surge in the homeowner vacancy rate. This is further evidence of the significant supply overhang in the housing market.

Fannie Mae economist David Berson has estimated the overhang at 600K units. This data from the Census Bureau suggests the overhang may be closer to my estimate of 1.1 to 1.4 million units.

Update: For a 50 year chart see: Empty homes everywhere

Sunday, January 28, 2007

OC Register on Subprime Lenders

by Calculated Risk on 1/28/2007 06:24:00 PM

From the OC Register: Subprime's grip slips

Many of Orange County's boldest lenders are struggling to stay in the black – and in some cases to stay in business – as their customers miss mortgage payments in record numbers.The article has this great quote:

...

Sluggish home prices, rising interest rates and lax underwriting spurred defaults on subprime loans made just last year to the highest level in six years. Perhaps most troubling, loans made by Orange County companies in 2006 were among the quickest to see defaults, data show.

And many of those subprime companies – which tend to cluster here in Orange County – are in trouble.

...

UBS Investment Bank ... found subprime loans made in 2006 are on track to be the worst-performing loans ever issued.

...

So what went wrong, exactly?

Lenders made two mistakes, according to UBS and other analysts. They didn't scrutinize borrowers' incomes, and they allowed subprime borrowers, who by definition have had past problems with their credit, to take on lots of risk.

...

Borrowers gambled on rising home prices to bail them out of trouble, analysts said. Consumers thought home prices would keep climbing, which would enable them to sell or refinance if they got into a jam, analysts said.

"[Borrowers] lost the motivation or incentive to send in the checks."This sounds like a quote from "Office Space":

David Liu, director of UBS' mortgage strategy group, Jan 28, 2007

PETER: I, uh, I don't like my job. I don't think I'm gonna go anymore.

JOANNA: You're just not gonna go?

PETER: Yeah.

JOANNA: Won't you get fired?

PETER: I don't know. But I really don't like it so I'm not gonna go.

JOANNA (LAUGHS) SO YOU'RE GONNA QUIT?

PETER: No, no, not really. I'm just gonna stop going.

JOANNA: When did you decide all that?

PETER: About a week ago.

JOANNA: Really?

PETER: Oh, yeah.

JOANNA: Ok. So, so you're gonna get another job?

PETER: I don't think I 'd like another job.

JOANNA (LAUGHS): SO WHAT ARE YOU GOING TO DO ABOUT MONEY AND BILLS?

PETER: Y'know, I never really liked paying bills. I don't think I'll do that either.

Saturday, January 27, 2007

On Blogging

by Calculated Risk on 1/27/2007 12:24:00 PM

This is my first post with the new blogger. I'd like to take this moment to offer some thoughts on my blogging experience:

I started blogging just to share a few thoughts with my friends. To my surprise, more and more people have been reading this blog - and happily I've made several new internet friends. That was unexpected and has been very rewarding for me.

The downside to more readers is I'm not able to answer all the questions in the comments or sent to me in emails. I appreciate all the emails and information I receive, and please accept my apology if I miss your question or I'm slow to respond to your email. I also receive many other inquiries or requests: interviews, link exchanges, offers for sponsorship, etc.

Given all these requests, I'd like to make this clear: this is a personal blog, I've made no effort to market this blog, I haven't accepted advertising or sponsorships, and I'm not looking for any publicity for myself or for this blog. I have no current plans to change my approach.

Perhaps readers have a sense of my personalty from this blog. One of the highlights for me was Don Luskin complaining I was "too polite"! I'm also happy to correct any mistakes I make, and point out when I've been wrong. These traits have served me well in real life.

I believe the one major misperception is that I'm all doom and gloom. Readers have frequently expressed surprise, in the comments, and occasionally via email, at my positive long term outlook. This reaction is probably understandable since most of my posts have a bearish economic tone.

At the time I started writing this blog, I was becoming increasingly concerned about the apparent excessive speculation in the housing market. I was also concerned that the inevitable housing correction might have a negative impact on the U.S. economy. Add in my very negative views of the current U.S. administration, and naturally my posts have had a cautious tone.

I've discovered there is quite an industry of publications catering to people's fears. My negative posts have led to several offers to write for these doom and gloom websites and magazines. That isn't me, and I've declined all these offers. I'm looking forward to being positive in my posts - maybe I'll get offers from Wall Street then!

That is all for now. My best to everyone, and hopefully the new blogger will work well.

Friday, January 26, 2007

More on December New Home Sales

by Calculated Risk on 1/26/2007 06:08:00 PM

Please see the earlier post: December New Home Sales

2006 is the 4th best year for New Home Sales behind 2003.

| New Home Sales | |

| Year | Sales |

| 2000 | 877,000 |

| 2001 | 909,000 |

| 2002 | 972,000 |

| 2003 | 1,088,000 |

| 2004 | 1,203,000 |

| 2005 | 1,283,000 |

| 2006 | 1,063,000 |

Click on graph for larger image.

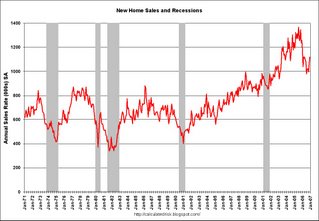

Click on graph for larger image.One of the most reliable economic leading indicators is New Home Sales.

New Home sales were falling prior to every recession of the last 35 years, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

Some more optimistic observers will argue that sales have fallen back to a sustainable level after the excesses of 2004 and 2005. Others will argue that sales have to fall more in coming years, to make up for the excesses of recent years. That is one of the reasons 2007 will be such an interesting year.

The second graph shows monthly Not Seasonally Adjusted (NSA) New Home sales. This provides a different prospective of the housing bust.

This shows why the Spring selling season is so important in 2007. Will sales recover? Or will Spring 2007 look like 1982 or 1991 when Spring sales were disappointing.

NY Times: Tremors at the Door

by Calculated Risk on 1/26/2007 10:36:00 AM

“The market is paying me to do a no-income-verification loan more than it is paying me to do the full documentation loans. What would you do?”From the NY Times: Tremors at the Door

William D. Dallas, the chief executive of Ownit Mortgage Solutions, Jan 26, 2007

Wall Street’s big bet on risky mortgages may be souring a lot faster than had been previously thought.

...

The grim statistics ... also indicate that mortgage lenders became more generous last year, giving 100 percent financing and allowing borrowers to state their incomes with little or no documentation in an effort to bolster volume, according to industry experts.

Banking regulators have increasingly voiced concerns about the loosening of lending practices by subprime lenders. Late last year some demanded that applicants be more closely vetted before being qualified for adjustable-rate and other risky loans.

Yet, housing advocates and industry experts say policy makers are also worried that too sharp a pullback in lending by Wall Street and commercial banks could cut off consumer access to credit.

December New Home Sales: 1.12 Million SAAR

by Calculated Risk on 1/26/2007 10:09:00 AM

According to the Census Bureau report, New Home Sales in December were at a seasonally adjusted annual rate of 1.12 million. Sales for November were revised up to 1.069 million, from 1.047 million. Numbers for September and October were revised downwards.

