by Calculated Risk on 1/08/2008 01:44:00 PM

Tuesday, January 08, 2008

CD Rates and NIMs

The WSJ had an interesting article this morning on the margin squeeze at many banks. From the WSJ: Banks' Narrowing Margins

Many banks ... are likely to report narrowing in net interest margins -- a key measure of industry profitability -- already at the lowest level since 1991.Check out the CD rates at CountryWide and IndyMac.

Much of the pinch is being attributed to a scramble for deposits. Even though the Federal Reserve has been cutting interest rates, many banks are still offering attractive rates for deposits. A quarterly survey released last week by Citigroup Inc. found that "the competition to raise new deposits" via certificates of deposit and money-market funds "remains intense."

...

While banks are now collecting less interest on loans because of the Fed's rate reductions, they are still making the same interest payments to depositors.

CountryWide is offering a 6 month CD with an APY of 5.45%.

IndyMac is offering a 3 months CD with an APY of 5.4%.

Click on graph for larger image.

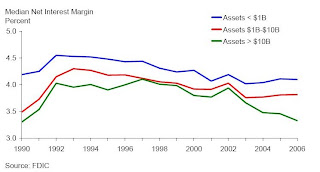

Click on graph for larger image.Here is a graph from the FDIC (through 2006) of Net Interest Margins (NIMs) by bank size. Even though the larger banks have seen more of a NIM squeeze, the smaller banks make more of their income from NIMs.

Another concern is that banks have been growing their asset portfolios to lessen the impact of falling NIMs. From the FDIC last year:

To offset the effects of lower margins, institutions have been growing their asset portfolios. ... Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.I eagerly await the next Emerging Risks report from the FDIC.