by Calculated Risk on 12/29/2007 04:54:00 PM

Saturday, December 29, 2007

Looking back at 2007 Housing Predictions

At the end of 2006, I offered some predictions for housing in 2007. Looking back it's hard to believe these predictions were out of the mainstream.

My overall view for the 2007 housing market was "falling prices, falling sales, falling residential construction employment, falling starts, falling MEW, falling percentage of equity, and rising foreclosures".

I expected that "existing home sales will "surprise" to the downside, perhaps in the 5.6 to 5.8 million unit range". It now looks like existing home sales will be close to 5.6 million.

I expected prices to fall "1% to 3% nationwide" as measured by OFHEO. OFHEO reports that the Purchase Only index are up 1.1% for the first three quarters, with prices falling in Q3. It now looks like OFHEO prices will be about flat for the year. Another index, S&P / Case-Shiller, shows prices down 3.7% through the first three quarters of 2007.

I also argued "Foreclosures will be approaching record levels in some states." If anything, I was too optimistic on foreclosures. In California, Notice of Default activity is well above previous record levels.

And my biggest error was on residential construction employment. I argued:

"We will see record residential construction job losses in 2007.According to the BLS, residential construction employment has only fallen 222K in 2007. I've been showing this graph all year:

... the loss of 400K to 600K residential construction employment jobs over the next 6 months."

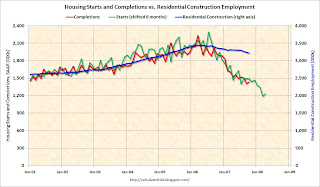

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.There are many reasons why the BLS reported employment hasn't fallen as far as expected (blue line). Some of the possible explanations include: the BLS has not correctly accounted for illegal immigrants working in the construction industry, the BLS Birth/Death model might have missed the turning point in residential construction employment, many workers have moved to commercial work, and many workers (subcontractors) are underemployed.

There is some merit to to all of these arguments, and I think the answer will be some combination of these explanations. The concern now is that if commercial construction spending slows, as appears likely from the recent Fed loan survey, then workers that have moved to commercial construction will have no work opportunities.

This was the concern expressed by the director of forecasting of the NAHB in August. From Reuters: Construction job losses could top 1 million

"The ability of nonresidential to continue absorbing additional workers is going to be limited, and that's going to put downward pressure on construction employment overall," [Bernard Markstein, director of forecasting at the National Association of Home Builders] said, adding that cuts may be deeper than in the 1990s.Whatever the reason, I was too pessimistic on residential construction employment in 2007.

And finally, for amusement, Jon Lansner at the O.C. Register interviews local economist Mark Schniepp: Economist eyes home sales pickup in ‘08. This is an amazing quote:

A year ago, we didn’t know what a subprime loan was, nor did anyone expect the likelihood of a “credit crunch.”Oh yeah.

Economist Mark Schniepp, Dec 29, 2007

Tanta and I have been writing about subprime loans for as long as this blog has existed. And as far as a credit crunch, back in January I mentioned the possibility of "a credit crunch based on bad loans in the RE sector (and possibly in CRE and C&D too)".

And many others were discussing these issues too.

We all make errors in forecasting - no one has a crystal ball - but I'm endlessly amused by the 'no one could have known' excuse.