Click on Graph for larger image.

Sales of new one-family houses in December 2006 were at a seasonally adjusted annual rate of 1,120,000... This is 4.8 percent above the revised November rate of 1,069,000, but is 11.0 percent below the December 2005 estimate of 1,259,000.

The Not Seasonally Adjusted monthly rate was 76,000 New Homes sold. There were 87,000 New Homes sold in December 2005.

On a year over year NSA basis, December 2006 sales were 12.6% lower than December 2005. Also, December '06 sales were below December 2004 (83,000).

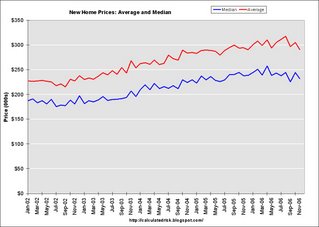

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in December 2006 was $235,000; the average sales price was $290,100.

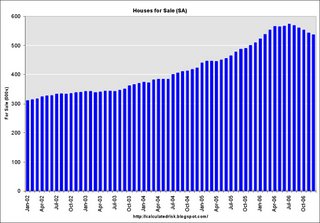

The seasonally adjusted estimate of new houses for sale at the end of December was 537,000.

The 537,000 units of inventory is slightly below the levels of the last six months. Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

This represents a supply of 5.9 months at the current sales rate.

More later today on New Home Sales.

Thursday, January 25, 2007

Existing Home Sales as Percent of Owner Occupied Units

by Calculated Risk on 1/25/2007 03:55:00 PM

First, a couple of quotes from the NAR press release today:

“It looks like we’re moving beyond the low for the housing cycle last fall ..."

David Lereah, NAR’s chief economist, Jan 25, 2007

"... we’re looking for slow, steady gains in both home sales and prices through 2008.”Last month economist David Berson at Fannie Mae projected existing home sales would fall to 5.925 million units in '07 (NAR reported 2006 sales at 6.48 million units today). Will sales rise in '07 as forecast by the NAR spokesmen, or will sales fall as projected by Fannie Mae economists and others?

NAR President Pat Vredevoogd Combs, Jan 25, 2007

One of the rarely told stories of the housing boom was the jump in turnover of existing homes. This graph shows sales normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

One of the rarely told stories of the housing boom was the jump in turnover of existing homes. This graph shows sales normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover. If sales fall back to 6% that would about 4.6 million units. If sales fall back to the level of 1998 to 2001 (7.3% of total owner occupied units sold) that would be about 5.6 million units in 2007.

My guess is existing home sales will "surprise" to the downside, perhaps in the 5.6 to 5.8 million unit range, or approximately 7.5% of owner occupied units.

Note: from my Housing in 2007 predictions.

Unemployment Insurance Weekly Claims

by Calculated Risk on 1/25/2007 10:51:00 AM

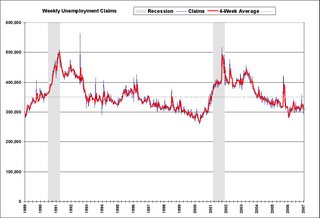

Here is a bad headline from the AP: Jobless claims rise to 16-month high.

The U.S. Department of Labor reported:

In the week ending Jan. 20, the advance figure for seasonally adjusted initial claims was 325,000, an increase of 36,000 from the previous week's revised figure of 289,000. The 4-week moving average was 309,250, an increase of 1,500 from the previous week's revised average of 307,750.Just 4 weeks ago claims were also 325,000, and in the last week of November, claims were 358,000. So why is this a "rise to a 16-month high"?

The AP is referring to the increase in claims from last week.

The Labor Department reported Thursday that 325,000 newly laid-off workers filed claims for jobless benefits last week, an increase of 36,000 from the previous week. That was the biggest one-week rise since a surge of 96,000 claims the week of Sept. 10, 2005, when devastated Gulf Coast businesses laid off workers following Hurricane Katrina.Why does anyone care? Weekly claims are notoriously noisy week to week, so everyone follows the 4-week moving average.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly unemployment claims and the 4-week moving average vs. recessions since 1989. The dashed line at 350,000 is the level of concern for the 4-week moving average.

Currently the 4-week average is 309,250; not a concern.

December Existing-Home Sales Ease

by Calculated Risk on 1/25/2007 10:13:00 AM

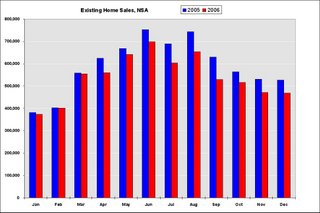

The National Association of Realtors (NAR) reports: Existing-Home Sales Ease Click on graph for larger image.

Click on graph for larger image.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased 0.8 percent to a seasonally adjusted annual rate1 of 6.22 million units in December from a level of 6.27 million in November. Sales were 7.9 percent lower than a 6.75 million-unit pace in December 2005.The above graph shows NSA monthly sales for 2005 and 2006. On an NSA basis, sales were 11% below December 2005.

Total housing inventory levels fell 7.9 percent at the end of December to 3.51 million existing homes available for sale, which represents a 6.8-month supply at the current sales pace – down from a 7.3-month supply in November.

Inventory is not seasonally adjusted, and it is normal to see a decline in inventory in December during the holidays. Usually 6 to 8 months of inventory starts causing pricing problems, and over 8 months a significant problem. With current inventory levels at 6.8 months of supply, inventories are now well into the danger zone.

Inventory is not seasonally adjusted, and it is normal to see a decline in inventory in December during the holidays. Usually 6 to 8 months of inventory starts causing pricing problems, and over 8 months a significant problem. With current inventory levels at 6.8 months of supply, inventories are now well into the danger zone.There were 6,480,000 existing-home sales in all of 2006, down 8.4 percent from a record 7,075,000 in 2005. The second highest total was 6,779,000 in 2004; NAR began tracking home sales in 1968.

2006 was the third highest sales year ever, and 2006 also had record year end inventories, both in actual numbers and as a percent of owner occupied units.

This graph shows the annual sales, since 1969, and year end inventory numbers since 1982.

Wednesday, January 24, 2007

Economic Experts are Optimistic

by Calculated Risk on 1/24/2007 08:02:00 PM

"You were talking about the ugly bears. The reality is that we see a lot of ugly bears growing horns and becoming bulls."From AP on the World Economic Forum in Davos, Switzerland: Experts Ponder Impact of U.S. Slowdown

Jacob Frenkel, vice chairman of insurer AIG, to Nouriel Roubini, Jan 24, 2007

The majority of panel members at the major economic session on the opening day of the World Economic Forum's annual meeting predicted a soft landing ...For the lone bear at Davos' views, see Roubini's First Day in Davos: 2007 Global Economic Outlook

Laura Tyson, a professor at the University of California at Berkeley who was Clinton's top economic adviser, agreed, saying "there are some reasons to be very optimistic for the coming year."

