by Calculated Risk on 2/28/2008 12:31:00 AM

Thursday, February 28, 2008

Inflation is Your (Ben's) Friend

Here is partial excerpt from a great Saturday Night Live piece in the late '70s, with Dan Aykroyd impersonating Jimmy Carter:

Inflation is our friend.

For example, consider this: in the year 2000, if current trends continue, the average blue-collar annual wage in this country will be $568,000. Think what this inflated world of the future will mean - most Americans will be millionaires. Everyone will feel like a bigshot. Wouldn't you like to own a $4,000 suit, and smoke a $75 cigar, drive a $600,000 car? I know I would! But what about people on fixed incomes? They have always been the true victims of inflation. That's why I will present to Congress the "Inflation Maintenance Program", whereby the U.S. Treasury will make up any inflation-caused losses to direct tax rebates to the public in cash. Then you may say, "Won't that cost a lot of money? Won't that increase the deficit?" Sure it will! But so what? We'll just print more money! We have the papers, we have the mints.

Click on graph for larger image.

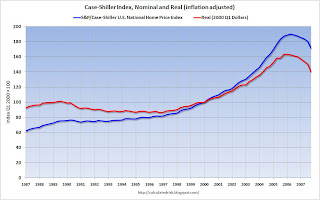

Click on graph for larger image.And here is a graph of the Case-Shiller index in both nominal terms and real terms (adjusted using CPI less shelter).

In nominal terms, the index is off 8.9% over the last year, and 10.2% from the peak.

However, in real terms, the index has declined 12.9% during the last year, and is off 14.6% from the peak.

Inflation is helping significantly in lowering real house prices. If prices will eventually fall 30% in nominal terms, then we are only about 1/3 of the way there. But if the eventual decline is 30% in real terms, then we are about half way there.

Wouldn't you like to own a million dollar home? With 4% inflation per year, many people will.