by Calculated Risk on 4/25/2008 05:25:00 PM

Friday, April 25, 2008

Why Haven't Existing Home Sales Fallen Further?

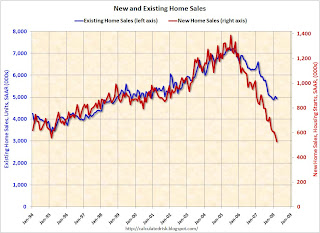

The first graph compares New Home sales vs. Existing Home sales since January 1994. Click on graph for larger image.

Click on graph for larger image.

Clearly new home sales have fallen faster than existing home sales.

Based on various reports, it appears new home builders cut their prices quicker than most existing home sellers. So why have new home sales fallen faster than existing home sales?

There could be a number of possible explanations:

Perhaps new homes were more overpriced than existing homes, so the larger price cuts haven't been enough to motivate buyers.

Or maybe there was more speculative buying in the new home market. During the boom, many buyers could put down 1% or less and hold a house for 6 to 9 months; essentially a call option on the house. But if that was the reason, wouldn't new home sales have increased quicker than existing home sales during the boom? It appears the ratio of sales tracked pretty closely from '94 through '05.

Or maybe all the REO sales (bank Real Estate Owned) are boosting the number of existing home transactions. Note: It is my understanding that banks taking possession of foreclosed properties are not counted in the NAR's existing home sales report, but the resale of REOs are counted.

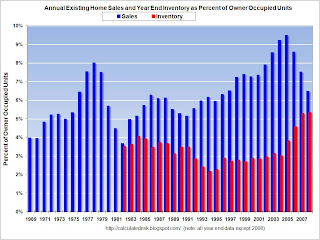

Whatever the reason - and I'm always a little skeptical of the NAR's numbers - existing home sales are still above the normal range. The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

The second graph shows annual existing home sales and year end inventory. As the NAR recently noted 2007 was the fifth highest sales year on record.

Note: for 2008 I used the March sales and inventory numbers. All other numbers are annual sales, and year-end inventory.

If the red columns (inventory) is as high as the blue column (sales) - something I expect to happen this summer - then the "months of supply" number will be 12.

The third graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that inventory is at an all time record level by this key measure.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - March sales were at a 4.93 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests that sales of existing homes could fall significantly more in 2008.