by Calculated Risk on 1/14/2008 02:02:00 PM

Monday, January 14, 2008

OFHEO: Implications of Increasing the Conforming Loan Limit

OFHEO has released a preliminary analysis of the Potential Implications of Increasing the Conforming Loan Limit in High-Cost Areas.

The conforming loan limit is the maximum loan that Fannie and Freddie can buy. An overview:

For mortgages that finance one-unit properties, [the conforming loan] limit is $417,000 in 2008, as it was in 2006 and 2007. Higher limits apply to loans that finance properties with two to four units. The limits for properties of all sizes are 50 percent higher in Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The limits are adjusted each year to reflect the change in the national average purchase price for all conventionally financed single-family homes, as measured by the Federal Housing Finance Board’s (FHFB’s) Monthly Interest Rate Survey (MIRS). Conventional single-family loans with original balances above the conforming loan limit are generally known as jumbo mortgages.And here is some interesting data on the Jumbo Market:

Click on graph for larger image.

Click on graph for larger image.According to Inside Mortgage Finance Publications, originations of jumbo mortgages have ranged from 15 percent to 21 percent of the total single-family market from 2000 through the first half of 2007.Jumbo loans are not only larger, and geographically concentrated (almost 50% are in California!), but they also have many risky features:

...

The jumbo market is much more geographically concentrated than the conventional mortgage market as a whole. Data from First American LoanPerformance suggest that California accounted for 49 percent of the dollar volume of first lien jumbo mortgages originated in the first half of 2007 and later securitized (Chart 1). In a comparable sample of conventional loans purchased by the Enterprises, the California market share was 14 percent.

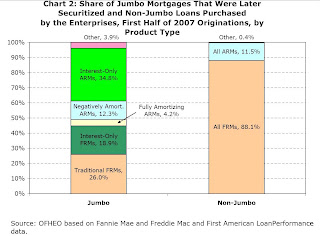

First American LoanPerformance data also suggest that interest-only (IO) loans and negatively-amortizing adjustable-rate mortgages (ARMs) comprised nearly two-thirds of the dollar volume of first lien jumbo loans originated in the first half of 2007 and later securitized, whereas traditional (fully amortizing) fixed-rate mortgages (FRMs) comprised only a quarter of those loans (Chart 2). In contrast, FRMs comprised over 88 percent of non-jumbo conventional loans originated in the first half of 2007 and purchased by Fannie Mae and Freddie Mac.With falling prices, many of these jumbo loans with IO or neg-Am features will probably be underwater soon. This will probably be a huge story in '08 and '09. (Note: There is much more in the OFHEO report).