by Calculated Risk on 3/16/2007 09:52:00 PM

Friday, March 16, 2007

Roach: The Great Unraveling

"Sub-prime is today’s dot-com – the pin that pricks a much larger bubble."Stephen Roach writes: The Great Unraveling

Stephen S. Roach, Managing Director and Chief Economist of Morgan Stanley, Mar 16, 2007

Sub-prime is today’s dot-com – the pin that pricks a much larger bubble. Seven years ago, the optimists argued that equities as a broad asset class were in reasonably good shape – that any excesses were concentrated in about 350 of the so-called Internet pure-plays that collectively accounted for only about 6% of the total capitalization of the US equity market at year-end 1999. That view turned out to be dead wrong.

...

This time, it’s the US housing bubble that has burst, and the immediate repercussions have been concentrated in a relatively small segment of that market – sub-prime mortgage debt, which makes up around 10% of total securitized home debt outstanding. As was the case seven years ago, I suspect that a powerful dynamic has now been set in motion by a small mispriced portion of a major asset class that will have surprisingly broad macro consequences for the US economy as a whole.

Too much attention is being focused on the narrow story ... To me, the real debate is about “spillovers” – whether the housing downturn will spread to the rest of the economy.

Click on graph for larger image.

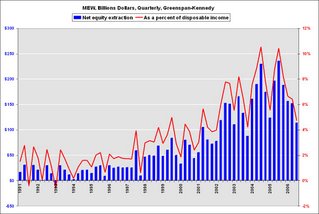

Click on graph for larger image.This is a graph of the Greenspan-Kennedy MEW results through Q3

... the US economy is now flirting with ... sub-2% GDP trajectory – while consumer demand remains brisk, a pullback in personal consumption could well be the proverbial straw that breaks this camel’s back. The case for a consumer spillover is compelling, in my view. ... the asset-dependent mindset of the American consumer, debt and debt service obligations have surged to all-time highs ... Equity extraction from rapidly rising residential property values has squared this circle – more than tripling as a share of disposable personal income from 2.5% in 2002 to 8.5% at its peak in 2005. The bursting of the housing bubble has all but eliminated that important prop to US consumer demand. The equity-extraction effect is now going the other way ... that puts the income-short, saving-short, overly-indebted American consumer now very much at risk – bringing into play the biggest spillover of them all for an asset-dependent US economy. February’s surprisingly weak retail sales report – notwithstanding ever-present weather-related distortions – may well be a hint of what lies ahead.