Looking at projections for 2007, she said, there is "an amazing similarity of predicted growth rates for the U.S., Europe and Japan, between 2 and 2 1/4 percent _ a result of the European and Japanese economies picking up and the slowdown in the United States."

Financial markets are not as volatile as they were because of a long-run positive trend in output and interest rates, she said.

Tyson added that the global economy has diversified to the point that it no longer is "dependent on a single locomotive, the United States."

Emerging markets have also been growing and expanding to account for more than half of the world economy, she said.

"All of those things to my mind suggest another Goldilocks year," Tyson said, adding that "it'll look different from the last Goldilocks year."

I was the only one who expressed some concerns about a US hard landing that could take the form of a growth recession or an outright recession ...Roubini suggests:

The consensus, clear at the panel, was for another Goldilocks year for the US and global economy with the US achieving a soft landing.

... housing is only 6% of GDP while consumption is 70% ... So any hard landing – whether a growth recession or an outright recession – will require a sharp slowdown of consumption growth. I do believe that the next leg of the US slowdown, that will lead at least to a growth recession, will be the consumer weakened by a variety of factors:One more comment from Frankel:- The job losses in housing and manufacturing will build up over 2007 and reduce job growth from 150k jobs to about 50k jobs per month over the next few months. So, labor slack will reduce income generation.So, while the US consumer will be the last shoe to drop it will drop this year as the consumer is at its tipping point in spite of the recent temporary factors that have boosted its consumption. So I do not believe that the economy will achieve the soft landing predicted by the economic consensus as the balance of risks and vulnerabilities suggests further economic weakness ahead.

- The negative wealth effects of falling housing values and falling mortgage equity withdrawal will slow down consumption as households with negative savings have been using their homes as their ATM machine for too long.

- Rising reset interest rates on monster mortgages, ARMs and subprime loans will increase debt servicing ratios.

- The coming credit crunch in the subprime sector will serious hurt subprime and other ARM borrowers.

"I'm optimistic but not sanguine."Say what? I think the AP writer missed something.

California Default Notices Increase

by Calculated Risk on 1/24/2007 11:47:00 AM

"We're in the midst of an adjusting market right now, and we won't know until spring or summer if this [foreclosure activity] is ominous or not,"UPDATE: Here is the DataQuick press release with some additional details: California Foreclosure Activity Jumps Again

Marshall Prentice, DataQuick president, Jan 24, 2007.

According to DataQuick, the number of default notices jumped significantly to 37,273 in Q4 2006.

Click on graph for larger image.

Click on graph for larger image.This graph shows Notices of Default (NOD) by year in California since 1992.

2006 had the highest number of NODs since 1998. And it now appears 2007 will see record or near record NODs.

From David Streitfeld at the LA Times: More Californians at risk of losing homes

Default notices are the initial step in the foreclosure process. In the fourth quarter of last year, lenders issued such notices to 37,273 borrowers across the state, warning them that they were at risk of foreclosure, compared with 15,196 during the same period a year earlier, DataQuick said.

Not every notice of default leads to a foreclosure, when a property is seized and sold to pay the mortgage. But foreclosures also are on the rise. There were 6,078 in the last quarter of 2006, up from 874 a year earlier.

MBA: Mortgage Applications Decrease

by Calculated Risk on 1/24/2007 11:21:00 AM

The Mortgage Bankers Association (MBA) reports: Mortgage Refinance Applications and Purchase Applications Both Decrease (UPDATE: link added)

Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 611.3, a decrease of 8.4 percent on a seasonally adjusted basis from 667.2 one week earlier. On an unadjusted basis, the Index decreased 5.7 percent compared with the previous week and was up 3.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index decreased by 9.6 percent to 1848.8 from 2045.8 the previous week and the seasonally adjusted Purchase Index decreased by 8.4 percent to 402.7 from 439.7 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 from 6.19 percent ...

The average contract interest rate for one-year ARMs increased to 5.91 percent from 5.85 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.7 percent to 430.5 from 427.4 for the Purchase Index.

The refinance share of mortgage activity decreased to 47.8 percent of total applications from 49.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 20.3 from 21.2 percent of total applications from the previous week.

Tuesday, January 23, 2007

WSJ: Mortgage Delinquencies Mount

by Calculated Risk on 1/23/2007 11:25:00 PM

From the WSJ: Banks Move Earlier To Curb Foreclosures

Some 2.51% of mortgages were delinquent in the fourth quarter, according to new data from Equifax Inc. and Moody's Economy.com Inc. That is up from 2.33% in the third quarter and the highest level since a recent peak of 2.53% in the first quarter of 2002.Anyone notice a theme this week?

The increase in bad loans is broad based, with delinquencies rising in the past year in roughly 80% of the 250 local areas analyzed by Moody's Economy.com....

The rise in delinquencies is unusual because it comes at a time when the economy is relatively strong. Even though job growth remains healthy, "the total mortgage delinquency rate is the highest that it's been since the depths of the [2001] recession," says Mark Zandi, chief economist at Moody's Economy.com. He attributes the increase in part to the weaker housing market and the widespread use of adjustable-rate mortgages, many of which now are resetting at higher rates.

... Zandi ... expects that nationwide delinquency rates could rise by as much as a full percentage point from current levels in the next year, but he doesn't expect the trend will have a significant impact on the overall economy.

D.R. Horton: Housing Slowdown in "Early Stages"

by Calculated Risk on 1/23/2007 02:56:00 PM

"Most downturns are longer and deeper (than people expect), and we are not seeing anything on the horizon to change that opinion."

D.R. Horton Chief Executive Don Tomnitz, Jan 23, 2007

North Carolina: Record Foreclosures

by Calculated Risk on 1/23/2007 01:54:00 AM

From the StarNewsOnline: Foreclosure filings hit record high

The number of North Carolina homeowners threatened with foreclosure reached an all-time high last year, new state figures show.

More than 45,500 foreclosure filings were recorded in 2006, according to the Administrative Office of the Courts.

...

Experts blame the growing availability of mortgage loans - especially high-interest and adjustable rate subprime mortgages - in part for the increase.

Monday, January 22, 2007

Record Foreclosure Activity in 2007?

by Calculated Risk on 1/22/2007 02:23:00 PM

From the Cincinnati Enquirer: Thousands face loss of homes

For the seventh straight year, foreclosure filings hit record highs not only here but in all of Ohio and Kentucky.And from the Dallas Morning News: Foreclosure lists near 1989 record

Record foreclosures were also a national phenomenon, and Ohio, Indiana and Kentucky were at the front. Through Sept. 30, Ohio led the nation with 3.32 percent of its home loans in foreclosure, according to the Mortgage Bankers Association.

Indiana was second at 2.9 percent; Kentucky, fifth at 1.76 percent. The national average was 1.05 percent.

