by Calculated Risk on 7/27/2008 09:01:00 AM

Sunday, July 27, 2008

Graphs: June New Home Sales

Since I was out of town on Friday, here is a somewhat belated look at the New Home sales report from the Census Bureau.

According to the Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 530 thousand. Sales for May were revised up to 533 thousand (from 512 thousand).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for June since the recession of '91. (NSA, 49 thousand new homes were sold in June 2008, just above the '91 recession low of 47 thousand homes).

As the graph indicates, there was no spring selling season in 2008. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

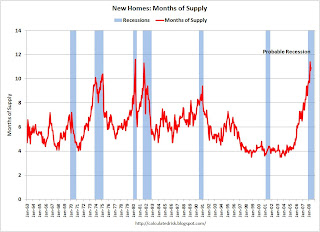

Sales of new one-family houses in June 2008 were at a seasonally adjusted annual rate of 530,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent below the revised May rate of 533,000 and is 33.2 percent below the June 2007 estimate of 793,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.0 months.

"Months of supply" is at 10.0 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of June was 426,000. This represents a supply of 10.0 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations - and cancellations are near record levels. Actual New Home inventories are probably much higher than reported - my estimate is around 90K higher. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Still the 426,000 units of inventory is well below the levels of the last year, and inventory is now falling fairly quickly. It appears the home builders are selling more homes than they are building, and it is very possible that months of supply has peaked for this cycle.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.