by Calculated Risk on 11/05/2007 02:57:00 PM

Monday, November 05, 2007

Fed: October 2007 Senior Loan Officer Opinion Survey

From the Fed: The October 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices

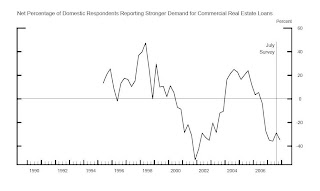

In the October survey, domestic and foreign institutions reported having tightened their lending standards and terms on commercial and industrial (C&I) loans over the previous three months. ... Both domestic and foreign institutions noted weaker demand for commercial real estate loans over the past three months. In the household sector, domestic banks reported, on net, tighter lending standards and terms on consumer loans other than credit card loans, as well as tighter lending standards on prime, nontraditional, and subprime residential mortgages over the survey period. Lending standards on credit card loans were, by contrast, little changed. Demand for residential mortgages and consumer loans of all types had reportedly weakened, on net, over the past three months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Fed shows loan demand for CRE loans. Clearly demand is weak, and lenders are tightening standards. (more later on CRE).

More charts here for residential mortgage, consumer loans and C&I.