... the 1,940 homes in Dallas County and 1,274 Tarrant County homes threatened with foreclosure are approaching record highs, said George Roddy, president of Foreclosure Listing Service.These are the areas that saw limited price appreciation during the housing boom. In 2007, the states with the highest appreciation will probably start experiencing near record levels of foreclosure activity. In California, foreclosure activity is already in the "normal range", according to DataQuick, and early January data suggests 2007 might exceed the records set in 1996.

"This is getting serious," Mr. Roddy said. "This level is getting very close to the all-time records set in 1989, when an average of 2,000 postings were filed monthly on Dallas County residences."

Back then, it was a regional recession that caused the number of home foreclosures to spike.

This go-around it's often because of poor consumer choices, credit analysts say.

"Some of them got into more house than they can afford," said Gail Cunningham with Consumer Credit Counseling Service of Greater Dallas.

This is one of the keys to my 2007 housing forecast.

Sunday, January 21, 2007

More Trouble for Lenders

by Calculated Risk on 1/21/2007 11:47:00 AM

From the Bradenton Herald: Developer leaves Coast Bank in lurch

A developer unable to complete construction on hundreds of homes has put $110 million worth of mortgage loans in jeopardy for Bradenton-based Coast Bank.From the Arizona Republic: Valley fighting mortgage fraud wave

The management of Coast Financial Holdings Inc., parent company of Bradenton-based Coast Bank, announced Friday that it was anticipating problems with loans to 482 borrowers after a local development company said it may not have sufficient funds to complete construction on the homes.

A wave of mortgage fraud is rippling through pockets of the Valley, inflating home values through scams called cash-back deals.

Left unchecked, cash-back deals cost homeowners and lenders millions of dollars and could erode confidence and values in Arizona's real estate market.

The fraud involves obtaining a mortgage for more than a home is worth and pocketing the extra money in cash. Neighbors may then discover home values in the area are exaggerated. Homeowners stuck with overpriced mortgages may never recover the difference. And lenders end up with bad loans that, in the long run, could hurt the Arizona real estate market, the largest segment of the state economy.

While the extent of the fraud is unclear, an Arizona Republic investigation into these cash-back deals found organized groups of speculators have bought multiple homes this way, leaving whole neighborhoods with inflated values. Add to these the individual deals done by amateurs who hear others talk about the easy money they made from cash-back sales.

State investigators and real estate industry leaders want more enforcement and greater public awareness to stop the spread of cash-back deals before the damage mounts.

"Mortgage fraud in the Valley has become so prevalent people think it's a normal business practice," said Amy Swaney, a mortgage banker with Premier Financial Services and past president of the Arizona Mortgage Lenders Association.

Saturday, January 20, 2007

What would change my mind?

by Calculated Risk on 1/20/2007 04:56:00 PM

Update: When I first started this blog, I promised to try to call the next recession - as a fun exercise. I didn't think we would have a recession in '05 or '06. Now I think there is a chance, so I'm going out on a limb.

For those interested in recession predictions, here is an excellent paper on why most forecasters miss recessions: The Arcane Art of Predicting Recessions

Since I've just turned bearish on the general economy (update: this is for '07, not next week or Q1 - sorry if that was confusing), I'd like to note what would change my mind.

1) Show me several hundred thousand residential construction jobs lost, and little or no impact on the general economy.

There are many stories like this one from the San Diego Union on the local economy: With real estate sector cooling, employment stays on simmer

Construction firms shed 1,800 workers during December and real estate firms cut 500 positions, according to data released yesterday by the California Employment Development Department.

...

During 2006, construction firms in the county lost a total of 5,000 jobs, more than 5 percent of their work force. Statewide, construction firms have axed 15,300 workers, a 1.7 percent loss.

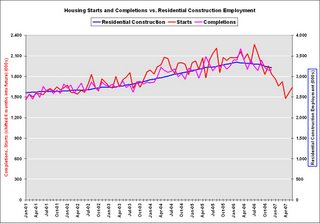

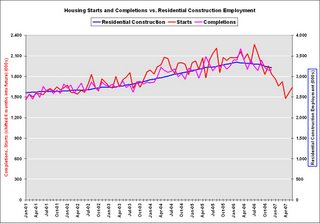

Click on graph for larger image.

Click on graph for larger image.That sounds grim, but in reality very few residential construction jobs have been lost so far. Since residential construction employment peaked in February 2006 at 3,347.4 thousand, only 133.6 thousand jobs have been lost according to the BLS, or about 4%.

Based on the current level of starts, many more jobs will be lost in the coming months (note starts are shifted 6 months into the future on graph, since completions and employment follow starts by about 6 months).

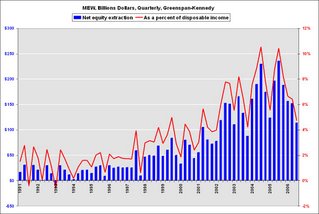

2) Show me mortgage equity withdrawal (MEW) at less than 3% of disposable personal income (DPI), with little or no impact on consumer spending.

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show

From the WSJ: Homeowners Borrow Less Against Equity in Their Homes, Data Show "Homeowners extracted $113.5 billion ... via mortgage refinancing and other means in the third quarter, the lowest since the fourth quarter of 2003, according to new estimates by a Federal Reserve staffer and former chairman Alan Greenspan3) Show me near record foreclosure activity, with little or no impact on lenders or the general economy. I'll have more on foreclosure activity this week.

That amount ... was down from $151.8 billion in the second quarter, and the high of $235.9 billion recorded in the third quarter of last year. The latest figure equals 4.7% of households' after-tax income, compared to 10.4% in the third quarter of 2005."

I don't ask for much.

Friday, January 19, 2007

First Horizon Hurt by Mortgage Unit

by Calculated Risk on 1/19/2007 03:17:00 PM

From Reuters: First Horizon profits fall, hurt by mortgage unit

First Horizon National Corp. said on Wednesday quarterly earnings fell a steeper-than-expected 28 percent as mortgage banking revenue plunged.UPDATE from Tanta (lifted from comments):

...

First Horizon of Memphis, Tennessee said pretax income from mortgage banking slid 91 percent to $3.5 million, while revenue from mortgage banking fell 27 percent to $111.9 million.

Lordy, the whole statement's worth a read. Looks like a perfect storm:

1. The carry trade died: "Net interest income decreased 41 percent to $20.4 million in fourth quarter 2006 from $34.7 million in fourth quarter 2005. An inverted yield curve resulted in compression of the spread on the warehouse, which was 1.24 percent in fourth quarter 2006 compared to 2.06 percent for the same period in 2005. Additionally, an 18 percent decrease in the warehouse related to lower origination activity negatively impacted net interest income."

2. Gain on sale dropped: "Net origination income decreased 22 percent to $69.2 million from $89.1 million in fourth quarter 2005 as loans delivered into the secondary market decreased 21 percent to $6.3 billion."

