by Calculated Risk on 9/07/2007 09:03:00 AM

Friday, September 07, 2007

August Employment Report

From WSJ: Payrolls Fall for First Time Since 2003, Likely Pressuring Fed to Cut Rates

U.S. employment fell for the first time in four years last month on steep drops in construction and manufacturing payrolls, suggesting that the housing recession is starting to grip the broader economy.Here is the BLS report. Note that the unemployment rate was unchanged, even though the household survey showed a decline in employment of 316,000 in August. The reason is the household survey showed the labor force fell by 340,000, keeping the unemployment rate the same.

...

Nonfarm payrolls fell 4,000 in August, the first decline since August 2003, the Labor Department said Friday.

Previous reports were revised sharply lower. July job growth was revised down to 68,000 from 92,000. June gains were revised to 69,000 from 126,000. The 44,000 monthly average job gain for the past three months is down sharply from the 147,000 average between January and May.

The unemployment rate, however, was unchanged last month at 4.6%.

Click on graph for larger image.

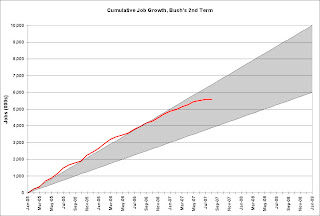

Click on graph for larger image.Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

Residential construction employment declined 23,000 in August, and including downward revisions to previous months, is down 167.6 thousand, or about 4.9%, from the peak in March 2006. (compare to housing starts off 30%).

Note the scale doesn't start from zero: this is to better show the change in employment.