by Calculated Risk on 11/23/2007 06:25:00 PM

Friday, November 23, 2007

Roubini on Recoupling

Nouriel Roubini writes: Recoupling rather than Decoupling: the Forthcoming Contagion to China, East Asia and Emerging Markets

Paradoxically China is the one country that has, so far, decouple the most – both in real and financial terms from the U.S. but it will also be the first and most serious victim of a U.S. led recession. The decoupling of China is clear as its growth rate has not decelerated, in spite of the U.S. slowdown, and its financial markets have – so far – blissfully avoided (thanks in part to its financial system partially isolated via capital controls from the global one) the turmoil and volatility that hit the US and Europe since the summer. But the reason for the Chinese growth decoupling is that, until recently the US slowdown was still modest (short of the coming hard landing) and it was not concentrated in private consumption but rather housing: China is mostly exporting low-priced consumer goods to the U.S. and the recoupling of China will occur soon once the US consumer recession is in full swing. Thus, the biggest victim of a US consumer led recession will be the country – China - that, so far, has decoupled the most from the US.Let me add a couple of graphs:

...

No wonder that Chinese officials have started to express serious concerns about the current sharp slowdown in Chinese exports to the US, from an annualized growth rate of over 20% in Q1 to a rate of 12.4% in Q3 of this year ("If demand in the US drops further, Chinese exporters will be devastated by a rapid and continuous fall in orders," a Chinese official report said).

Click on graph for larger image.

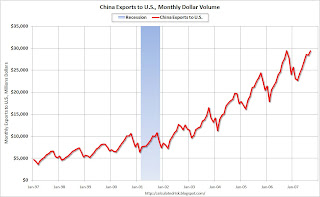

Click on graph for larger image.The first graph shows the growth in China's exports to the U.S. over the last ten years. There is a clear seasonal pattern, and October is the peak month for Chinese exports to the U.S.

The second graph shows the Year-over-year change in Chinese exports to the U.S. Note: this graph uses a 3 month centered average to calculate the YoY change.

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).

Since the last data point (trade data) is for September, and I'm using a 3 month centered average, the last plotted point is for August (9.5% YoY change).Looking at data from the Ports of LA and Long Beach, the YoY change might be close to zero soon - something that hasn't happened since the 2001 recession.

Roubini argues for recoupling:

And once there is a sharp growth slowdown in China the next victims of this recoupling will be East Asia and commodity exporters.