by Calculated Risk on 6/02/2008 04:51:00 PM

Monday, June 02, 2008

Minneapolis: Price Distribution of Distressed Homes

This morning I posted some graphs on the price distribution of distressed homes (short sales, REOs) in Orange County.

Here is some similar data on the Minneapolis area, from a recent report by MAAR Research Manager Jeff Allen and Aaron Dickinson: Foreclosures and short sales in the Twin Cities Housing Market (hat tip Jeff) Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just like for Orange County, there are many more distressed homes for sale at the low end; over 50% of inventory priced below $120,000 is distressed. Many of these distressed homes were probably purchased with subprime loans.

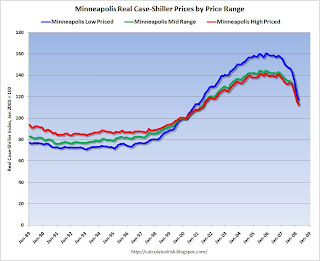

Naturally the areas with a higher percentage of distressed properties have seen faster price declines. Of course - just like for Orange County - those areas also saw the most appreciation because of loose underwriting for subprime lending. Here is a graph showing the real Case-Shiller prices in Minneapolis for three price ranges. This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

The low price range is less than $176,486 (current dollars). Prices in this range have fallen 27.0% from the peak in real terms.

The mid-range is $176,486 to $250,300. Prices have fallen 21.9% in real terms.

The high price range is above $250300. Prices have fallen 20.8% in real terms.

This is the common pattern: the low end saw the most appreciation, the most foreclosures, and now the fastest price declines. This higher distressed property activity at the low end is also distorting some of the median price measures, as Jeff and Aaron report:

[The] higher market share places a heavy downward weight on aggregate sales price figures, giving many the erroneous impression that the housing market in its entirety is seeing massive declines in value. In reality, the lender-mediated market and the traditional seller market are experiencing stark differences.I spoke with Jeff Allen today, and just like for some REOs in Oceanside, the low end REOs in Minneapolis are seeing a significant pickup in buyer interest, possibly from investors, as the lenders have started to price these homes aggressively. This suggests that prices are approaching a bottom in some of these low end areas.

As has been widely reported in recent months (including in our own research products), the median sales prices of Twin Cities homes in the first quarter of 2008 were 10.3 percent below the first quarter of 2007—a sizeable and conspicuous decline. But lost in the hub-bub—and partly because no one had the data until now—is that the traditional sales market that does not include foreclosures and short sales saw only a 3.9 percent decline in median sales price during the same time period.