by Calculated Risk on 8/25/2008 10:00:00 AM

Monday, August 25, 2008

July Existing Home Sales: Record Inventory

From NAR: July Existing-Home Sales Show Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.1 percent to a seasonally adjusted annual rate¹ of 5.00 million units in July from a downwardly revised level of 4.85 million in June, but are 13.2 percent lower than the 5.76 million-unit pace in July 2007.

...

Total housing inventory at the end of July rose 3.9 percent to 4.67 million existing homes available for sale, which represents an 11.2.-month supply at the current sales pace, up from a 11.1-month supply in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2008 (5.00 million SAAR) were the weakest July since 2000 (4.82 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested last month that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September). Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels have peaked for the year, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year.

My forecast was for Months of Supply to peak at about 12 months this year and this metric is pretty close.

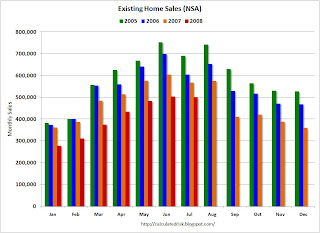

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.NSA sales were reported at 501 thousand in July, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of July 2005 and 2006.