by Calculated Risk on 9/02/2007 09:05:00 PM

Sunday, September 02, 2007

Leamer on Housing and Macroeconomics

Here is the paper Professor Leamer (UCLA Anderson Forecast) presented at the Jackson Hole conference: Housing and the Business Cycle (Hat tip Cal). Leamer is one of the better economic forecasters, and he has an enjoyable writing style.

Leamer starts by noting that most academic macro economists typically ignore residential investment:

... if you look up “real estate” in the index to Mankiw’s(2007) best selling Principles of Macroeconomics, you will find real exchange rates, real GDP, real interest rates, real variables, and even reality, but no real estate. Under “housing” you will find a reference to the CPI and to rent control, but no reference to the business cycle. I have not been able to find any macroeconomic textbook that places real estate front and center, where it belongs.The joke is Mankiw couldn't forecast his way out of a paper bag. However many of the better private sector forecasters (like Leamer and Paul Kasriel at Northern Trust) know that residential investment is the best leading indicator for the U.S. economy. Leamer notes the residential investment is a small part of long run growth, but that the contribution of residential investment to "US recessions is huge!"

...

Likewise, the index to James H. Stock and Mark W. Watson’s edited volume, Business Cycles, Indicators and Forecasting, has no references to residential investment or to housing. Housing is treated with the same level of interest that housing starts has in the Index of Leading Indicators: one of many things that might predict a recession, about as interesting as x7 in the list x1, x2, x3, ..., x10.

...

Something’s wrong here. Housing is the most important sector in our economic recessions ...

Leamer also points out the common temporal pattern of an economic slowdown:

First homes, then cars, and last business equipment.Sound familiar? I've covered this many times, pointing out that business investment in equipment and software and structures lags residential investment. Read the paper, there is a tremendous amount of detail.

Leamer also has some data from the Great Depression:

Click on graph for larger image.

Click on graph for larger image.The Great Depression: Housing Again!A little poke at Bernanke!

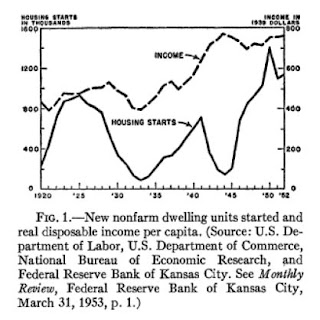

The housing starts data available from the Census Bureau begin in 1959 and leave us wondering what happened earlier, but in searching for references I ran across the image to the right of the earlier data in Ketchum(1954). Look at that: housing starts declined beginning in 1925! Industrial production didn’t begin its nosedive until July 1929 and the Dow Jones Average peaked in October 1929. How weird is that!

Problems in housing led the great depression by full three years. Without doing the hard work to confirm, it seems possible that the increase in the discount rate in 1928 was very hard on an already weakened housing sector, and set in motion the events that led to the Great Depression, dropping housing starts dramatically from over 900 thousand in 1925 to under 100 thousand in 1933. But, of course, I must defer to Bernanke’s(2000) Essays on the Great Depression, which does not emphasize housing.

But Leamer still doesn't expect a recession:

The historical record strongly suggests that in 2003 and 2004 we poured the foundation for a recession in 2007 or 2008 led by a collapse in housing we are currently experiencing. Only twice have we had this kind of housing collapse without a recession, in 1951 and in 1967, and both times the Department of Defense came to the rescue, because of the Korean War and the Vietnam War. We don’t want that kind of rescue this time, do we?So Leamer expects an extended period of sluggish growth. I disagree with Leamer somewhat: I think a recession (not severe) is likely. Of course Leamer notes "this is largely uncharted territory."

But don’t worry. This time we don’t need the DOD to save us. This time troubles in housing will stay in housing. It’s because manufacturing has done an “L” of a job. An official recession cannot occur without job loss, [and the] sectors with volatile employment are manufacturing and construction ...

Look at manufacturing. It’s V, V, V in every recession - a sharp drop in jobs and a sharp recovery. The 1990 recession was different. That was a U. But in the 2001 recession we got an L! [note: no recovery in jobs] Though this is largely uncharted territory, it doesn’t look like manufacturing is positioned to shed enough jobs to generate a recession. And without the job loss, expect the housing adjustment to be shallower but more long-lasting.