3. Keeping the loans rather than selling them didn't help credit quality: "Provision for loan losses increased to $23.0 million in fourth quarter 2006 from $16.2 million in fourth quarter 2005. This increase primarily reflects continued growth of the commercial and construction loan portfolios and an expectation of slowing economic growth. As a result of this increase, the allowance to loans ratio has increased from 92 basis points in fourth quarter 2005 to 98 basis points in fourth quarter 2006. Nonperforming assets were $139.0 million on December 31, 2006, compared to $79.7 million on December 31, 2005. The nonperforming assets ratio related to the loan portfolio increased to 58 basis points in fourth quarter 2006 from 33 basis points last year. The nonperforming asset ratio continues to migrate from historical low levels due to maturation of the loan portfolio, issues with several commercial credits in the retail commercial bank's traditional lending markets, and deterioration in the residential real estate portfolio reflecting the slow down in the housing market. The net charge-off ratio increased to 25 basis points in fourth quarter 2006 from 22 basis points in 2005 as net charge-offs grew to $13.5 million from $11.0 million during a period of strong loan growth."

I also see they increased their portfolio of residential construction loans by 11%, and also took a $7MM loss, part of which was "the result of employee misrepresentation in our construction lending business."

On Turning Bearish

by Calculated Risk on 1/19/2007 02:12:00 PM

I've recently turned bearish on the U.S. economy. This shouldn't be confused with my longer held negative views on housing.

For housing, I'm very confident that 2007 will be worse than 2006 by every material measure: prices, sales, residential construction employment, starts, MEW, percentage of homeowner equity, and the number of foreclosures.

But the impact of the continuing housing bust on the U.S. economy is far less certain. Although I think a recession is better than a "coin flip" in '07, the odds of a soft landing are still good.

Professor Leamer identified two key missing ingredients for a recession: enough job losses, and a credit crunch (see: Is a Recession Ahead? The Models Say Yes, but the Mind Says No). These are the two issues I wrestled with over the holidays, and I couldn't come to a definitive conclusion.

At the core, recessions are about jobs, and it is easy to imagine scenarios with job growth slowing to 100K per month, maybe even 50K per month. But that isn't a recession. Click on graph for larger image.

Click on graph for larger image.

This graph shows the average monthly job growth since 1997. In 2001, the economy lost an average of 147K jobs per month - and that was a fairly mild recession.

Over the last three years, the U.S. has added an average of 164K jobs per month. Right now, based on housing starts, it looks like residential construction employment will fall by 400K to 600K jobs by this Summer. Many of these workers will find new jobs, but it is easy to imagine job growth slowing to 100K per month. Adding in other housing related lost jobs, and some ripple effect, maybe growth will slow to 50K per month. Not enough for a recession.

So how can the U.S. economy slide into recession in '07?

Some possible sources: a credit crunch based on bad loans in the RE sector (and possibly in CRE and C&D too), less consumer spending based on falling MEW, and another downturn in the housing market. If all of these can be avoided, a recession is unlikely.

Right now I don't think these problems can be avoided.

Thursday, January 18, 2007

Pulte Homes Warns

by Calculated Risk on 1/18/2007 08:02:00 PM

Pulte Homes warns on Q4 results.

"Pulte Homes continues to navigate through a challenging operating environment, with demand for new homes during the fourth quarter still far below pre-2006 levels."Pulte had already guided earnings expectations lower. Now they are reducing their Q4 earnings estimates again:

Richard J. Dugas, Jr., President and CEO of Pulte Homes, Jan 18, 2007

The Company expects fourth quarter results to be in the range of a loss of $.05 to earnings of $.05 per diluted share from continuing operations. Pulte Homes had previously issued earnings guidance in the range of $.30 to $.70 per diluted share, guiding to the lower end of the range in its earnings conference call for the third quarter.Orders are getting worse:

The Company closed 12,566 homes during the fourth quarter of 2006, a decline of 20% from the fourth quarter of 2005. Net new orders for the quarter were 6,446 homes, a 34% decrease from last year's fourth quarter. For the full year 2006, home closings were 41,487, down 9% compared with 2005. Net new orders for the full year 2006 decreased 29% from the prior year to 33,925 homes.But the cancellation rate improved slightly:

"... [Pulte] experienced a stabilization to a slight improvement in our fourth quarter cancellation rate compared with the third quarter, as this metric showed progressive improvement throughout the period."Of course if orders fall to zero, the cancellation rate will decline to zero too. So this metric needs to be kept in context.

Impairments are much worse than expected:

On a preliminary basis, Pulte Homes anticipates that these impairments and land-related charges will be in the range of $330 million to $350 million for the fourth quarter, or $.83 to $.88 per diluted share. The Company previously issued guidance of $150 million for impairments and land-related charges.Perhaps the only good news is Pulte is reducing their production:

"[Pulte] continue[s] to reduce the number of homes we are starting, as evidenced by our meaningful reduction in speculative units under construction during the quarter."

DataQuick: 2006 California Sales Lowest Since 1996

by Calculated Risk on 1/18/2007 02:39:00 PM

DataQuick reports: California December Home Sales

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.Note that 1996 was the last year of the early '90s housing bust in California.

Click on graph for larger image.

Click on graph for larger image.A total of 41,100 new and resale houses and condos were sold statewide last month. That's up 4.8 percent from 39,200 for November and down 22.2 percent from a 52,800 for December 2005.Although some areas in California are already seeing YoY nominal price declines - like San Mateo, Sonoma, San Diego and Ventura - the median YoY price in California increased slightly.

Last month's sales made for the slowest December since 1996 when 33,591 homes were sold.

The median price paid for a home last month was $474,000. That was up 1.1 percent from November's $469,000, and up 3.5 percent from $458,000 for December a year ago.

Housing: Starts and Completions

by Calculated Risk on 1/18/2007 11:06:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits rose slightly:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,596,000. This is 5.5 percent above the revised November rate of 1,513,000, but is 24.3 percent below the December 2005 estimate of 2,107,000.Starts were up for the second straight month:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,642,000. This is 4.5 percent above the revised November estimate of 1,572,000, but is 18.0 percent below the December 2005 rate of 2,002,000.And Completions were flat, at just below the recent record levels:

Privately-owned housing completions in December were at a seasonally adjusted annual rate of 1,900,000. This is 0.4 percent above the revised November estimate of 1,893,000, but is 2.7 percent below the December 2005 rate of 1,953,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

I'm a little surprised at the slight rebound in starts, especially since completions and inventories are still near record levels. Still Starts have fallen "off a cliff", and completions have just started to fall.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs by this Summer.

Wednesday, January 17, 2007

Worth a second look ...

by Calculated Risk on 1/17/2007 05:51:00 PM

If you missed Tanta's most recent post, it is definitely worth reading (and rereading): Information is Power, Which is Why You Don’t Get Any.

Make sure you read the comments too.

