by Calculated Risk on 10/24/2007 12:37:00 PM

Wednesday, October 24, 2007

More on September Existing Home Sales

For more existing home sales graphs, please see the previous post: September Existing Home Sales Plummet

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.399 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.5 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units.

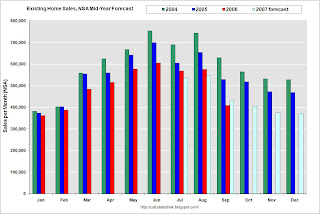

The second graph is an update to my mid-year forecast adding the actual results for July, August and September in 2007. My forecast was for sales to be between 5.6 and 5.8 million units.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through September there have been 4.5 million units sold, and it looks like the total will be right around 5.6 million.