by Calculated Risk on 8/01/2007 12:20:00 PM

Wednesday, August 01, 2007

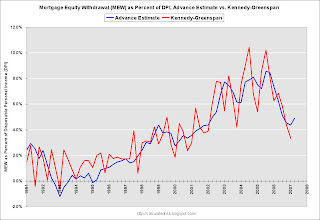

Advance Q2 MEW Estimate

Based on the Q2 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $120 Billion or 4.9% of Disposable Personal Income (DPI). This would be an increase from the Q1 estimates, from the Fed's Dr. Kennedy, of $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

The actual Q2 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for Sept 17th for Q2). Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.89) but there is substantial differences quarter to quarter. Also, there are some seasonal adjustment issues. This does suggest that MEW rebounded somewhat in Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the second half of 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a slowdown in consumption expenditures is likely.

Here are the Kennedy-Greenspan estimates of home equity extraction for Q1 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.