I just hope she wasn't referring to me when she wrote:

"... next time I'll write something calm and polite and professional and bland and get my case jumped by the readers who are tired of calm and polite and professional and bland because that's all you ever get in the newspaper and we come to blogs for some juice."

DataQuick: Bay Area home prices flat, slow sales

by Calculated Risk on 1/17/2007 05:14:00 PM

From DataQuick: Bay Area home prices flat, slow sales

Bay Area home prices were flat last month while the sales pace was the slowest pace in a decade ...Just six months ago, DataQuick reported "indicators of market distress are still largely absent" and "foreclosure rates are coming up from last year's low point, but are still below normal levels". Now foreclosures are in the "normal range", and from the information I'm receiving, foreclosures will be significantly above normal shortly.

A total of 7,488 new and resale houses and condos sold in the Bay Area last month. That was up 3.9 percent from 7,204 in November, and down 19.9 percent from 9,347 for December last year, according to DataQuick Information Systems.

Sales have declined on a year-over-year basis the last 21 months. Last month's sales count was the lowest for any December since 1996 when 7,180 homes were sold. The average for all Decembers since 1988 is 8,339.

...

The median price paid for a Bay Area home was $612,000 in December. That was down 0.6 percent from $616,000 in November and up 0.5 percent from $609,000 for December a year ago. The median peaked last June at $644,000.

...

Indicators of market distress are still in the normal range. Financing with adjustable-rate mortgages is flat. Foreclosure activity is rising but is still in the normal range. Down payment sizes are stable. Flipping rates and non-owner occupied buying activity are down, DataQuick reported.

Fed's Mishkin on Monetary Policy and House Prices

by Calculated Risk on 1/17/2007 01:12:00 PM

From Fed Governor Frederic Mishkin: The Role of House Prices in Formulating Monetary Policy

Once again the Fed is arguing against taking action when a possible bubble is forming. This is the same argument Greenspan made during the stock market bubble, but this time the issue is housing. However, the Fed stands ready to take action if the bursting of the bubble impacts the general economy.

Mishkin's conclusion:

Large run-ups in prices of assets such as houses present serious challenges to central bankers. I have argued that central banks should not give a special role to house prices in the conduct of monetary policy but should respond to them only to the extent that they have foreseeable effects on inflation and employment. Nevertheless, central banks can take measures to prepare for possible sharp reversals in the prices of homes or other assets to ensure that they will not do serious harm to the economy.

NAHB: Builder Confidence Improves in January

by Calculated Risk on 1/17/2007 12:59:00 PM

From NAHB: Builder Confidence Improves in January

Click on graph for larger image.

Click on graph for larger image.

Excerpts:

The HMI increased from an upwardly revised 33 in December to 35 in January, its highest level since July of 2006.

...

Two out of three component indexes registered improvement in January. The index gauging current single-family home sales and the index gauging traffic of prospective buyers each gained three points, to 36 and 26 respectively, while the index gauging sales expectations for the next six months remained unchanged at 49.

Meanwhile, three out of four regions surveyed in the HMI posted gains in January. Two-point gains were registered in the Northeast, Midwest and South, to 39, 24 and 41, respectively. The HMI for the West remained unchanged from the previous month at 32.

MBA: Purchase Applications Decrease

by Calculated Risk on 1/17/2007 10:39:00 AM

The Mortgage Bankers Association (MBA) reports: Refinance Applications Increase and Purchase Applications Decrease Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 667.2, a decrease of 0.6 percent on a seasonally adjusted basis from 671.1 one week earlier. On an unadjusted basis, the Index increased 28.9 percent compared with the previous week and was up 9.8 percent compared with the same week one year earlier.Mortgage rates increased:

The Refinance Index increased by 6.3 percent to 2045.8 from 1923.8 the previous week and the seasonally adjusted Purchase Index decreased by 7 percent to 439.7 from 472.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.19 from 6.13 percent ...

The average contract interest rate for one-year ARMs increased to 5.85 percent from 5.79 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 0.2 percent to 427.4 from 426.6 for the Purchase Index.The refinance share of mortgage activity increased to 49.9 percent of total applications from 48.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 21.2 from 20.1 percent of total applications from the previous week.

Tuesday, January 16, 2007

Leamer: Is a Recession Ahead?

by Calculated Risk on 1/16/2007 02:59:00 PM

Dr. Edward Leamer, Director UCLA Anderson Forecast, writes in The Economists' Voice: Is a Recession Ahead? The Models Say Yes, but the Mind Says No

My view, announced in December 2005, is that this time will be different. This time the problems in housing will stay in housing. So far, I am feeling very smug. But this keeps me up at night. In this column, first the models, and then the mind. The models say that a recession is coming soon. The mind says otherwise.I'll have more later, but here is Dr. Leamer's conclusion:

The mind: why i think the models are wrong

The models that rely on history suggest that the extreme problems in housing currently being corrected will almost surely infect the rest of the economy, but that history does not take into account two important facts:

• Manufacturing is not poised to contribute much to job loss.

• Real interest rates are very low and there is no evident credit crunch, now or on the horizon.

These facts make the problem in housing less severe than it would be otherwise, and help to confine the pathology to the directly affected real estate sectors: builders, real estate brokers and real estate bankers.

...

The models say “recession;” the mind says “no way.” I’m going with the mind. This time the problems in housing will stay in housing. If you are a builder or a broker, it will feel like a deep depression. The rest of us will hardly notice.

DataQuick: SoCal New price peak, slowest December in ten years

by Calculated Risk on 1/16/2007 02:06:00 PM

DataQuick reports: New price peak, slowest December in ten years

Southern California's housing market ... prices reached a new peak while sales volume remained at a ten-year low ...

The median price paid for a home in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties was $495,000 last month, a new record. That was up 1.6 percent from $487,000 for the month before, and up 3.3 percent from $479,000 for December a year ago, according to DataQuick Information Systems.

The previous peak was $493,000 last June. Year-over-year price increases have been in the single digits for nine months. Last month's record median was in large part due to strong sales of new homes, which is normal for December.

"The market is still readjusting after the frenzy in 2004 and 2005. Market indicators tend to point in different directions during a turn. We are watching the San Diego market carefully, sales and price trends there have tended to lead the region," said Marshall Prentice, DataQuick president.

A total of 22,485 new and resale homes were sold regionwide last month. That was up 10.3 percent from 20,388 in November, and down 22.3 percent from 28,952 in December a year ago. Last month was the slowest December since 1995 when 19,202 homes were sold. DataQuick's statistics go back to 1988, the December average is 23,699 sales.

...

While year-over-year sales in the region have declined for the last 13 months, San Diego County's sales started to decline 30 months ago. San Diego County's median peaked in November 2005 at $518,000 and was $483,000 last month, a 6.8 percent decline.

Centex, KB Home

by Calculated Risk on 1/16/2007 11:27:00 AM

"We are navigating through one of the most challenging housing environments in the past 25 years. We are responding by reducing our land position and inventory, aligning our workforce to the current sales pace and improving our overall cost structure."

