by Calculated Risk on 3/04/2008 11:58:00 AM

Tuesday, March 04, 2008

Fed's Kohn on CRE

Fed Vice Chairman Donald L. Kohn tesitified to Congress today: Condition of the U.S. banking system. Here are some of his comments on Commercial real estate (CRE) loans:

Commercial real estate is another area that requires close supervisory attention. The delinquency rate on commercial mortgages held by banking organizations almost doubled over the course of 2007 to over two percent. The loan performance problems were the most striking for construction and land development loans--especially for those that finance residential development--but some increase in delinquency rates was also apparent for loans backed by nonfarm, nonresidential properties and multifamily properties.Many small and mid-sized institutions are overexposed to CRE loans. Here is a repeat of a graph from the FDIC quarterly report (released last week) showing that a growing number of institutions have significant exposure to CRE:

In the most recent Senior Loan Officer Opinion Survey, a number of banking organizations reported having tightened standards and terms on commercial real estate (CRE) loans. Among the most common reasons cited by those that tightened credit conditions were a less favorable or more uncertain economic outlook, a worsening of CRE market conditions in the areas where the banks operate, and a reduced tolerance for risk. Notably, a number of small and medium-sized institutions continue to have sizable exposure to CRE, with some having CRE concentrations equal to several multiples of their capital.

Despite the generally satisfactory performance of commercial mortgages in securitized pools, spreads of yields on BBB-rated commercial mortgage-backed securities over comparable-maturity swap rates soared, and spreads on AAA-rated tranches of those securities have risen to unprecedented levels. The widening of spreads reportedly reflected heightened concerns regarding the underwriting standards for commercial mortgages over the past few years, but it also may be the result of increased investor wariness regarding structured finance products. CRE borrowers that require refinancing in 2008, particularly those with short-term mezzanine loans, will face difficulty in locating new financing under tighter underwriting standards and reduced demand for CRE securitizations.

In those geographic regions exhibiting particular signs of weakness in real estate markets, for several years we have been focusing our reviews of state member banks and bank holding companies on evaluating growing concentrations in CRE. Building on this experience, we took a leadership role in the development of interagency guidance addressing CRE concentrations, which was issued in 2006. More recently, because weaker housing markets have clearly started to adversely affect the quality of CRE loans at the banking organizations that we supervise, we have heightened our supervisory efforts in this segment even more. These efforts include monitoring carefully the impact that lower valuations could have on CRE exposures, as well as evaluating the implementation of the interagency guidance on concentrations in CRE, particularly at those institutions with exceptionally high CRE concentrations or with riskier portfolios.

Recently, we surveyed our examiners about their assessments of real estate lending practices at a group of state member banks with high concentrations in CRE lending. We had two main objectives for this effort. First, we wanted to evaluate the Federal Reserve's implementation of the interagency CRE lending guidance and to determine whether there were any areas in which additional clarification of the guidance would be helpful to our examiners. Second, we wanted to assess the degree to which banks were complying with the guidance and gain further information on the degree of deterioration in real estate lending conditions. Through this effort, we confirmed that many banks have taken prudent steps to manage their CRE concentrations, such as considering their exposures in their capital planning efforts and conducting stress tests of their portfolios. Others, however, have not been as effective in their efforts and we have uncovered cases in which interest reserves and extensions of maturities were used to mask problem credits, appraisals had not been updated despite substantial recent changes in local real estate values, and analysis of guarantor support for real estate transactions was inadequate. Based on these findings, we are currently planning a further series of targeted reviews to identify those banks most at risk to further weakening in real estate market conditions and to promptly require remedial actions. We have also developed and started to deliver targeted examiner training so that our supervisory staff is equipped to deal with more serious CRE problems at banking organizations as they arise.

emphasis added

Click on graph for larger image.

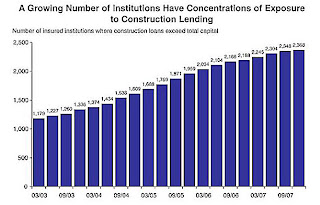

Click on graph for larger image."A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

There are several reasons why a CRE slowdown matters: the slowdown will be a drag on GDP, the slowdown will hit construction employment resulting in many more layoffs, and, as Kohn notes, the CRE slowdown will impact institutions overexposed to this sector - probably resulting in a number of bank failures over the next couple of years.