by Calculated Risk on 11/21/2007 02:10:00 PM

Wednesday, November 21, 2007

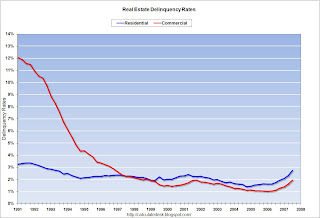

Fed: Delinquency Rates Rise in Q3

From the Federal Reserve Charge-off and Delinquency Rates.

Delinquency rates rose in Q3 for real estate (residential and commercial), consumer loans and commercial and industry loans.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the delinquency rates for residential and commercial real estates since 1991 (start of series).

For residential real estate, the delinquency rate increased from 2.32% to 2.74%. For commercial real estate, the delinquency rate increased from 1.61% to 1.94%.

There was a also sharp increase for consumer credit card delinquencies, rising from 4.03% to 4.29% in Q3.

Update: Note that the Commercial Real Estate delinquency rate is above the peak of the '91 '01 recession (1.94% now, 1.93% then). I doubt CRE delinquencies will match the S&L crisis levels of the late '80s, early '90s - but clearly delinquencies are rising rapidly.

Yes, it does appear the curves are about to go parabolic!