by Calculated Risk on 2/02/2008 02:49:00 PM

Saturday, February 02, 2008

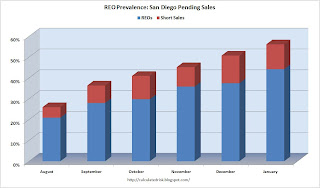

San Diego REO / Short Sale Prevalence above 50%

Ramsey Su, an REO broker in San Diego, has sent me the following:

I started tracking REOs and short sales 6 months ago. It is alarming how consistently they climbed month after month. I do not remember any time in the history of SD real estate that REOs and short sales account for over 50% of all sales. This phenomenon is so negative, but ignored and under appreciated by analysts, economists and the media.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percentage of pending sales for REOs and short sales in San Diego. Combined they accounted for 56.1% of all pending sales in January.

For units sold, REOs and short sales combined for 51.7% of the total market in January, up sharply from 6 months ago (about 20%). Clearly the San Diego market is starting to be dominated by REOs.

I called one of the top agents in San Diego yesterday, and she told me that the housing market is steadily getting worse with the flood of REOs. She said the banks are still dragging their feet on lowering prices, and she expects prices to decline 40% to 50% from the peak in many areas of San Diego. She gave me an example of a house that sold for $500K in 2005. The bank foreclosed and is now asking $380K - with no offers - and she believes it will eventually sell for $300K or less.