by Calculated Risk on 10/24/2007 10:00:00 AM

Wednesday, October 24, 2007

September Existing Home Sales Plummet

The NAR reports that Existing Home sales plummeted to 5.04 million in September, the lowest level since September 2001.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.0 percent to a seasonally adjusted annual rate1 of 5.04 million units in September from a downwardly revised pace of 5.48 million in August, and are 19.1 percent below the 6.23 million-unit level in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The impact of the credit crunch is obvious as sales in September declined sharply.

For existing homes, sales are reported at the close of escrow. So September sales were for contracts signed in July and August.

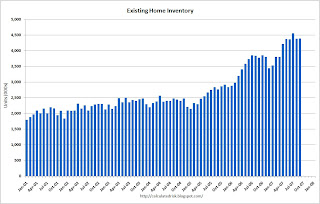

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September. Total housing inventory inched up 0.4 percent at the end of September to 4.40 million existing homes available for sale, which represents a 10.5-month supply at the current sales pace, up from a downwardly revised 9.6-month supply in August.This is basically the same inventory level as August, although the months of supply increased to 10.5 months because of the sharp drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the monthly 'months of supply' metric for the last six years.

The third graph shows the monthly 'months of supply' metric for the last six years.Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11).

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11). I wouldn't be surprised to see a small rebound in SAAR sales next month, but the trend is clearly down.

More later today on existing home sales.