by Calculated Risk on 9/19/2007 01:07:00 PM

Wednesday, September 19, 2007

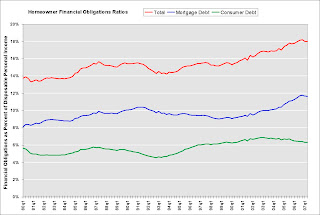

Fed: Household Debt Service and Financial Obligations Ratios

The Federal Reserve released the Q2 Household Debt Service and Financial Obligations Ratios today.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. This data has limited value in terms of absolute numbers, but might be useful in looking at trends. Here is the discussion from the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.After several years of the homeowners financial obligations ratio (FOR) increasing rapidly - due almost entirely to increases in mortgage obligations - it appears the FOR might have peaked at the end of 2006.

The recent rapid increase in the FOR was especially stunning considering interest rates were falling (if the debt to income ratio had stayed stable, the FOR would have declined along with rates).

Even with the small declines over the first half of 2007, the homeowner FOR (and mortgage FOR) are still near record levels. For the FOR to decline to more normal levels requires some mix of an increase in disposable personal income, a decrease in debt, or a decrease in interest rates. This correction process will probably take several years, as U.S. households work to reduce their financial obligations as a percent of DPI.