by Calculated Risk on 7/02/2007 05:40:00 PM

Monday, July 02, 2007

Is Paulson the New Lereah?

From Reuters: Paulson: Housing 'at or near bottom'

Treasury Secretary Henry Paulson said Monday the U.S. housing market correction was "at or near the bottom," although it could be some time before an upturn.Perhaps Paulson missed the BofA Monthly Real Estate Agent Survey released on Friday. The analysts wrote:

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters. "It's had a significant impact on the economy. No one is forecasting when, with any degree of clarity, that the upturn is going to come other than it's at or near the bottom."

"Another leg down in June as traffic and prices worsen further."Or maybe Paulson missed the incredible surge in inventory in the recent housing reports.

Click on graph for larger image.

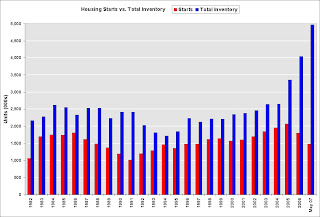

Click on graph for larger image.Maybe Paulson should spend a few minutes looking as this graph. This graph shows Total Inventory (new and existing homes) vs. housing starts.

Existing homes are a competing product for new homes, and the record inventory of total homes for sale will continue to negatively impact home-building activity. Until inventory drops significantly, starts will most likely continue to fall. And, with tighter lending standards, demand will probably continue to fall too. Instead of calling the bottom for home-building activity, perhaps Paulson should be looking for the next decline in housing starts.

Or maybe Paulson is just repeating the same comments he made in April:

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said.The more he repeats the same positive comments, the more he sounds like NAR economist David Lereah. (hat tip Brian for the post title)