by Calculated Risk on 1/04/2008 08:31:00 AM

Friday, January 04, 2008

December Employment Report

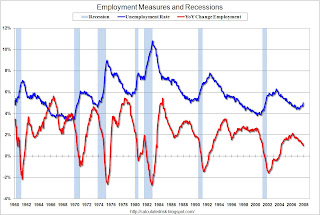

Update: This graph shows the unemployment rate and the year-over-year change in employment vs. recessions. Click on graph for larger image.

Click on graph for larger image.

The rise in unemployment, from a cycle low of 4.4% to 5.0% will set off alarm bells.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Employment numbers can be heavily revised, but this report will definitely get attention.

Original Post: From the BLS: Employment Situation Summary

The unemployment rate rose to 5.0 percent in December, while nonfarm payroll employment was essentially unchanged (+18,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job growth in several service-providing industries, including professional and technical services, health care, and food services, was largely offset by job losses in construction and manufacturing. Average hourly earnings rose by 7 cents, or 0.4 percent.

Click on graph for larger image.

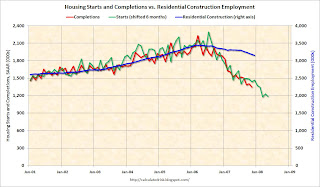

Click on graph for larger image.Residential construction employment declined 28,500 in December, and including downward revisions to previous months, is down 293.1 thousand, or about 8.5%, from the peak in March 2006. (compared to housing starts off almost 50%).

Note the scale doesn't start from zero: this is to better show the change in employment.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.This suggests residential construction employment could fall significantly from current levels.

Overall this is a very weak report, and the unemployment rate rising to 5% will set off recession arguments.