by Calculated Risk on 8/21/2007 02:54:00 PM

Tuesday, August 21, 2007

BofA: New Home Sales could fall to 700K

From MarketWatch: Mortgage crisis will strain home builders: B. of A.

The broadening mortgage crisis, which is making home loans more difficult to obtain, will hit home builders hard as home sales slump, Bank of America analysts said on Tuesday.There are several key points here: 1) some builders, maybe even some large public builders, will likely go BK, 2) with a surge in cancellations, new home sales will be overstated, and inventory levels understated by the Census Bureau, 3) New Home sales (and existing home sales) will continue to decline, and 4) remodeling expenditures will probably decline significantly.

...

As mortgage lenders tighten underwriting standards and home prices fall, Bank of America analysts estimated that 40% of home buyers who got a mortgage in 2006 probably wouldn't qualify for a home loan now.

That dwindling mortgage availability means that more home purchases will be cancelled as buyers fail to get the loan they need to pay for their new house. Such disruptions could strain home builder's access to liquidity and borrowing, the analysts warned.

...

"Our market checks point to a recent spike in cancellations as lenders pull loan commitments and buyers fail to qualify," Bank of America analyst Daniel Oppenheim and his colleagues wrote in a note to clients on Tuesday. "Lower cash flow will strain liquidity, particularly for high leverage builders."

...

Lack of mortgage availability will mean demand for new homes could fall 35% in 2007, the analysts said. That's bigger than the 20% drop they were predicting earlier this year when subprime problems emerged.

New-home sales could fall as low as 700,000 a year, down from 1.283 million in 2005, they said, noting that traffic at real estate agents is down sharply in August.

...

The dwindling supply of home loans will also crimp remodeling activity, Oppenheim and colleagues said. Remodeling could drop by 20% ...

To understand the impact of cancellations on sales and inventory, see this explanation from the Census Bureau: Cancelled Sales Contracts.

The point on remodeling is interesting. In response to a comment from Home Depot CEO, I wrote the following back in May: What Home Improvement Investment Slump? (the following is a repeat - obviously I think Oppenheim is correct):

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

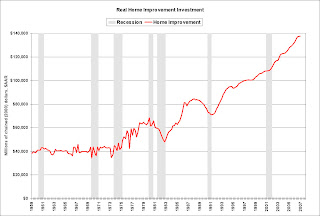

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.