by Calculated Risk on 8/21/2008 11:25:00 AM

Thursday, August 21, 2008

Borrowing Trouble: Merrill Lynch on Housing

Merrill Lynch released a research note earlier this week: Wall-to-wall homes. This piece was widely quoted, and - as bearish as I am on housing - I believe this analysis is incorrect.

Starting with the 3rd paragraph:

"Single starts dropped to 641k in July, the lowest since January 1991, but even this is well ahead of the pace of sales."Yes and no. It is correct that starts of one unit structures declined to 641K (SAAR) in July according to the Census Bureau. However it is a mistake to compare one unit starts directly with new home sales. The main problem is one unit starts include homes built for or directly by owners. The quarterly data from the Census Bureau mostly resolves this problem, and the quarterly data shows that starts are now running below new home sales - so inventory of new homes is declining (Note: this needs to be adjusted for cancellations too, but even then new home inventory is declining sharply).

More Merrill:

"Given our expectation for sales to decline by 1% in July to 411k units, we expect months’ supply to drop to 9.4 months from 10.4 in June."I think Merrill meant they expect new home inventory to decline to 411K units in July or about 3% (from 426K SA in June). That would put the months of supply in July near Merrill's estimate of 9.4 months - a sharp decline from the recent high of 11.2 months in March 2008.

This takes us to Merrill's first paragraph:

"[H]ome building needs to contract by another 30% ... and stay in that range through at least the end of 2009 in order to get months’ supply down, in our view."This begs the question: down to what? Merrill just argued (correctly in my view) that months of supply will probably decline in July, but in this statement they are arguing that starts need to fall another 30% to get months of supply down. Really?

Click on graph for larger image in new window.

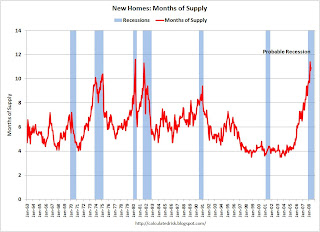

Click on graph for larger image in new window.This graph shows the months of supply metric over the last 45 years. During the boom, the months of supply was around 4, but in more normal markets, the months of supply is usually around 5 to 6.

At the current rate of starts (single family, built for sale) and new home sales, the months of supply will probably decline to the low 8s by the end of 2008. That is about half way to a normal market! Yes, new home sales will probably decline a little further because of tighter lending standards, but starts will probably fall further too (based on permits) - so the bottom line is I expect inventory and months of supply to continue to decline for the rest of 2008.

The biggest problem for home builders is the huge overhang of existing homes for sale, especially distressed properties. This will keep a lid on new home sales for some time - so there won't be much of a rebound in sales, and the housing correction will probably look like an "L" (sharp drop and then flat). But, it is clear that the new home inventory correction is already under way.

And a final excerpt from Merrill:

"Housing completions remained elevated at 1035k in July (791k singles and 244k multi units), which will not help the supply situation ..."This is just confusing. Completions are important for looking at residential construction employment, but they are not as useful for supply. This is because most homes are sold early in the process, before they are started or early in the construction process. Starts are better for analyzing supply - or completions with a six month lag (time to build a home), and once again, you can't compare starts (or completions) directly to sales because many homes are not "built for sale".

I remain bearish on housing in general, and there is no question there are many negatives for the housing market. I expect prices to fall for some time in the bubble markets because prices are still too high relative to incomes and rents, and because of the huge overhang of inventory, especially REOs and other distressed properties. There are also serious problems building in the Alt-A market, see Tanta's Subprime and Alt-A: The End of One Crisis and the Beginning of Another and Reset Vs. Recast, Or Why Charts Don't Match. And there are well publicized problems with Fannie and Freddie, and other lenders are still tightening standards.

But we don't need to borrow trouble. Single family starts (built for sale) have fallen enough that new home inventory and months of supply is now declining.