Centex Chairman and Chief Executive Tim Eller, Jan 16, 2007

From MarketWatch: Centex, KB Home write off $793 million on value of land holdings, options

Centex said it will record land-valuation adjustments of about $300 million because of the declining housing market. It also has decided not to exercise land-option contracts on 37,000 lots, resulting in walk-away costs of about $150 million.

...

Centex added closings for the quarter dropped fell 12% to 8,360, and net orders slumped 24% to 6,139.

As for KB Home, it said ... that it will take an inventory-impairment charge of $255 million and an $88 million charge from the abandonment of some land-option contracts.

Monday, January 15, 2007

Berson on Housing Overhang

by Calculated Risk on 1/15/2007 10:35:00 PM

Fannie Mae economist David Berson asks: How large is the housing overhang?

We have argued for some time that the surge in housing demand in recent years (principally from investors over the period from 2004 to early-2006) was unsustainable. Understandably, builders responded to this pickup in overall housing demand by significantly increasing house construction. As a result, too many housing units were built in recent years relative to the underlying pace of housing demand-- bringing unsold inventories up to record highs. But how large is this overhang relative to long-term housing demand?Berson estimates the overhang at about 600K units. In an earlier post, I estimated the overhang at 1.1 to 1.4 million units. The differences in our estimates come from two main sources: 1) I estimated current total demand at about 1.7 million units per year, Berson used 1.8 million units. 2) Since I used a lower number, I also calculated some excess overbuilding prior to 2004; Berson only calculated overbuilding in 2004 through 2006.

The difference is important for estimating the length and depth of the building slump. Using my estimates, I further calculated completions "might fall to 1.2 million units per year over the next few years" and "New Home Sales might fall to 800 thousand per year or less - until the excess inventory is absorbed".

Using Berson's 600K estimate, completions will probably stabilize at around 1.5 million units per year for the next couple of years, and New Home sales will probably decline to 900K per year or so. This is close to Berson's forecast of 975K New Home sales in 2007, and starts of 1.58 million units. (Starts and completions will be close in 2007 if starts stabilize at the 1.5+ million SAAR level).

Tanta: Information is Power, Which is Why You Don’t Get Any

by Calculated Risk on 1/15/2007 01:53:00 PM

About 15 years ago I was working for a decently-sized regional bank in Secondary Marketing (the bitch with the rate sheet), and one fine day this unspeakably cheerful young person from Primary Marketing (the ditz with the Sunday Ad Section) sashayed into my cubicle with the request that I, as a “subject matter expert” (corporate-speak for “nearest available victim”) review this brochure being produced for mortgage applicants and other innocent bystanders. It took the form of a glossary of terms—how original—and it had actually occurred to Marketing that perhaps it should be reviewed for accuracy. Being a sucker for that sort of thing—accuracy, and light bulbs going on over in Marketing, I mean, not extra work—I held out my hand. I will never forget the definition provided for the term “points”: “A fee paid at closing to increase the lender’s yield on the loan.”

Now, that definition is, in fact, perfectly accurate (and copied directly from The Handbook of Mortgage-Backed Securities, second edition, I believe). For a mortgage portfolio investor, it’s a good thing to know, too: you may have a low-rate loan to invest in, but luckily Verne and Mary Sue coughed up some points at closing that you get to amortize over the expected life of the loan to bring that yield up to market. Oh, wait, that definition doesn’t actually tell you that. Not to worry, you’re just an investor with great gobs of money at risk, you don’t need details.

If, on the other hand, you are Verne and Mary Sue, and you have just been confronted with a loan officer telling you to bring a four-figure check to closing to pay for this thing called “points,” and you don’t know what they are, and you check out the handy Glossary of Terms provided by your trusty bank, and it says that points are things you pay just to make the lender richer—there is no other way to construe that sentence if you don’t already know what points are—you will of course happily whip out the checkbook instead of running across the street to some other bank. Happens all the time.

So I got out the red pen and re-wrote the definition of points to indicate that they are an optional fee that you may pay if you want a lower interest rate, and that there are loans that do not charge points, but the interest rate on those loans is higher. After I turned in my marked-up copy, the Marketing Ditz did mention that some of my revisions might get edited a bit for length. Not surprising, I thought; Tanta does blather on.

The final printed version contained the following definition of points: “A fee paid at closing to increase the lender’s yield on the loan.”

I’d like to say we lost customers over it, but I doubt that’s true. I’m sure that net-net—losing all the literate and at least marginally sane borrowers, gaining the ones who cannot be stopped by information of any sort, true or not, keeping everyone with the good sense to refuse to accept a brochure offered by a stranger—we came out even. It used to make me so proud when I went to conventions and met colleagues from other, bigger banks: “You might have more customers than I do, but mine are still more ignorant than yours.”

My point is that there is, in fact, no party to any transaction—borrowers, lenders, investors, regulators, those menacing sorts who squeegee your windshield at busy city intersections, my Aunt Harriet’s cats—for whom this definition is more useful than an acid flashback. If you do not already know something, it either doesn’t tell you enough or tells you the wrong thing. If you already know something, it doesn’t exactly advance you toward the goalposts. It’s a classic example of a statement that is literally true and perfectly worthless. Yet my employer saw fit to use it because it came from a real published textbook, whereas the suggested revision came from that coffee-torqued bitch on the third floor, and besides, it fit into the margins of a tri-fold better. Those of you who know anything about the writing of annual CRA reports will know what we included among our “community outreach” efforts for the year, of course. The regulators were glad to see us make such nice educational commitments, too; I think we got an “Outstanding” rating that year. And people call me cynical.

I have often wondered over the years what happened to the Marketing Ditz, but I wonder no more: looks like she got a job with the Washington Post. Consider, if you can bear to, ”Mortgage-Trapped”:

At 64, and looking toward his retirement next year, Willie Lee Howard agreed to refinance his duplex in Northeast Washington, thinking that a fixed-rate loan would help stabilize his finances.That’s it, kids. That’s all the information provided in the article on Howard’s loan—read the whole thing if you don’t believe me. Read the whole thing anway: you really need to absorb the vicarious-outrage-on-behalf-of-the-uninformed tone of the whole worthless thing in order truly to savor the irony:

What Howard got instead was a mortgage he did not understand. Baffled by the loan documents he was mailed after the closing, he consulted an AARP lawyer and learned that he now had an interest-only loan, a new and controversial kind of mortgage. Howard was told that under its terms, his mortgage balance will rise instead of fall and that he will need to refinance in 10 years, when he may be too old to work.

"This is a bunch of junk they done to me," said Howard, a construction worker.

Howard's chagrin at his mortgage's complex provisions illustrates the confusion felt by many borrowers struggling to adapt to a radically transformed home lending market. . . .

Howard said he was persuaded to refinance his house by a "very friendly" loan officer who called once a week for a year, telling him the time was right to stabilize his finances.

