by Calculated Risk on 2/08/2008 06:35:00 PM

Friday, February 08, 2008

Recession: Impact on Employment

John Schmitt and Dean Baker at CEPR released a new report on the possible impact of the recession: What We’re In For, Projected Economic Impact of the Next Recession (hat tip risk capital)

If the next recession follows the pattern set by the three most recent downturns, a recession in 2008 would raise the national unemployment rate by between 2.1 (a mild-to-moderate recession) and 3.8 percentage points (a severe recession along the lines of the early 1980s), increasing the number of unemployed Americans by between 3.2 million and 5.8 million.This raises a key point: the severity of an economic downturn can be measured in how high the unemployment rate rises. I've argued several times that the current slowdown will not be severe, with severe being defined as an unemployment rate above 8%.

Following Schmitt and Baker, and using the cycle unemployment rate low of 4.4%, the unemployment rate would rise to 6.5% for a mild-to-moderate recession, and to 8.2% for a severe recession.

Click on graph for larger image.

Click on graph for larger image. This first graph shows the unemployment rate and the number of unemployed workers since 1969. The two curves clearly move together, although with a growing population, the same number of unemployed workers now gives a lower unemployment rate than in earlier periods.

During an economic slowdown, some potential workers don't seek work (whether by choice or circumstances), so the participation rate falls too. This makes forecasting the rise in unemployed workers, using a given unemployment rate, a little tricky.

By my calculation, an increase in the unemployment rate to 8.2%, would give about 12.8 million unemployed workers, or an increase of 5.2 million from today. For a mild-to-moderate recession, with an increase in the unemployment rate to 6.5%, the number of unemployed workers would rise by 2.6 million to 10.2 million.

Based on the size of the current credit and solvency problems, in relation to the $14 trillion U.S. economy, I think a less than severe recession is most likely (less than 8% unemployment at the peak). A severe recession is still possible, as San Francisco Fed President Janet Yellen noted today:

"[W]e can’t rule out the possibility of getting into an adverse feedback loop—that is, the slowing economy weakens financial markets, which induces greater caution by lenders, households, and firms, and which feeds back to even more weakness in economic activity and more caution."To predict a severe recession, we need to forecast the number of unemployed workers rising by 5 million or more. Right now I don't see this happening. Here is why:

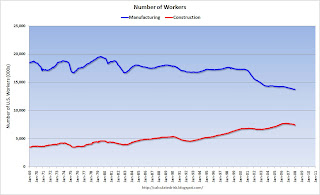

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession.

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession. Another way to look at construction and manufacturing employment is as a percent of the total civilian workforce.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs. For the recession to be "severe", another 3+ million unemployed workers would have to come from financial, retail, manufacturing and other areas. Right now this seems unlikely to me.