by Calculated Risk on 2/17/2007 02:59:00 PM

Saturday, February 17, 2007

Subprime: The impact on Existing Home Sales in 2007

What will be the impact of tighter lending standards in the subprime mortgage market on existing home sales? First, some numbers ...

UPDATE: Here is a graph from immobilienblasen (via mish):

This graph is from Inside Mortgage Finance and shows the subprime share of the mortgage market near or over 20% for each of the last 3 years.

Original Post:

From America’s Second Housing Boom (hat tip: Blackstone):

By 2005, subprime originations had risen to $625 billion, now up to 20 percent of total originations and 7 percent of the total outstanding mortgage stock.

This is 2005 data, and other sources (and here) suggest non-prime (subprime and Alt-A) mortgage lending was about one third of all originations in 2005 and 2006.

Nonprime originations were 33% of market in 2005, up from 11% in 2003And, according to this note perhaps 25% of subprime borrowers will be unable to obtain loans in 2007:

Merrill researcher Kamal Abdullah raised the specter of a subprime "contagion" that could lead to the inability of the "bottom" 25% of all subprime borrowers to get loans.So if one fourth of potential subprime borrowers are unable to purchase homes in 2007, as compared to 2005 and 2006, then 25% of 20%, equals 5% of the total market. In 2006, there were 6.48 million existing homes sold, so 5% would be just over 300K homes.

But it's worse: The housing market is a sequence of chained reactions (just ask any agent or broker). If 300K buyers are excluded, the number of fewer houses sold in 2007, compared to 2006, is some multiple of that number. So this will probably have a significant impact on sales in 2007.

How far will sales fall?

Click on graph for larger image.

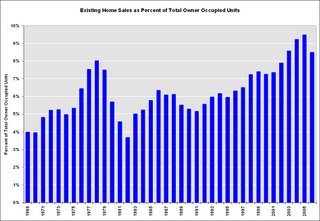

Click on graph for larger image.This graph shows sales normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover. If sales fell back to 6% that would about 4.6 million units. If sales fell back to the level of 1998 to 2001 (7.3% of total owner occupied units sold) that would be about 5.6 million units in 2007.

Fannie Mae is projecting existing home sales will fall to 5.925 million units in '07. My guess is existing home sales will "surprise" to the downside, perhaps in the 5.6 to 5.8 million unit range.