After deciding to take out the loan, he said he told the lender he would need help reading the paperwork at the closing. He said he still doesn't understand exactly what kind of mortgage he signed.

Howard's mortgage contains several of these new features, said Sugarman, who has reviewed the documents. It is an interest-only loan, which is one of the nontraditional mortgages designed to help wealthy people manage their cash flow, and for people whose incomes are likely to rise -- not for those whose incomes, such as Howard's, are likely to fall as they retire on Social Security. The rate is fixed, but only for 10 years. Sugarman said Howard appears to have qualified for it with a "NINA" loan, a "no-income, no assets" loan that required minimal income documentation.

"It's a very exotic mortgage, and he had no idea he was getting that," Sugarman said. "He thought he was doing something smart."

• Howard was told that an interest-only loan would result in a rising balance. This is of course false, a confusion of interest-only with negative amortization. The reporter does not correct this misinformation. Possibly the AARP lawyer is an illiterate moron. Possibly the AARP lawyer was misquoted by the reporter. Possibly a rather condescending article on how borrowers don’t often understand loan terms has gotten off to a rocky start in the second paragraph.

• Later in the article, we are given to understand that a “no-income, no assets” loan requires “minimal” income documentation. There are some misleading terms used by the mortgage industry, but in the case of a NINA, “no” actually means “no.” Not “some.” Loans with “minimal” income documentation are usually called “Reduced Doc” or “Streamlined Doc” or “Alternate Doc.” Have you ever heard the cliché “the blind leading the blind”? Just askin’.

• Howard was told that “he will need to refinance in ten years.” Why? Is the loan a ten-year balloon, which remains, in literal fact, the only kind of loan that really does require you to refinance in ten years? Tanta suspects—but can’t prove—that the loan is not a balloon but a 10/1 ARM. It is possible that Howard might want to refinance it in ten years. It is possible that Howard might not be able to afford the payments after the first rate adjustment. It is possible that Howard can’t afford the payments today. If you do not already know something about how mortgage loans work, what does “he will need to refinance in ten years” mean to you? If the Post thinks these loans are so dangerous to uninformed consumers, what would be the argument against actually letting us know what they’re called? That’s what I thought.

• Howard qualified for the loan with no—or possibly some but not much—income or asset documentation. What, precisely, is the problem with that? Do you know? Did you know before you read the Post? Do you still know after you read the Post? Would it have wrecked the layout of the entire newspaper to add one little sentence pointing out that this was a problem because Howard would not have qualified for the loan if he had provided verifications, or would have gotten a more affordable interest rate if he had provided verifications, or thought that he had provided verifications when in reality the lender threw them away, or perhaps is less an innocent victim than he would like us to think, or whatever the bloody problem actually is? Is it time for a drink yet?

• Howard, the story goes, refinanced his existing loan. He thought, the story goes, that “a fixed-rate loan would help stabilize his finances.” Um, did Howard start out with an ARM? Did he start out with a really high-rate loan? Did he need to take cash out? Other facts aside—and Dog knows we aren’t getting any anyway—if Howard already has a high-rate adjusting ARM, how, exactly, did he get screwed by being put into a 10/1 IO ARM? How did he fail to recognize another ARM? Is Howard illiterate? Would better-written disclosures have helped him in that case? Does the reporter actually believe that an IO loan legally prevents you from making the equivalent of an amortizing payment if you want to? If not, would it be worth providing that advice to people who have one? Could it be that Howard couldn’t have afforded a fixed rate amortizing loan if one had been offered? Does the reporter understand that amortizing fixed rate loans require higher payments and carry higher interest rates than IO ARMs do? Does Howard have faulty expectations as well as missing information? Does Howard have a very serious problem—he cannot afford his home with any available mortgage type—that cannot, actually, be solved merely by the provision of more information by a more honest loan officer? Would it be worth sacrificing the lack-of-lender-disclosure-screws-borrower-who-always-wants-the-right-thing-but-doesn’t-get-it boilerplate narrative in order to examine the question of what the real problem is? Could we, like, advance the ball?

There’s a definition of “news” that involves providing relevant information that readers don’t already have—true information, even—and there’s a definition of “serious reporting” that involves not providing unintentional comedy by parading one’s ignorance about mortgages in an article full of high-minded tut-tutting over ignorance about mortgages. There is. Really. Maybe we should send out a press release.

Fleck: Home-loan house of cards ready to fall

by Calculated Risk on 1/15/2007 01:05:00 AM

Bill Fleckenstein writes at MSN Money: Home-loan house of cards ready to fall

... a former top executive at a subprime lender (whose chronicling of the unwind has been amazingly accurate and timely), told me that serious issues are developing, and that large companies like New Century Financial (NEW, news, msgs), Accredited Home Lenders (LEND, news, msgs) and NovaStar Financial (NFI, news, msgs) will, in his words, "hit the wall" very soon.This is a rumor, Fleck has been bearish for some time, and he is short New Century Financial. But it is still interesting.

Sunday, January 14, 2007

Mankiw Confuses Fed Transparency and Oversight with Independence

by Calculated Risk on 1/14/2007 11:55:00 PM

Professor Mankiw reads Greg Ip at the WSJ: Fed Chairman May Face Heat At Hearings

When Federal Reserve Chairman Ben Bernanke testifies on monetary policy next month, he is likely to get far more scrutiny than usual.Mankiw asks:

By law, the Fed chairman must testify twice a year to Congress: in February and July. Ordinarily, each installment lasts two days, one before the Senate Banking Committee, the other before the House Financial Services Committee. There are no other witnesses.

In a break with that tradition, Barney Frank, the Massachusetts Democrat who took over the House panel this month, said he plans to hold an additional day of hearings in which witnesses, such as economists and labor experts, will give their views on what Mr. Bernanke said.

"After reading a story like this, one might worry that more Congressional scrutiny will translate into less Fed independence and ... worse macroeconomic outcomes."Mankiw's concern about Fed independence is a false worry. The hearings may provide more heat than light, but, as Fed President William Poole wrote in 2004: FOMC Transparency

It is natural to ask why central banks need to be transparent. One answer is that central banks are governmental agencies and as such are accountable to the public for their actions.This is called oversight. But Poole also argues that transparency leads to better results:

The roots of central bank transparency are found not only in the principles of democratic accountability but also in economic theory.Better transparency usually leads to better results, not worse.

...

Transparency should help markets to make the best possible adjustments over time and minimize uncertainty flowing from monetary policy itself.

Oversight. Transparency. Perhaps these extended hearings will not be especially productive in terms of oversight or transparency, but then they are at worst neutral in terms of macroeconomic outcomes. And these hearings are definitely not an assault on Fed independence.

Lansner Q&A with Lender

by Calculated Risk on 1/14/2007 11:27:00 AM

Excerpt from Jon Lansner at the OC Register: Insider Q&A with local lender

Lansner: What are your home-buying clients thinking? What's the popular financing for this crowd?"Strategic financing".