by Calculated Risk on 1/07/2008 11:36:00 AM

Monday, January 07, 2008

Investment Patterns

Investment slumps correlate very well with recessions. The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters, shaded areas are recessions. (Source: BEA Table 1.1.1) (note these are year-over-year changes, not quarter-by-quarter). Click on graph for larger image.

Click on graph for larger image.

Some observations:

1) Since 1948, private fixed investment has fallen during every economic recession.

2) Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.

3) The year-over-year change in private fixed investment appeared to have bottomed in early 2007, suggesting the economy might have avoided a recession.

So what happened during the periods around 1951, 1967, and the minor slump in 1986, to keep the economy out of recession? These are the periods when private investment fell, but the economy didn't slide into recession. The answer is generally the same for all three periods: a surge in defense spending. The defense spending in the early '50s was due to the Korean war, in the mid '60s the Vietnam war, and in the mid '80s a general defense build-up helped offset a small decline in private investment. The mid '80s also saw a surge in MEW (mortgage equity withdrawal) that also contributed to GDP growth.

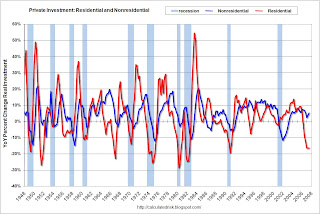

Looking at 2007, it appears the year-over-year change in private fixed investment has bottomed and started to turn up. Usually this means the recession is over, or at least almost over. This has given some hope to the idea that non-residential investment (along with consumer spending) would keep the economy out of recession. However it appears that investment is about to take another turn down; both for residential and non-residential. The second graph shows the separation of private fixed investment into residential and nonresidential components.

The second graph shows the separation of private fixed investment into residential and nonresidential components.

This graphs shows something very interesting: in general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble.

However, the typical pattern is residential investment leads non-residential investment, so a slowdown in non-residential investment is not unexpected. This is one of the reasons I've been so focused on Commercial Real Estate (CRE) investment.

The next two graphs break down non-residential investment into structures, and equipment and software investment. Historically investment in non-residential structures follows residential investment by about 5 quarters, and investment in equipment and software follows residential investment by about 3 quarters.  The third graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative in mid to late 2007.

The third graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative in mid to late 2007.

Although investment in equipment and software investment was not strong, investment didn't slump significantly either. And this is one of the reasons the economy avoided a recession through Q3 2007. The fourth graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The fourth graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The strong investment in non-residential structures has been one of the keys to avoiding recession through Q3 2007. Now that commercial real estate appears to be slumping, it looks like non-residential investment will slump too - putting the economy into recession.