by Calculated Risk on 8/16/2007 12:30:00 PM

Thursday, August 16, 2007

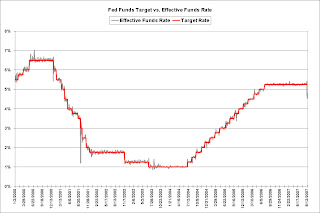

Fed Funds Target vs. Effective Funds Rate

UPDATE: From the WSJ: Has the Fed Secretly Cut U.S. Interest Rates?

Speculation intensified that the U.S. Federal Reserve is going to cut interest rates soon -- or even has already done so secretly -- without any clear signal from the Fed to encourage it.Maybe the Fed will cut soon, but they haven't cut rates in secret. As noted below, it is not that unusual for the Fed to let the Fed Funds effective rate drift away from the target rate for a few days. Besides, with the Fed's emphasis on transparency, they simply would not cut rates in secret. Right now, it's best to assume the Fed's intention is to bring the Fed funds rate back to 5.25%.

Original post: For the last few days, the Effective Fed Funds rate has been well below the target rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Fed Funds target rate vs. the effective funds rate. There have been other short periods when the Fed didn't defend their target rate, like after 9/11. This was true for short periods in the '90s too.

This morning the Fed did a repo at 5.1% (for MBS), suggesting that the effective rate is already back above 5%.

As of yesterday, the probabilities for a rate cut in September had increased sharply (see the Cleveland Fed). However this was before Fed President William Poole spoke:

Barring a "calamity," there is no need to consider an emergency rate cut, Poole said.With the effective rate rising back above 5%, I expect that the odds of a rate cut in September have diminished, barring a "calamity" of course. But I do expect a rate cut later this year as the economy weakens further.